Cards

How to apply for the Mercantil Bank Payroll Card

See now how to apply for the Banco Mercantil payroll card in a quick, easy and safe step by step.

Advertisement

Mercantil Bank Payroll Card

Payroll Bank Mercantil has therefore been an advantageous option for those with fixed income and wish to have a better credit option to use during the month.

With zero annuity, low minimum income requirement, digital invoice, international reach and no surprise values, it is therefore a great option, especially for negatives.

If you are interested and want to apply for this card, follow now an easy and safe step by step. Learn how to order yours, how to download the app and other necessary steps.

Step by step to apply for the Mercantil Bank Card

Anyway, see below the step by step to apply for your Banco Mercantil payroll card. So you can start right now and apply from your home. Therefore, follow the steps and enjoy the advantages offered by this bank that only grows in Brazil.

Remember, therefore, to check all the information and ensure access to the right website so as not to fall into fraud.

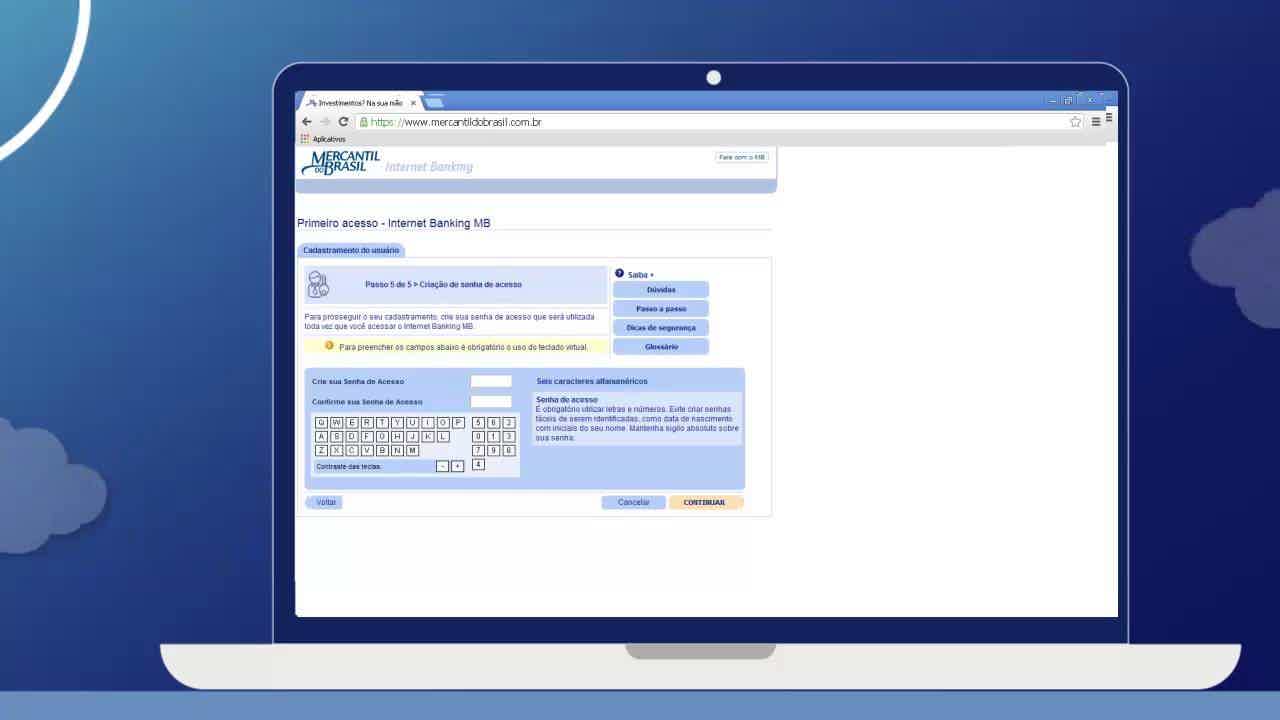

Order online

To apply for your card online and from home, you will first need to open a bank account.

Then, access the Bank's website, go to the card option and choose the payroll. There you will be able to check all the information and specifications given here, to guarantee the information. Then, create your bank account, send your documents and, once approved, apply for your card.

Request via phone

Banco Mercantil does not, therefore, offer the form of request via telephone, for the safety of its customers, as it needs a photo of documents.

