loans

How to apply for a payroll loan

Find out how to apply for the Caixa payroll loan, with direct payroll deduction and without the need for a guarantor. Plus, take advantage of great credit conditions. Check out!

Advertisement

Consigned cash: loan with hiring without bureaucracy

First, the payroll loan is requested in numerous ways. However, it is only available to INSS beneficiaries and civil servants. In addition, employees of private companies associated with Caixa can also take advantage of this.

It is important to point out that being a Caixa customer also favors the request, in addition to receiving the salary from the bank. That is, before requesting, the tip is to do the portability! However, consult the company beforehand.

Also, check out how to apply for this loan. Follow!

Order online

First, do the simulation on the Payroll Cash loan page. Thus, you will be able to know the number of installments and the interest rate based on the total amount desired. If you happen to be an employee of a private company, first check the available margin with HR, as well as whether there is an agreement with Caixa.

In addition, Caixa customers can apply via internet banking or an application. In view of this, it is enough to fill out the required forms with personal data, in addition to proving income with photos of documents. Thus, the bank will carry out the credit analysis before approval.

Finally, the money is released into the chosen account. However, do not forget to follow the installments being deducted from the payroll.

Request via phone

It is not possible to apply for a loan over the phone. However, contact the Caixa Assistance Center. It is certainly the right channel to answer questions or contest installments, for example. See the numbers below:

- 4004 0104 (capitals and metropolitan areas);

- 0800 104 0104 (other regions).

Request by app

This request is only allowed for Caixa account holders who have already released the banking application. After that, look for the loan area and proceed with the request. Also, wait for the credit analysis and get the answer in one of the indicated channels. Certainly, it will take a few days to have the answer and the money released.

BMG loan or payroll loan: which one to choose?

How about knowing another option, so that the decision taken is effective? So, check out the comparison with another payroll option. Likewise, get a payroll discount and cash release within 24 hours. However, in the BMG payroll loan, the money falls even earlier in some cases.

| BMG Payroll | Payroll Box | |

| Minimum Income | not informed | not informed |

| Interest rate | 1.80% per month | not informed |

| Deadline to pay | Up to 96 months | Uninformed |

| Where to use the credit | Payment of debts; Vacation travel. | Settlement of financial debts; Investment in a new business. |

| Benefits | Release in a short time; Direct discount on the payroll; Low interest rate. | Reduced interest rate; Payroll discount; No guarantor. |

How to apply for the BMG loan

Check out how to apply for the BMG payroll loan with a long term for payment, reduced interest rate and quick release.

Trending Topics

Discover the Sicoob Cabal Classic credit card

Check out in this post everything about how the Sicoob Cabal Classic credit card works and what are its main advantages!

Keep Reading

How to fill out a promissory note

Do you know how to fill out a promissory note? There are still many people who use this method of charging. Before that, read this post and discover the step by step.

Keep Reading

How to subscribe to Mandando Bem? See the process

Find out in this post how to subscribe to Mandando Bem and thus get the necessary amount to invest more and more in your business!

Keep ReadingYou may also like

How to get free stuff on Shopee: see how to redeem prizes and coupons

Discover the secrets to saving and even getting free products on Shopee. Take advantage of incredible offers and exclusive coupons!

Keep Reading

See the chronological order of Marvel movies

For those who like superhero movies, the Marvel Universe is a classic that needs to be seen. However, with so many movies in the franchise, it's hard to understand where to start. Therefore, we have brought the timeline of movies so you don't get lost anymore.

Keep Reading

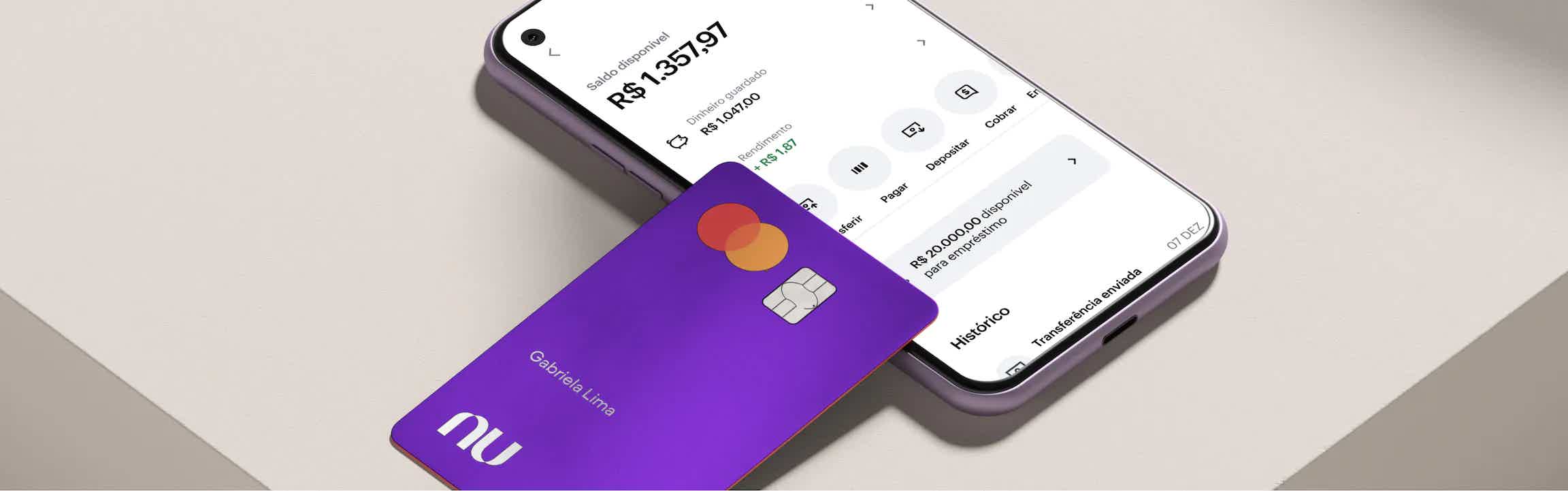

PIX with Nubank credit card: understand how it works

Monthly bills squeezed or need to pay an urgent bill? PIX with Nubank credit card can be a solution. But, before using it, get to know its features, fees and more. See information in the article.

Keep Reading