Cards

How to apply for the Brazilian Business Bank Card

Brazilian Business Bank card is an excellent option for those with negative credit, with a high credit limit and an exclusive app Check out how to order yours!

Advertisement

Brazilian Business Bank Card

The Brazilian Business Bank card is a financial product offered by the company of the same name, which is an intermediary for the card. But the issuers of the Visa and Mastercard versions are Brasil Pré-Pagos and ZenCard, respectively.

So, the Brazilian Business card is a little different from other cards that accept negative payments. Because the card offers a credit limit even for those who have restrictions on their CPF. Thus, whoever requests a card may have a limit of 10 thousand reais after the first month of using it in their daily lives. But how cool, right?

But in addition, the customer has access to an exclusive application and a digital account. This way, you can manage your balance, statement and expenses in a practical way, carry out financial operations such as withdrawals, transfers, etc.

Furthermore, keep an eye on the fees for each financial transaction, and don't allow your expenses to exceed your payment possibilities, even with a high credit limit on the Brazilian Business Bank card, right?

So, if you're already curious and want to know how to request one of these cards to call your own, don't worry! We have put together an excellent step-by-step guide to help you with applying for a credit card, just keep reading and check it out below.

Step by step to apply for Brazilian Business Bank Card

The Brazilian Business Bank card can be requested online in a practical and quick way. So, check out how to order your card below!

Order Online

So for those who want to order a Brazilian Business Bank card online, it's very simple! All you need to do is access the company's digital platform, and on the main page, search for the “Card” option in the menu.

You will then be directed to a page with more exclusive information about the credit card. But you can also click on the “Request card” button, and then you will see a page with an online registration and card request form.

So, you just need to fill in all the fields requested on the form with personal data, documents, income information, etc. So, the information you will have to fill in is as follows:

- CPF.

- Full name.

- Cell phone

- DDD of your city;

- ZIP CODE;

- State;

- City;

- Complete residential address, with number and complement;

- What is your monthly income;

Then, agree to the BBB terms and conditions and simply click the “Request Card” button. Within 1 business day you will receive a response to your request, and the Brazilian Business Bank card will be sent to your home address that you entered on the form, simply activate the card via the company's platform, or by telephone.

Request Via Phone

It is not possible to request your BBB card over the phone, but you can call and answer any questions you may have with the company's customer service team at:

- (13) 3357-8586, during business hours.

Download Application

The Brazilian Business Card app is available free of charge in the app store for Android and IOS systems. So, just access and download to start using.

BMG Card or Brazilian Business Bank Card?

But if you still have doubts, how about checking out a comparative table with another similar card, the BMG card? Then you might have another reference to think about:

| BMG | Brazilian Business Bank | |

| Minimum Income | minimum wage | not required |

| Annuity | exempt | monthly fee of 7 reais (Visa)/ 7.90 (Mastercard) |

| Flag | MasterCard | Visa or Mastercard |

| Roof | International | National |

| Benefits | Cashback and Mastercard Surprise Program | Exclusive digital account and app, Visa or Mastercard benefits |

How to apply for BMG card for negatives?

See the quick and easy step-by-step way on how to apply for the BMG credit card, a card that offers financial ease.

About the author / Aline Saes

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

What is the difference between protest and negation?

We often know that the name is dirty, but we don't know exactly how. Know the difference between protest and negation to know how to solve it

Keep Reading

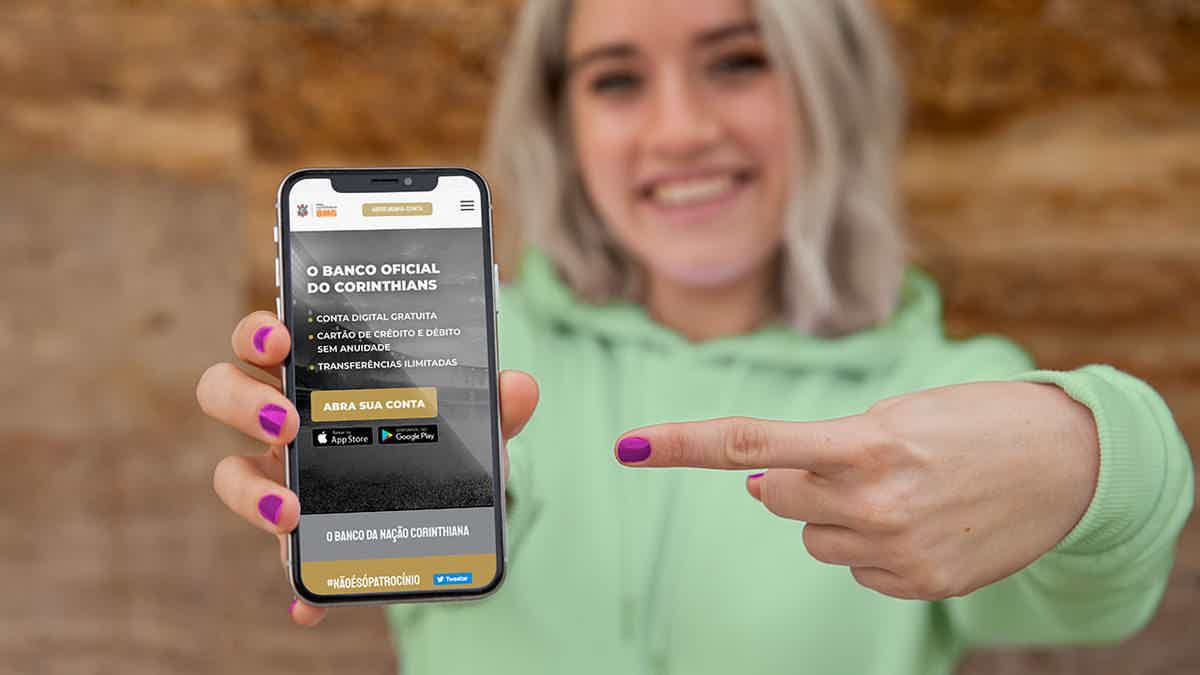

Discover the Corinthias BMG credit card

Get to know the Corinthias BMG credit card and see if this card is what you need right now! Ah, he is ideal for negatives! Check out!

Keep Reading

Payroll card Caixa or Banrisul payroll card: which is better?

Payroll card Caixa or Banrisul payroll card: do you know which one is the best option for negative credit cards? So, read the post and check it out!

Keep ReadingYou may also like

Agibank card or Pan card: which one to choose?

Agibank card or Pan card? You don't know which one to order? So, read our post and find out which is the ideal financial product.

Keep Reading

Get to know Montepio personal consolidated credit

Have you ever heard of personal consolidated credit? This is a credit option that you can use the contracted amount for different purposes, either to pay off debts or to fulfill dreams. Here, we will introduce you to one of the most attractive options on the market: consolidated credit from Banco Montepio. So, if you are interested in the subject, just continue with us!

Keep Reading

Balaroti Financing or Creditas Reforma Financing: which is better?

The ideal solution for renovating your home could be Balaroti financing or Creditas Reforma financing! With attractive benefits and special conditions, these loans offer the financial help you need to build the home of your dreams! Want to know more? Click here and check it out!

Keep Reading