loans

How to apply for the American loan

The Americanas loan offers credit of up to R$ 30,000 for those who have the store card. Plus, you have up to 48 months to pay with an interest rate of up to 1,99% per month. Apply for the loan and still have 70 days to pay.

Advertisement

Americanas: apply for your loan and pay it in up to 48 installments

First, the Americanas loan is a line of credit offered by Americanas in partnership with the Cetelem bank. Furthermore, it is possible to simulate and hire 100% online and the money will be deposited in your account within 2 business days.

The main advantage of the Americanas loan is having up to 70 days to start paying. And, also, having the convenience of having the installments appear on the card statement. That way you only worry about a due date and a payment. That is, you don't have to remember several dates and fear the extra interest.

Another positive point is the easy hiring. You can apply for the loan via WhatsApp, website or application. In today's article, we'll show you the step-by-step process for applying for an Americanas loan. So let's go!

Order online

Applying online is one of the preferred ways these days. That's because it's fast and convenient. And with the Americanas loan it would be no different. First, you need to have an Americanas card to complete the application process.

Then just access the Cetelem website. There you will need to register to do the simulation and receive the offer. If everything is right, make the request and wait for the credit analysis. So, in case of approval, you receive the money within 2 business days.

Request via phone

In addition, it is also possible to take out the loan via WhatsApp. To do so, simply include the number (11) 99407 8742 in your schedule and send a message stating your intention to apply for credit. The process is fast and intuitive.

In addition, you can contact us by phone to request the credit, the service is from Monday to Saturday, from 08:00 to 22:00. See the numbers below:

- 4004 7990 (Capitals and Metropolitan Regions);

- 0800 704 1166 (Other locations).

Request by app

Hiring through the app is done through the Cetelem App, which can be downloaded for free from the App Store or Play Store. After this process, just register and then the simulation. So if everything is right, wait for the credit analysis. In case of approval, the money falls into your account within 2 business days.

Credits loan or Americanas loan: which one to choose?

Now that you know the Americanas loan, let's show you the Creditas loan.

Between the two, what changes is more your end goal. Americanas credit is better for smaller purchases, such as travel or unforeseen circumstances. Creditas, on the other hand, has a longer term to pay, covering higher amounts. See details below:

| Credits | Americans | |

| Minimum Income | not informed | not informed |

| Interest rate | From 0.99% per month | From 1,99% per month |

| Deadline to pay | Up to 240 months, depending on the modality | Up to 48 months |

| Where to use the credit | Renovate a house, invest in your business | Occasional travel and unforeseen circumstances |

| Benefits | Three loan options | 70 days to start paying |

How to apply for the Creditas loan

The Creditas loan offers three types of credit for you to choose the one that best fits your finances. See how to apply!

About the author / Leticia Maia

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Pão de Açúcar card miles: how to convert points into miles?

Check out how miles are redeemed on the Pão de Açúcar card and start using them to save money on your next trips!

Keep Reading

Is there a loan with a property guarantee for bad credit?

Are you negative? In today's article, we are going to show you 7 loan options with property guarantee for negative credit. Check out!

Keep Reading

10 virtual museums for you to visit at home: discover the world's largest collections in the comfort of your home

The doors of the largest collections in the world have been opened and you, who are inside the comfort of your home, can visit them through virtual museums.

Keep ReadingYou may also like

How to make money with Cryptocurrencies 2021

It's time to earn money by investing in cryptocurrencies for the long term, trading, arbitrage, mining and even for free. Here's how to do it.

Keep Reading

25 best no annual fee credit cards of 2020

Discover the 25 best credit cards with no annual fee in 2020.

Keep Reading

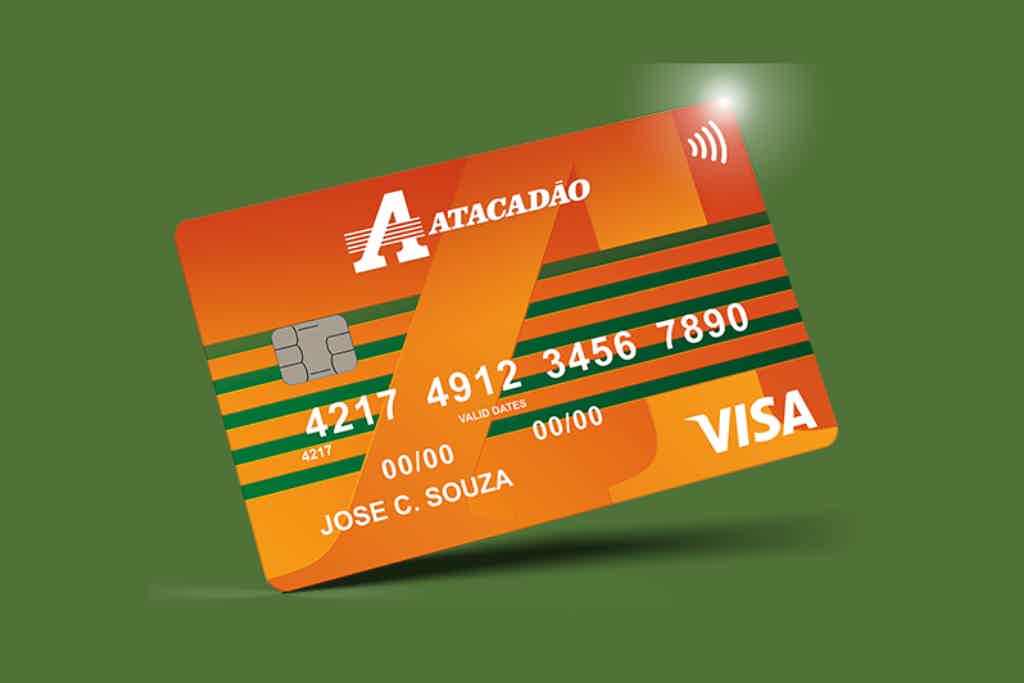

Does the Atacadão card have an annual fee? Find out the answer here!

If you are in doubt about the annual fee for the Atacadão card, we can help you. We will explain the features, advantages and disadvantages of the card, so that you can decide if it is worth requesting.

Keep Reading