loans

How to apply for a Daycoval loan

Learn how to apply for a Daycoval loan and how this type of credit can be a great way out for you! Check out!

Advertisement

Daycoval loan

Initially, Daycoval offered credit to retirees, civil servants and INSS pensioners, as well as other categories of people. So, let's teach you how to apply for a Daycoval loan and other information about it!

So, to understand more about it and how you can access it, read on! Check out!

Step by step to apply for the Daycoval payroll loan

So, let's get to know the step-by-step process for applying for a Daycoval loan:

Order online

Well, ordering online is quite simple. Just go to the official website of the Daycoval bank to access the list of authorized correspondents. After that, just fill in the registration informing all personal data such as CPF and RG.

Then, the credit analysis will take place quickly, without consulting credit protection agencies such as SPC and SERASA.

Request via phone

So, as we mentioned, the application for the Daycoval payroll loan can only be done through the internet.

However, if you want to ask any questions about the company, just contact the Customer Service at number: 0300-111-0500.

download app

So, there is no application to make a Daycoval loan proposal, because all proposals must be sent directly on the website.

But the Daycoval bank has an official application for you to access the payroll card and several other financial services of the company. Just download it from the Apple Store or Google Play completely free of charge and then access Daycoval's services.

Bxblue loan or Daycoval loan?

Thus, the Daycoval payroll loan has several advantages such as low interest rates and payment methods and is very simple to apply for. So, don't leave it for later and do it today! But if you still have doubts, how about getting to know the Bxblue loan as an option? Check it out below:

| Daycoval | BxBlue | |

| Value | Up to R$250,000. | R$1,500 to R$400,000 |

| Installment | Up to 96x. | 96x SIAPE and 84x at INSS |

| Interest Rates | 22.15% per year | From 0.99% per month |

| release period | Up to 2 business days | up to 20 days |

How to apply for the BxBlue loan

Learn how to apply for a BxBlue payroll loan, other useful information about this loan, so that you can pay off all your debts!

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

SIM loan or Geru loan: which one to choose?

SIM Loan or Geru Loan: Do you know which one is the best option when taking out a personal loan? Check the conditions!

Keep Reading

How to order the Ton card machine

Check out in this post a step by step for you to request the Ton card machine online without having to leave your home!

Keep Reading

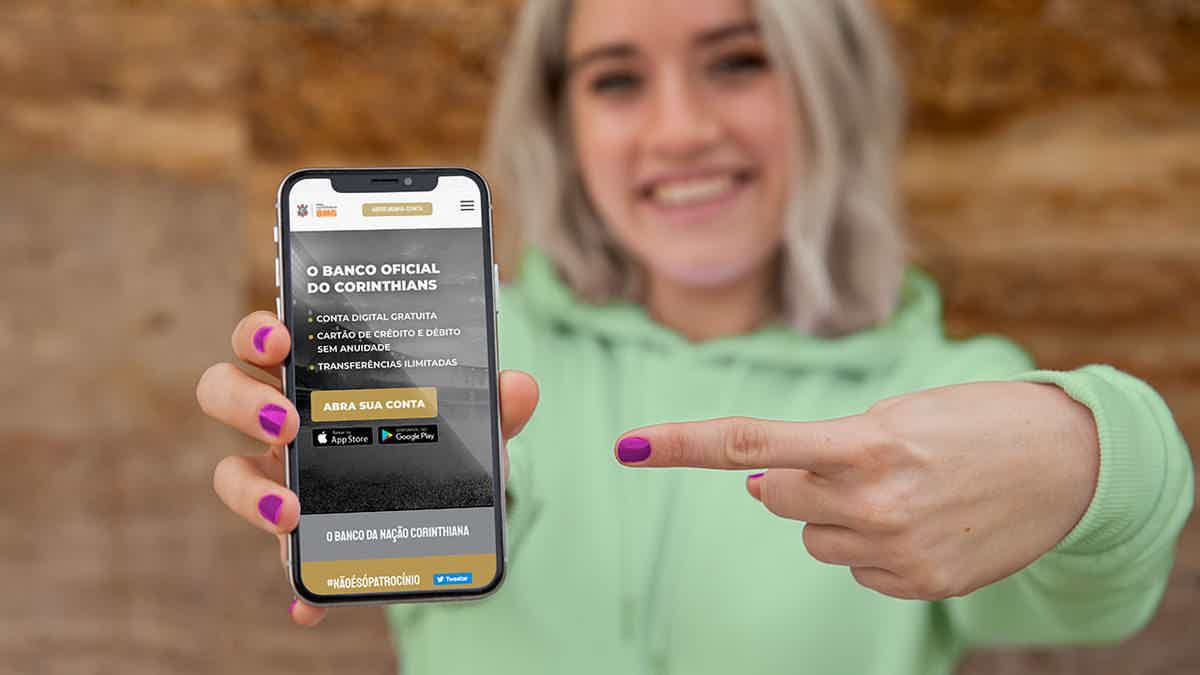

Discover the Corinthias BMG credit card

Get to know the Corinthias BMG credit card and see if this card is what you need right now! Ah, he is ideal for negatives! Check out!

Keep ReadingYou may also like

Get to know the Santander Visa Gold Decolar Card

Get to know Decolar Santander Visa Gold, with 1.6 pts for every dollar spent. With international coverage and ideal for those who like to travel, with a lower annuity.

Keep Reading

How to check your Calcard bill

Do you want to have a card with access to credit in a practical way? Learn more about Calcard and take the opportunity to learn how to control your invoices through the website or the application.

Keep Reading

Discover the online English course Rachel's Academy

Do you want to learn English in an easy and intuitive way? Ráchel's Academy platform is a teaching method and can help you. Continue reading and learn more.

Keep Reading