Cards

How to apply for the C&A Bradescard card

The C&A Bradescard card allows customers to make purchases with exclusive benefits at any store in the chain. In view of this, check below how to apply for this card and take advantage of the advantages it has to offer.

Advertisement

C&A Bradescard credit card

The C&A Bradescard card was developed especially for those who are already customers of the stores and want to get bigger discounts, as well as access to exclusive offers. Therefore, it undoubtedly becomes a great ally for saving money when making your purchases. As well as having a new way of managing payments and having credit in the market.

But, thanks to the C&A credit card, you can make purchases in thousands of stores and establishments that accept this form of payment. That's why we've written this article with some information on how to apply for a credit card. So, check out our article and get yours now.

Step by step guide to applying for a C&A Bradescard card

So, to apply for the C&A card, you must be over 18 years old, prove your income from the last 3 months, and not have a negative credit history with Serasa. Therefore, not everyone can apply for this card. However, if you meet these requirements, you will have to go to one of the C&A stores with your personal documents.

When you arrive at the store, go to the customer service center and request your credit card. Then, after submitting your application, it will undergo a credit analysis and if approved, you will receive your card and can use it to make purchases with special discounts.

Therefore, check out other ways to contact C&A about your credit card and how to request it.

Order online

Customers cannot yet apply for the C&A Bradescard card through the website. Therefore, you must go to one of the chain's physical stores, bringing your personal documents. After that, just speak to one of the attendants to make the request.

Request via phone

So, it is not yet possible to order the C&A card over the phone. However, you can request information about this product by contacting the Customer Service Center on the following telephone numbers:

- 4004-0127 (capitals);

- 0800-701-0127 (other regions);

- 0800-722-0099 (hearing impaired).

download app

However, the app cannot be used to apply for a Bradescard card. This is because its main purpose is to allow customers to obtain information about their bill, available credit, among others. However, it is available on Google Play and the App Store, which undoubtedly makes it easier for many customers to access.

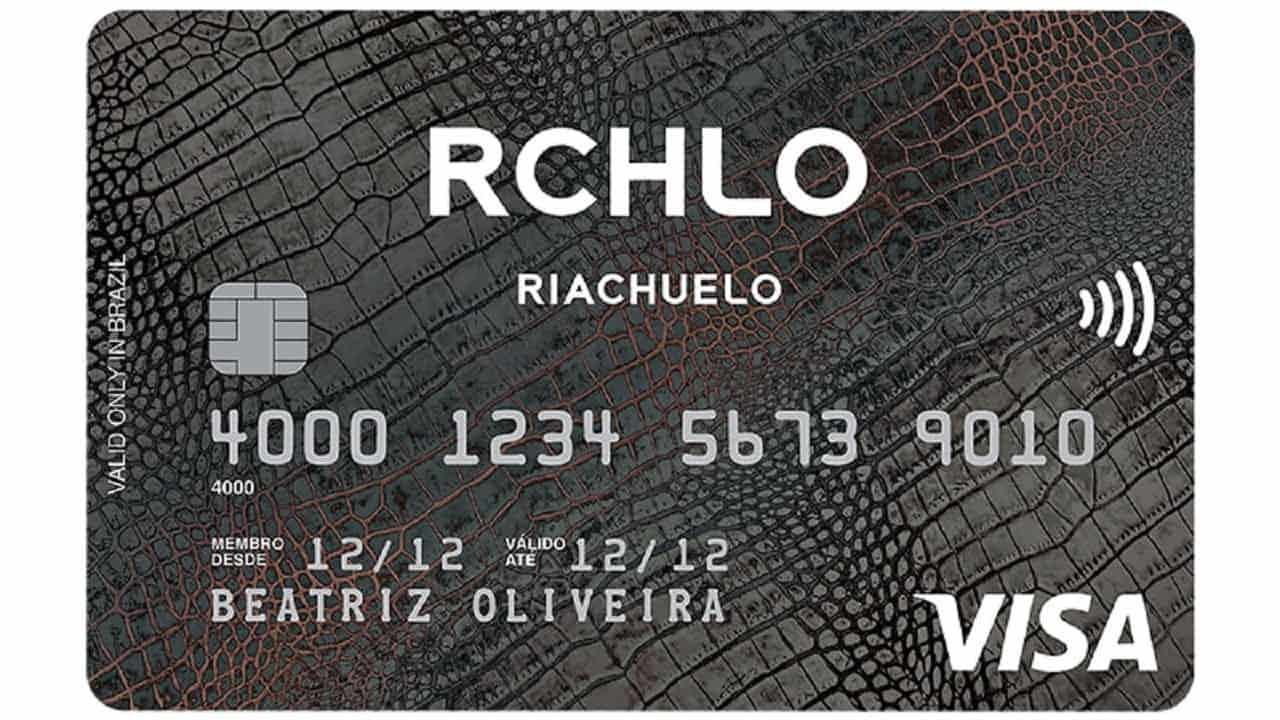

Riachuelo card or C&A Bradescard card?

So, to make their customers' daily lives easier, several retailers have created their own credit cards. After all, this product allows consumers to have special payment conditions, as well as discounts when making their purchases.

Therefore, due to these advantages, it can be difficult to choose between the Riachuelo card or the C&A card, for example. Therefore, we compared the main information about these two credit cards so that you can evaluate which is your best option. So, check out the information below.

| Riachuelo Card | C&A Bradescard Card | |

| Minimum Income | Minimum wage | Minimum wage |

| Annuity | R$ 87.00 | R$ 221.88 |

| Flag | MasterCard | Visa |

| Roof | National | International |

| Benefits | 24-hour emergency servicePoints system to exchange for productsSecurity and flexibility in paymentsAccepted in millions of locations worldwide | Discount on your first purchaseDifferentiated installmentsInsurance and assistance against theftDirect withdrawal at C&A stores and the Banco 24 horas network |

How to apply for the Riachuelo credit card

Check out our complete tutorial and apply for your Riachuelo credit card without bureaucracy.

About the author / Lays Brandão

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

GINEAD free receptionist course: learn how to do it!

Do you want to position yourself better in the job market? Meet the receptionist course that has been helping many people to be employed.

Keep Reading

Bradesco personal loan: what it is and how it works

If you are looking for special credit conditions, such as low interest rates and a repayment term of up to 06 years, check out Bradesco loans.

Keep Reading

Condor Loan or Free Digital Loan: which is better?

Which one to choose between Condor loan or Free Digital loan? In today's article we will help you with this choice. Check out!

Keep ReadingYou may also like

How to increase the Sicoob card limit?

If you have a Sicoob card and want to know better how it works, in addition to other information about the limit. So, check out this post and clear all your doubts!

Keep Reading

How does the income tax exemption work?

Need to declare income tax exemption and don't know how? So stay with us and find out how to do it without stress.

Keep Reading

How to get the Old Age Pension

Understanding how to obtain the Old Age Pension guarantees your quality of life and the necessary income for your daily life. To check out the step-by-step, continue reading the article!

Keep Reading