loans

How to apply for the loan Marisa

The Marisa loan offers excellent credit conditions for those who have a store card. In today's article you will learn the loan application process. Continue reading to check it out.

Advertisement

Marisa: it won’t be long before you have access to the loan

Recently, the Marisa store chain innovated by launching a new product for its network, the Marisa personal loan. With it, you can take out credit at competitive rates and pay with installments that fit your pocket.

Furthermore, the product has advantages such as insurance in case you are fired from your job and cannot pay the loan installments.

Do you want to know how to apply for your Marisa loan? Continue reading and check it out!

Discover the Marisa credit card

Check here how the Marisa card works and find out what are the advantages you can take advantage of when applying for it.

Order online

It is not yet possible to take out the loan online, because it is necessary to go in person to one of the Marisa chain stores and speak to an attendant or access the MBank app. Additionally, you must have a store card.

On the other hand, Marisa's website can help you find the nearest store, so go with your ID, CPF, proof of income and residence and get your Marisa store card or go with the card in hand to request the loan. In fact, the process is very simple and the analysis and release of values is immediate!

Request via phone

So, unfortunately you cannot apply for a Marisa loan over the phone. But, if you want to contact the company to ask questions about credit, just contact the following telephone numbers:

- To make purchases: 11 99350 7571;

- To receive invoices, check limits and more: 11 4004 2211.

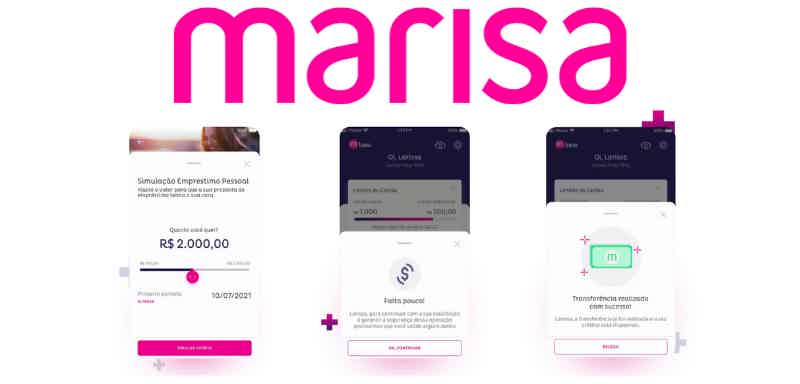

Request by app

The Mbank app is available for free download on Google Play and the Apple Store. Through it, you can see if you have a pre-approved limit, as well as request and control your Marisa loan. To do this, simply access it, locate the personal loan option and fill in the requested information.

Superdigital loan or Marisa loan: which one to choose?

Firstly, the Marisa loan is a great option for those who have a Marisa store chain card and are looking for a hassle-free loan to pay their bills.

But, if it's still not what you're looking for or if you don't fit the requirements, we'll also introduce you to the Superdigital loan.

In it, contracting is without any bureaucracy, interest rates are variable. Furthermore, you have up to 24 months to pay the loan. So, see the details below and understand which one works best for your reality.

| Superdigital loan | Marisa Loan | |

| Minimum Income | not informed | not informed |

| Interest rate | From 1.6% per month | not informed |

| Deadline to pay | Up to 24 months | Uninformed |

| Where to use the credit | Not specified | Not specified |

| Benefits | Credit simulator, accepts freelancers and independent professionals | Withdrawal is in hand, short response time |

How to apply for the Superdigital loan

Learn all about how to apply for this loan with amounts of up to R$25 thousand, low interest rates and up to 24 months to pay off the credit.

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Discover the Impact Bank Credit Card

Get to know the Impact Bank credit card, and see the proposal for sustainable growth and the quality services it has! Check out!

Keep Reading

Discover the Young Apprentice Program

The Young Apprentice Program offers a great opportunity for young people to study and work. Discover the program in this article!

Keep Reading

Discover 5 apps to control your finances in 2022

Apps to control finances can help you plan your capital to have an even healthier financial life. Learn more here!

