loans

How to apply for the Condor loan

The Condor payroll loan is exclusive to INSS retirees and pensioners. With it, you can get credit with an interest rate from 1,69% per month. Find out here how to apply for your loan and enjoy the lowest rates on the market!

Advertisement

Condor: apply for the loan with the lowest market rates

If you have plans and want to get them off the ground, the Condor payroll loan can be a good option. This line of credit is specific to INSS retirees and pensioners, hence the lower rates. In addition, the Condor loan has several advantages, such as:

- Lowest market rates;

- After hiring, the money does not take long to fall into your account;

- Consolidated and secure company to handle your loan;

- Carry out your loan digitally 100%.

In today's article, we will show you how to apply for the loan. Check out!

Order online

It is possible to apply for the loan 100% online via WhatsApp. To do so, add the number (41) 99249-8832 to your cell phone and send a message to the attendant. Thus, he will guide you to solve everything without leaving home.

Request via phone

It is also possible to apply for your payroll loan over the phone, at the number: (41) 3888-3663. Just be aware of the schedule, the company only works from Monday to Friday, from 8am to 6pm.

Request by app

Condor does not yet have an application, but the other forms of request work quickly and conveniently.

BMG loan or Condor loan: which one to choose?

Now that you know about the Condor loan, let's show you the BMG loan. Compared to Condor, the fees are higher. However, at BMG you receive the BMG Card to make your purchases, which facilitates the use of credit.

See the main differences between the two loans below.

| BMG | Condor | |

| Minimum Income | Minimum wage | not informed |

| Interest rate | From 1.80% per month | From 1,69% per month |

| Deadline to pay | 96 months | depends on the loan |

| Where to use the credit | on any purchase | trips, courses |

| Benefits | Long term to pay | Lowest market rates |

How to apply for the BMG loan

Applying for your BMG loan is much easier than you might think! Read our text and understand more about this process.

About the author / Leticia Maia

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to apply for a loan with Santander property guarantee

Learn here how to apply for a loan with Santander property guarantee and have up to 240 months to pay with fixed interest rates. Check out!

Keep Reading

How to apply for the American loan

The Americanas loan can be requested by phone, app or website. Check out in this article how to hire and make your dreams come true!

Keep Reading

How to send resume to Americanas? Check it out here

Learn in this post how to send resume to Americanas and know the requirements that the vacancies of this great retailer have!

Keep ReadingYou may also like

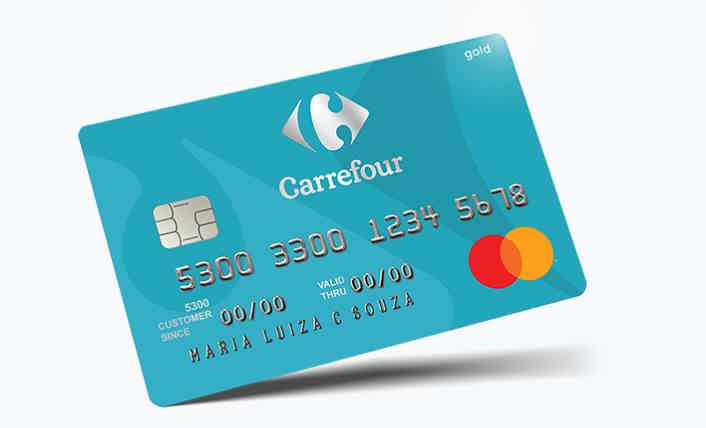

Carrefour Mastercard Gold Card Review 2021

With our Carrefour Mastercard Gold card review, you will learn about the main features of the financial product. In addition to its incredible benefits, such as the Mastercard Surprise program, the possibility of waiving the annuity, international coverage and much more. Check out!

Keep Reading

Is it safe to buy from the Shein website?

Meet the Shein store, a Chinese e-commerce that delivers worldwide and offers low prices and discounts. Find out if it's safe here!

Keep Reading

Pan Mastercard Gold credit card: how it works

Are you looking for a card that has a points and cashback program? With the Pan Mastercard Gold card you can enjoy these and many other advantages. Want to know this option better? So read this post and check it out!

Keep Reading