Cards

How to apply for an Americanas card

The Americanas card offers exclusive benefit programs, in addition to having an easier credit analysis. Your request can be made online, without leaving your home. See more details here!

Advertisement

Americanas Card: exclusive discounts and easy membership

Well, the Americanas card is managed by Banco Cetelem, a bank that has been in the market for over 50 years. So don't worry as it is completely safe and reliable. By the way, if you are interested and want to know how to apply for the Americanas card, then continue reading and check out how the process works.

Order online

First of all, don't worry, as the application process is very practical. First, you need to access the official website of American stores. Then you will need to register with your personal data.

Then you must complete the credit card application form. By the way, it is important to say that the credit analysis is fast and without bureaucracy. Therefore, the chances of approval are quite high.

Then, when approved, you will receive an email with more information. Then, you must wait for the card to be received at the address provided.

Request via phone

Therefore, it is not possible to apply for the Americanas card over the phone. However, you can contact the store to solve your doubts through the numbers:

- 4004 7990 (capital or metropolitan areas);

- 0800 704 1166 (other locations).

Request by app

Finally, if you prefer, you can also order your Americanas card through the application. In this sense, the app is available on the Play Store or the App Store. After downloading it, click on the menu in the upper left corner and then click on “American card”.

The next step is to click on the “order yours now” field and register with your personal information. Then, continue filling in the requested information and then wait for approval. Thus, if you are approved, you should receive the Americanas card at the address provided in the registration.

Submarino card or Americanas card: which one to choose?

However, are you still in doubt if this card is right for you? So, check out the suggestion we leave below.

Anyway, both the Submarino card and the Americanas card have an annual fee. By the way, both cards are Mastercard and offer exclusive points programs for their customers. In addition, see, below, the table with the main information about them and compare them:

| Submarine Card | Americanas Card | |

| Minimum Income | Minimum wage | Minimum wage |

| Annuity | 12x of R$15.70 | 12x of R$15.70 |

| Flag | Visa | MasterCard |

| Roof | National | National |

| Benefits | exclusive discounts League points program Cashback | Mais Sorrisos points program exclusive discounts Cashback |

How to apply for the Submarino card

Discover now how to apply for the Submarino card step by step, simply and online 100%.

About the author / Aline Barbosa

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

10 virtual museums for you to visit at home: discover the world's largest collections in the comfort of your home

The doors of the largest collections in the world have been opened and you, who are inside the comfort of your home, can visit them through virtual museums.

Keep Reading

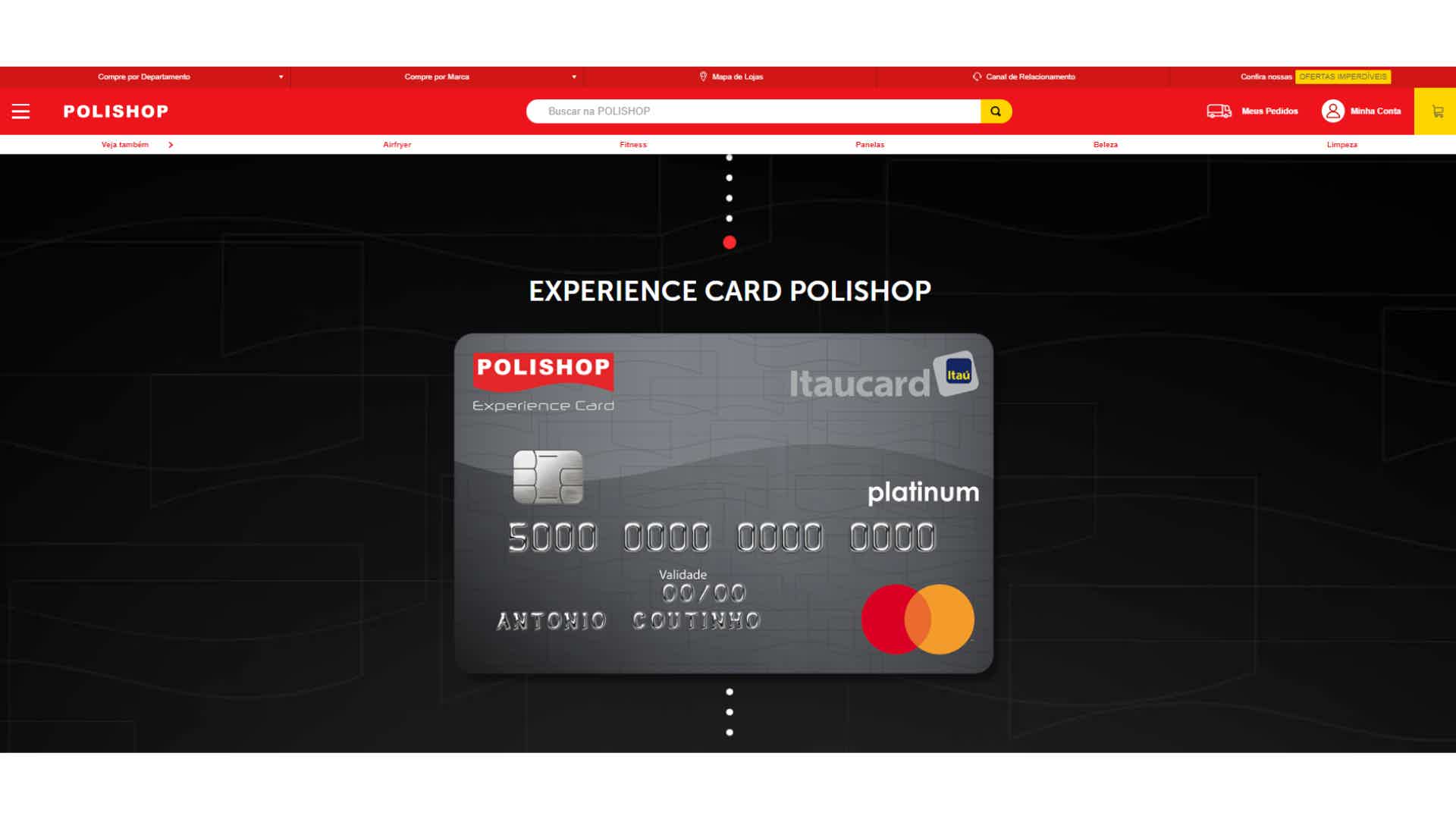

Discover the Polishop credit card

Discover the Polishop credit card, with two points programs and exclusive installments for purchases at the brand's stores. Learn more here!

Keep Reading

Consigned credit Auxílio Brasil: check the rules

Discover in this post all the rules that the Auxílio Brasil payroll loan will have for you to prepare yourself when applying for it!

Keep ReadingYou may also like

Bolsa Atleta: how does it work and how to register?

Whether you are a high-performance athlete in Olympic sports or not, you may be entitled to the Bolsa Atleta benefit. To find out how to register, just continue reading the article.

Keep Reading

IPO: what is it?

Do you know what IPO is and its advantages and disadvantages for investors and companies? We tell you below.

Keep Reading

Discover the BPI Moeda Estrangeira current account

The BPI Moeda Estrangeira account is a great option for anyone who wants to take care of their financial life and receive payments in more than 10 different currencies without paying a maintenance fee. To learn more about this option, just stay with us throughout the review!

Keep Reading