loans

How to apply for the NoVerde loan

Do you need credit up to R$ 8 thousand to pay within 18 months? In that case, NoVerde is a great option. It has a fast, secure and bureaucratic application process. See how it's done in this post!

Advertisement

Apply for a loan without bureaucracy and 100% online

The NoVerde loan is a model that came to help those who are in a hurry, but who want to take out a loan safely, online and with many benefits!

This startup, which has been in existence for 6 years, has already helped several people with its quick loan and continues to allow more people to realize their dreams using this financial product.

Therefore, if you want to know how to apply for the NoVerde loan, stay with us in this post where we show you in detail all the steps necessary to access this credit.

Order online

Certainly, the main way to carry out the NoVerde loan is online from its official website.

To do so, simply access the page and click the “Start Now!” button. With this, the site will redirect you to another page where you will answer some questions, do the credit simulation and send your personal data.

In this way, NoVerde will be able to generate the credit proposal that best matches your profile.

When analyzing and accepting the proposal, just proceed with the security step, where you will take a photo of your document and a selfie. With that, just sign the contract and wait for the money to fall into the account!

Request via phone

In short, NoVerde still does not offer to take out a loan from a phone call. In this way, the entire process is only available online, such as the company's official website or application.

On the other hand, if you want to talk to one of the company's attendants to resolve any doubts about the process, just call (11) 4020 1583, which is NoVerde's call center.

Request by app

Finally, you can apply for the NoVerde loan from its official application. For this, you need to have a device with Android system to be able to install. There is currently no version of the app for iOS users.

Thus, when downloading the application, you can register on the platform. From here, the steps will be very similar to those on the website.

Therefore, you will do the simulation, send your personal data and answer some questions. In this way, you can analyze the proposals made, choose the one that best fits and proceed with the loan contract.

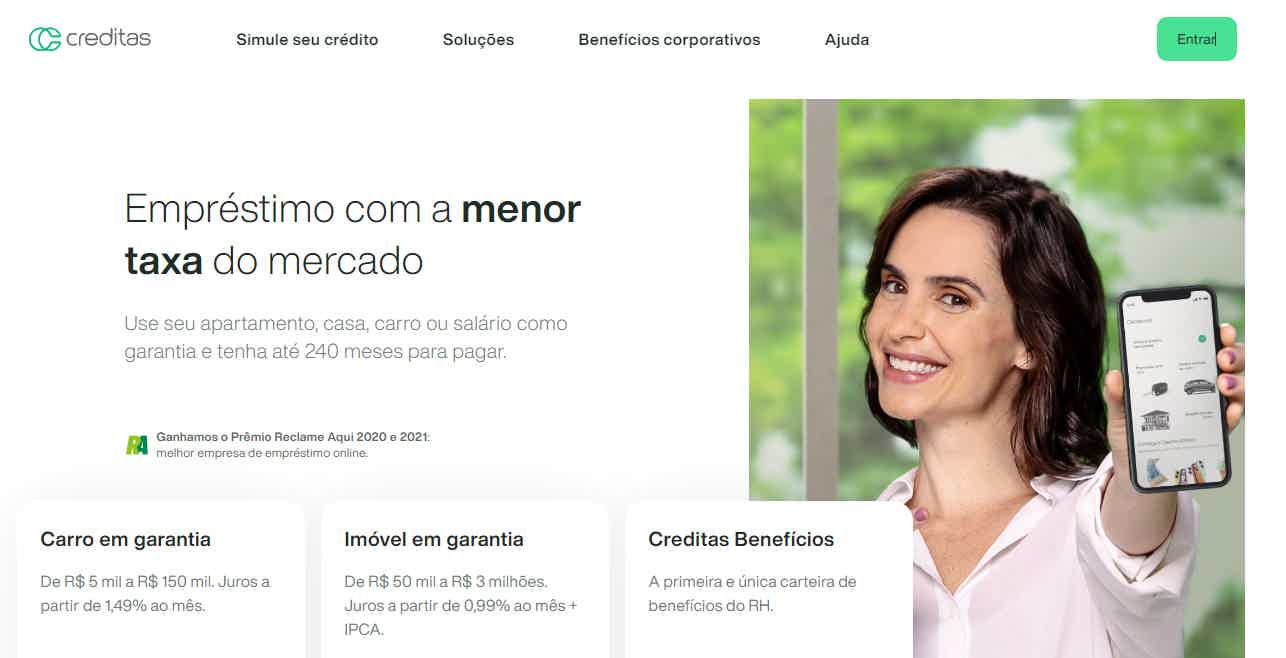

Creditas loan or NoVerde loan: which one to choose?

As much as the NoVerde loan is a great credit option, it may still have some limitations for some people. Therefore, if this option does not fit into your financial life, you can opt for the Creditas loan.

With it, you can access credit with higher amounts and a lower interest rate. In addition, depending on the type of loan, you can pay in up to 240 months.

So, if you liked this option, check out in the post below how you can apply for a loan from Creditas.

| Credit Loan | NoVerde Loan | |

| Minimum Income | not informed | not informed |

| Interest rate | From 0.99% per month | From 7.9% per month |

| Deadline to pay | Up to 240 months | Up to 18 months |

| Where to use the credit | for any purpose | for any purpose |

| Benefits | Up to 3 loan options to choose from Lower fees and installments Online process | Money falls within 24 working hours Completely online application process Offers discount for early installments |

How to apply for the Creditas loan

See here how to get a loan from Creditas to take advantage of its benefits and excellent credit conditions.

About the author / Leticia Jordan

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Ali Credit payroll loan: what is Ali Credit?

Ali Credit is a digital 100% platform for applying for payroll loans in two ways! See below and clear your doubts.

Keep Reading

Discover the Activo Bank credit card

The Activo Bank credit card offers a series of advantages. Know what they are and see if it's worth asking for. Learn more here!

Keep Reading

How to apply for an Ali Credit loan

Do you want to learn how to apply for the Ali Credit personal loan with quick and secure release? So read on to learn!

Keep ReadingYou may also like

Caixa Econômica Federal releases credit of up to R$1 thousand for people with name restrictions!

Getting a loan is not the simplest task when you have a dirty name in the market. With that in mind, Caixa Econômica created the Sim Digital. The project seeks to help people with name restrictions and MEIs to get lines of credit with special conditions. Know more.

Keep Reading

Boost credit card: how it works

Do you want an uncomplicated card, with no annual fee and international Visa coverage? So, see below how ActivoBank's Boost prepaid card works and find out if it's ideal for what you need.

Keep Reading

How to apply for the IKEA card

IKEA stores offer their customers an international credit card with no annual fee so that they can shop with more peace of mind. In today's post we will teach you how to make the IKEA card. Has interest? Continue reading and check it out!

Keep Reading