loans

How to apply for a loan with a property guarantee Creditas

Requesting a loan with a Creditas property guarantee can be done completely online so that you can take out credit wherever you are. Find out more here.

Advertisement

Take out this loan online 100%

If you are looking to apply for credit with a Creditas property guarantee, know that you have come to the right place!

This large financial institution offers this type of credit where you can access high amounts of credit and pay back in up to 20 years!

This way, with the Creditas property secured loan you are sure that you will be able to access the amount you need within the period you can pay.

Therefore, in the following post you will find out how it is possible to take out this loan through the company's main channels.

Order online

First of all, let's learn how to request a loan with Creditas property guarantee from the finance company's website.

Therefore, all you have to do is access the secured loan page and start simulating the credit you would like to take out. This way, you will be able to preview the amount of interest you will be able to earn.

Once this is done, all you need to do is send some of your personal data and information about the property so that Creditas can carry out an analysis and offer a proposal.

Upon receiving the proposal and accepting it, Creditas will begin analyzing the property to see if it meets the requirements that the finance company establishes.

When she finishes inspecting the property and, if everything is ok, the contract will be issued and Creditas consultants will schedule a time for you to sign it.

Soon after, the contract will be recognized by a notary and registered in the property registration. After that, the money will be released into your account.

Request via phone

Some finance companies allow you to apply for loans via a phone call.

However, aiming at the security of the operation, nowadays Creditas only works with credit requests through its digital channels, namely the website and the application.

Request by app

Finally, to request a loan through the Creditas app you need to download the app on your cell phone.

With that done, just follow the same steps as hiring on the website. Therefore, carry out the simulation and send your data and that of your property for analysis by the company.

When you pass the analysis, you will only need to sign the contract and then wait for the money to be released.

Creditas property secured loan or Creditas vehicle secured loan: which one to choose?

Namely, in addition to the Creditas property-secured loan, the same financial institution also allows you to take out a loan by adding your car or motorcycle as collateral.

This way, you can get credits between R$ 5 thousand and R$ 150 thousand and a good term and payment. Furthermore, during the duration of the loan, you can continue using your vehicle normally.

Therefore, to find out how to apply for a loan with a vehicle guarantee from Creditas, just check the step-by-step instructions in the post below!

| Loan with property guarantee Creditas | Loan with vehicle guarantee Creditas | |

| Minimum Income | not informed | not informed |

| Interest rate | From 0.99% + IPCA | Starting at 1,49% am |

| Deadline to pay | Up to 240 months | Up to 60 months |

| Where to use the credit | As you wish | As you wish |

| Benefits | Personalized service Online application Quick and efficient loan | Installments from R$ 151.00 Simple, fast and secure Online application |

How to apply for a loan from Creditas

Find out how you can use your vehicle as collateral for this loan!

About the author / Leticia Jordan

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

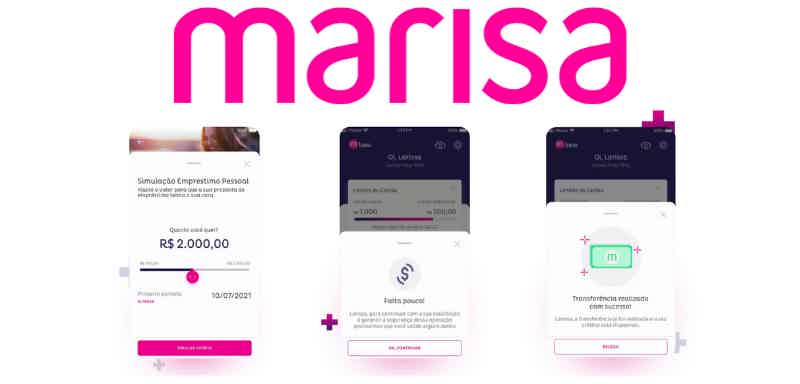

How to apply for the loan Marisa

Do you want to apply for your Marisa loan, but don't know how to do it? Check out in today's article the step-by-step application!

Keep Reading

Online PagBank card: free and with a guaranteed limit

Get to know the PagBank card online, its features and guarantee a credit limit of up to 100% of your salary, without annuity and abusive fees.

Keep Reading

Consigned Credits Loan or C6 Consig Loan: which is better?

Do you want to know which one to choose between Creditas Consignado loan or C6 Consig loan? Read this post now and discover the best option!

Keep ReadingYou may also like

How to apply for a credit loan

Are you in need of money? Credibom can be a good option for you in Portugal. Read on to find out how to apply!

Keep Reading

SuperSIM loan or Agibank loan: which is better?

If you are looking for personal credit, know that the SuperSIM loan or Agibank loan can help you, even if you have a dirty name. Learn more here.

Keep Reading

Discover the Caixa Leve credit card

Do you know the Caixa Leve credit card? He has a great rewards program. Do you want to know more about him? So, read the post.

Keep Reading