Keep ReadingYou may also like

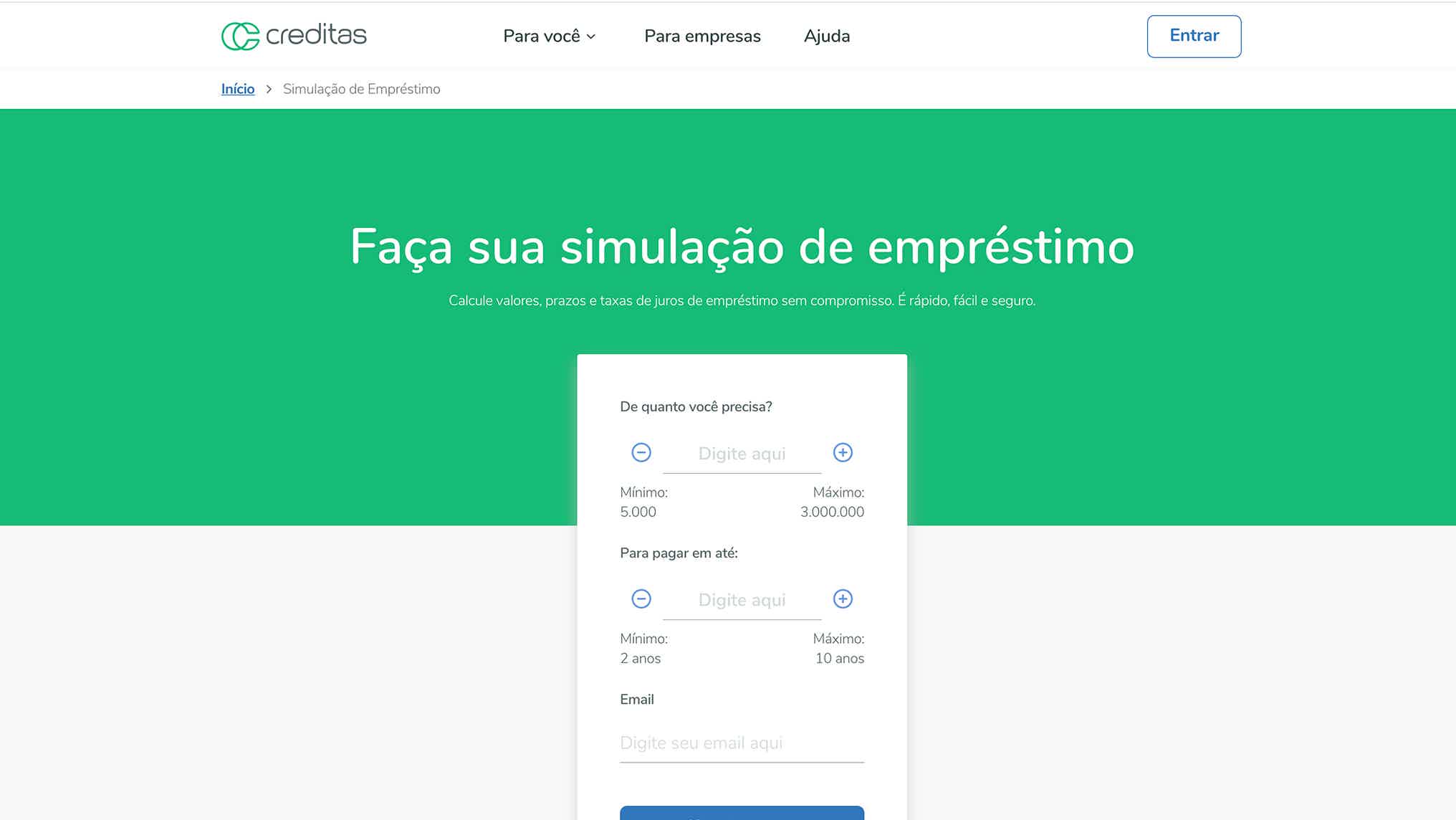

Is credits reliable?

If you are looking for a reliable fintech that offers low interest rates for loans, then you need to check out Creditas. In this sense, the platform offers online credit with an excellent payment term. Check out more about her here!

Keep Reading

7 card options for salaried employees 2021

If you are salaried and looking for a functional card? Compare here the characteristics, advantages, disadvantages and credit evaluation criteria of the best financial product options on the market. So you can find the card that makes sense for you.

Keep Reading

Discover the Caetano Go credit card

The Caetano Go credit card is a great financial product for anyone who does constant car maintenance. Since you can count on the benefits offered by Caetano Retail. Read this post and learn more about it.

Keep Reading