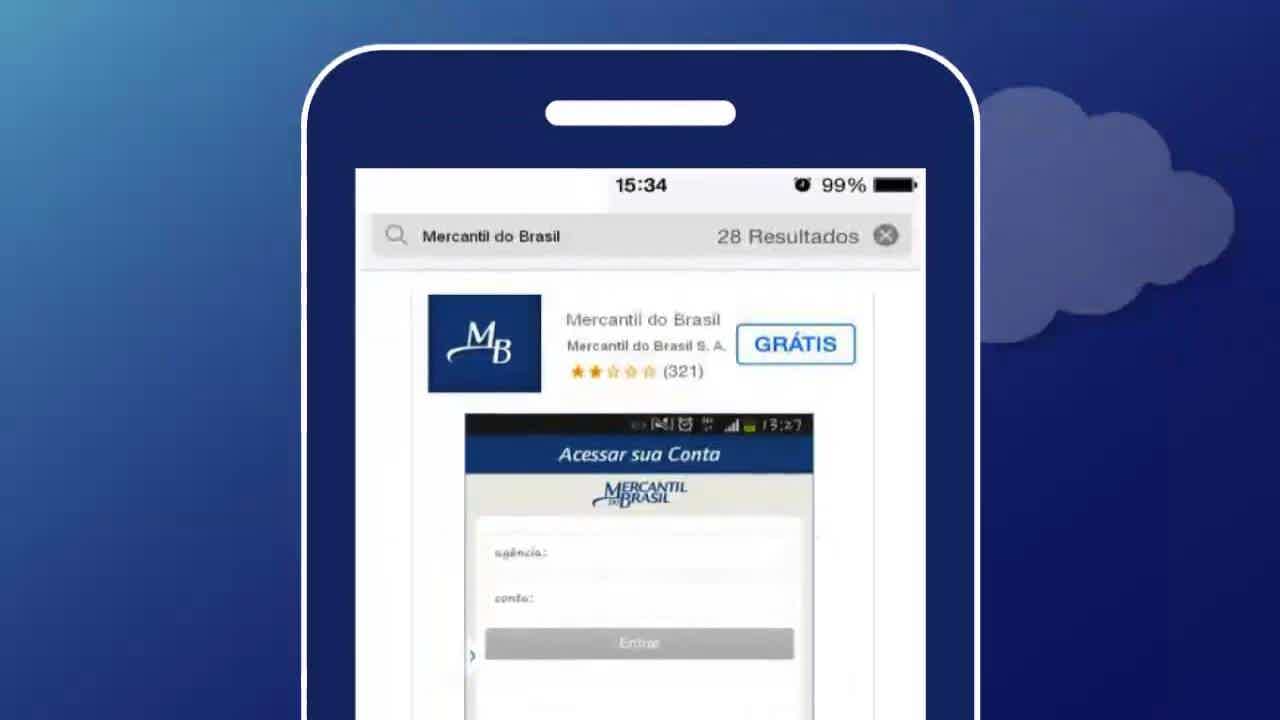

download app

You can also download the Mercantil bank application to track your available payroll balance, purchases made, invoice amounts, that is, to have all your movements at hand.

So then, you avoid fraud and manage to have greater control of what you are doing every month with your finances.

To do this, just access your mobile app store (Play Store or App Store), search for Banco Mercantil and download.

After that, you will need to access your account, with the previously received data. Then your information will be available to track from month to month.

Cetelem Card or Banco Mercantil Payroll Card?

So, to help you decide once and for all the best payroll card to use on a daily basis with your purchases, we'll make a comparison.

Cetelem offers a card that is a direct competitor to Mercantil. So, see the characteristics and what differs from each other to be able to decide the best.

| Mercantile Bank | Cetelem | |

| Minimum Income | subject to review | 1 minimum wage |

| Annuity | Zero | Zero |

| Flag | unspecified | mastercar |

| Roof | International | National |

| Benefits | Digital invoice, lower interest | Duty free |

Finally, here you can understand how to apply for your Banco Mercantil payroll card and also see a comparison between another competitor. Now it's up to you to decide which one is best for you!

How to apply for the Cetelem Payroll Card

Zero annuity and benefits for you. Request Cetelem now and use this step by step below to order yours from home.

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to apply for the Daycoval card

Do you want to know how to apply for the Daycoval card? If so, read the text and be one step away from having one of the best products on the market.

Keep Reading

Become a beneficiary of Aid Brazil

Find out how to become a beneficiary of Auxílio Brasil and the new requirements in accordance with the new decree of the Federal Government. Check out!

Keep Reading

Will Bank card or Caixa Mulher card: which is better?

Will Bank Card or Caixa Mulher Card? What's the best option for you? Both are international and free of annual fees. Check out!

Keep ReadingYou may also like

Discover the Inter Limite Investido credit card

With the Inter Limite Investido credit card, you set the limit when investing your money and also have several advantages, such as international coverage, Mastercard brand and even control your finances online 100%. Check out its main features here!

Keep Reading

8 cards to order on the Serasa Ecred platform

The Serasa eCred platform offers the best alternatives for its consumers. For this, you just need to fill in some information and she finds options that fit in your pocket!

Keep Reading

Platinum Mastercard Card: How it works

If you like to travel and want to enjoy more benefits while you rest, the Mastercard Platinum card helps you relax. After all, you have insurance for medical emergencies and another for rental cars. But not only that! Check out other advantages of this card right now.

Keep Reading