loans

How to apply for the BxBlue loan

Learn how to apply for a BxBlue payroll loan, other useful information about this loan, so that you can pay off all your debts!

Advertisement

BxBlue Loan

Initially, BxBlue works by offering loans to retirees, INSS pensioners, public servants and workers with a formal contract at the lowest interest rates on the market. So, we will teach you how to apply for a Bxblue loan and other information about this type of credit to help you pay off your debts!

So, to understand more about it and how you can access it, read on! Check out!

Step by step to apply for the BxBlue payroll loan

So, let's take a step-by-step guide to applying for a BxBlue loan:

Order online

Well, ordering online is very simple. Just go to the Bxblue website, fill out the registration form, providing all your personal data. Then, the credit analysis will take place quickly and efficiently!

In this, if you meet the company's criteria, the proposal will be approved. So it's a fast, safe and interesting way to get money!

Request via phone

So, as we mentioned, the BxBlue payroll loan request can only be made online.

This is because it relies on the speed of the internet so that proposals can be approved in a faster and safer way. Likewise, complaints can also be made via the website.

But, if you want to ask questions about Bxblue, just contact us at: 3004-4883.

download app

So, there is no application to make a Bxblue loan proposal, this is because all proposals must be sent directly on the website.

Agibank loan or BxBlue loan?

Therefore, the Bxblue payroll loan has several advantages such as low interest rates and is very simple to apply for. So, don’t put it off for later and do it today! But if you still have doubts, how about finding out about the Agibank loan as an option? Check it out below:

| BxBlue consigned | Agibank for negatives | |

| Minimum Income | uninformed | uninformed |

| Interest rate | Starting at 0.99% am | 1.63% am |

| Deadline to pay | 96 months (SIAPE) and 84 months (INSS) | up to 72 months |

| release period | Immediate cash release for digital banks and 2 to 5 business days for other banks. In case of portability of credit or debt between banks, the money can take up to 20 days to be released. | Until 16:30 on the same day of release |

| loan amount | R$1,500 to R$400,000 | R$200 to R$10,000 |

| Do you accept negatives? | Yes | Yes |

| Benefits | Payroll deduction | Payment by bank slip, check or direct debit |

How to apply for the Agibank loan

If you already understood what the Agibank loan for negatives is and you were delighted with its advantages, the time has come to find out how to apply for it.

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

The 15 Beautiful Sacred Sites Around the Planet You Must See One Day!

There is no shortage of beautiful sacred sites in the four corners of the world. If you are curious to know more, then check out our text.

Keep Reading

How to open account Neon

Do you want a fee-free digital account with a credit card without an annual fee? So, here's how to open a Neon account and enjoy its benefits.

Keep Reading

Meet the personal loan Help!

Meet the personal loan Help! and understand how it works and can help you get out of debt in comfort and safety!

Keep ReadingYou may also like

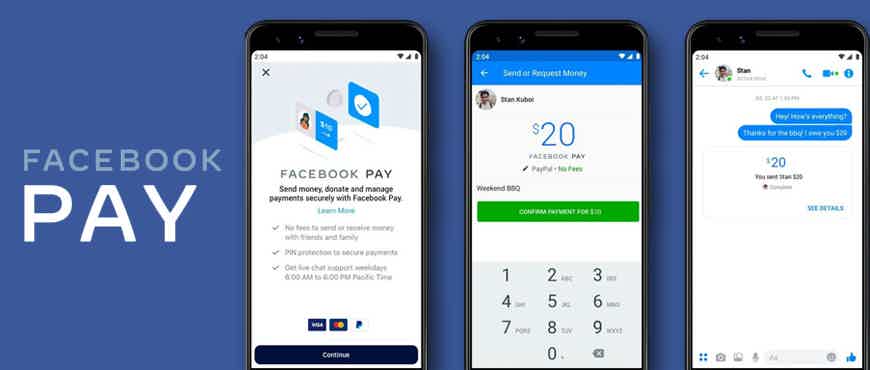

Meet Facebook Pay: new payment system 2021

As a new payment method, Facebook Pay has emerged to simplify your relationship with online transactions. Learn more about it here and start using it.

Keep Reading

How to apply for the Bankinter Platinum card

If you are a resident of Portugal, you need to know about the Bankinter Platinum card. It offers many benefits to its customers. Read this post and check out how to request it.

Keep Reading