Real Estate Credit

How to apply for CrediHome real estate credit

With CrediHome, you will find the best options to finally make your dream of home ownership come true. Read this article and find out how to simulate and hire yours!

Advertisement

CrediHome: simulate now and have the best credit options

First, CrediHome is a fintech that acts as an intermediary in the financing process. In this sense, with it, you can simulate your CrediHome mortgage and find the best options for your pocket. Furthermore, there are more than 10 banks authorized by the Central Bank that work in partnership with CrediHome.

Therefore, in today's article, we will show you how to simulate and apply for your credit. Continue reading and get closer to the dream of owning a home.

Order online

Firstly, applying for your home loan online with CrediHome is very simple. To do this, just go to the official website and fill out the form. Also, follow the steps described below.

- Access the CrediHome website;

- Then select “Real Estate Financing”;

- Once this is done, enter the value of the property;

- Then, enter the financing amount you need;

- The next step is to indicate whether you are going to use your FGTS;

- Then fill in your basic information;

- Finally, submit your proposal for review.

Likewise, after the analysis period, CrediHome will send you the credit options that best fit your profile. Thus, you can send your documentation and contract your desired real estate financing.

Request via phone

Likewise, if you prefer, CrediHome offers the option of requesting your mortgage over the phone. In addition, the process is similar to the previous one, the difference is that a specialized consultant will assist you and assist you in the process. To do so, contact us via WhatsApp, whose number is (11) 96626-8241.

Request by app

Unfortunately, CrediHome does not yet have an app available. But you have full support from the official website.

CrediPronto Real Estate Credit or CrediHome Real Estate Credit: which one to choose?

So, now that you've met CrediHome, it's easier to decide if it's ideal for your needs. But, if you realize that you want to analyze other proposals, how about getting to know CrediPronto? Furthermore, it is an Itaú bank company. In short, CrediPronto finances its real estate with standard interest, savings and mix interest.

That is, it is also an interesting option, as well as CrediHome. Then, see the differences between each in the table below. As a result, choose the best option according to your needs.

| credipronto | credit home | |

| Minimum Income | not informed | not informed |

| Interest rate | From 8.3% aa | Depends on the chosen bank |

| Deadline to pay | 360 months | Depends on the chosen bank |

| Deadline for release | Up to 5 business days after approval | Depends on the chosen bank |

| credit amount | Up to 90% of property value | Depends on the chosen bank |

| Do you accept negatives? | No | Depends on the chosen bank |

| Benefits | It belongs to the Itaú bank, so it is reliable | You can compare different banks before choosing the best option for you. |

How to apply for CrediPronto real estate credit

With CrediPronto real estate credit, you have up to 360 months to pay and interest from 8.3% pa Now we'll show you how to apply for yours. Check out!

About the author / Leticia Maia

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to send resume to Pernambuco? check here

Find out in this post how to send resume to Pernambuco following just 5 steps completely online without having to leave your home!

Keep Reading

How to apply for the Magalu consortium

Looking for a consortium to acquire your own home? With the Magalu consortium, the contract has zero interest and up to 240 installments. Find out how to apply!

Keep Reading

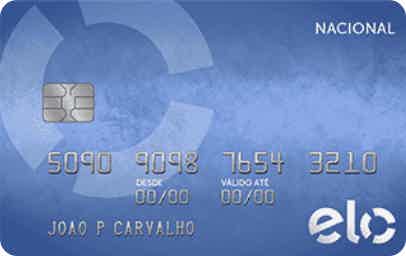

Basic Elo credit card: what is Basic Elo?

Elo Basic is a basic credit card, with international coverage and with several advantages for customers, in addition to having a different annual fee.

Keep ReadingYou may also like

How to open an account at Rico investment brokerage

Are you going to invest with Rico? Know that the brokerage fee is exempt for the administration of Direct Treasury and custody of assets. Check out how to open your account and take the next step here!

Keep Reading

How to make Pix in Box

If you haven't registered your Pix in Caixa yet, check out how to make your Pix key and how to transfer it here. Thus, you avoid unwanted fees for TED or DOC transfers, for example, and you can have the money in your account immediately. Check out!

Keep Reading

Find out about the Single Mother Assistance benefit

If you are a single mother, have children or dependents under the age of 18 and meet some of the other requirements described in the text below, you may be eligible to receive Single Mother Allowance. Read the post and understand more about it.

Keep Reading