Cards

How to apply for Zap card

If you want to have the convenience of carrying out any banking activity from your WhatsApp, the Zap card may be the ideal choice for you. Check out this post to find out how you can apply for it!

Advertisement

Learn how to request a Zap card from your WhatsApp

The Zap credit card is a great option for those who want to manage their banking activities from WhatsApp.

With it, you can have a digital card with no annual fees or membership fees, which allows you to make purchases in various establishments and online stores.

In this post, you will see how you can apply for your Zap card and enjoy the benefits it offers. Check it out!

Order online

The Zap card request can only be made through WhatsApp. When you contact it, you can talk to the virtual intelligence called “Zapelino” who provides all the instructions for requesting your card.

However, you can access it from the card's official website. When you click on the “Order your card now” button, the page redirects you to the WhatsApp conversation with Zapelino.

When you get there, just say “hi” and wait a few minutes and he will respond with the available options.

When he sends you a message, select the “Card” option and then choose “Request Card”. From here, just send your details and wait for confirmation!

Request via phone

At the moment, the Zap credit card cannot be requested via telephone calls with bank representatives.

The only way to request the card is from a cell phone that has the WhatsApp application installed and the contact number of the Zap artificial intelligence, which is: (11) 4502-4494.

Request by app

Zap also has an app available for Android and iOS. From there, you can top up, pay bills, transfer money and also create your digital account on Zap.

However, the Zap credit card application can only be made via WhatsApp. The idea behind Zap is to be a digital account managed on WhatsApp, so all the actions you can take on your card can be performed via the messaging app.

Zap card or Neon card: which one to choose?

The Zap card is an option that makes things easier for the user, in addition to being completely free. However, it is not the only card that can offer this.

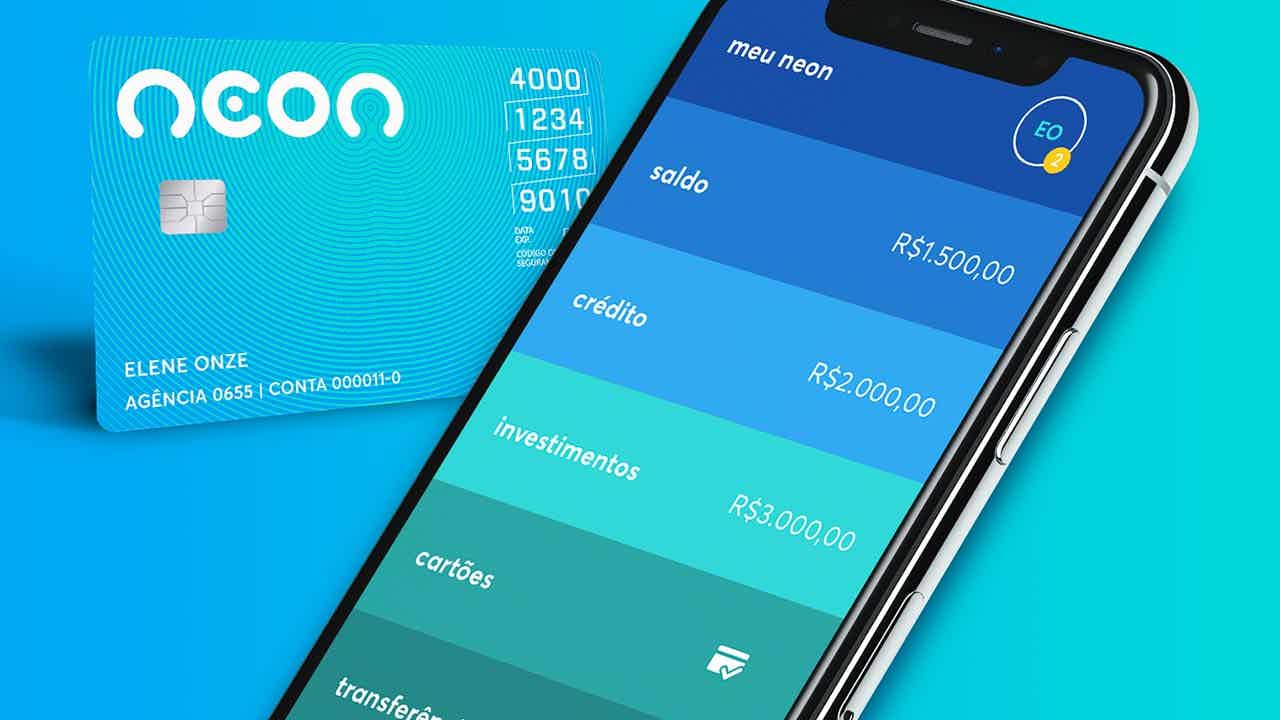

Another very popular option on the market is the Neon credit card. It is an option with no annual fee and can approve your purchases even if you don't have a limit on the card!

In the table below you can see the comparison between each of the banks to make the best choice for you!

If you liked the Neon credit card and believe it will be a good option for you, check out the post below and find out how to apply for yours!

| Zap Card | neon card | |

| Annuity | Exempt | Exempt |

| minimum income | not required | not informed |

| Flag | MasterCard | Visa |

| Roof | International | International |

| Benefits | Totally free No membership fee | Has a virtual credit card Approves purchases even without a limit |

About the author / Leticia Jordan

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Nubank Ultraviolet Card or Modalmais Card: which one is better?

Learn about the advantages and choose between the Nubank Ultravioleta card or the Modalmais card to enjoy the high limit, cashback and much more!

Keep Reading

How to send resume to Seara? Check it out here

Find out how to send your resume to Seara and thus apply for several open opportunities with salaries of up to more than R$ 8 thousand per month!

Keep Reading

Leader Card: How it works

Check here the main characteristics of the Leader card, such as exclusive discounts and differentiated installments in the chain's stores!

Keep ReadingYou may also like

PIX rates for companies can reach up to R$150.00!

PIX was created to facilitate banking transactions for millions of Brazilians instantly and at no cost. However, since the beginning of 2021, a fee has been charged for transfers and payments for legal entities, and many entrepreneurs still do not know this. See more here!

Keep Reading

How to Apply for the Inter Bank Card?

Find out now the step-by-step process to apply for your Banco Inter credit card. Read the instructions and choose one of the ways to order yours.

Keep Reading

Discover the Abanca Value current account

Discover the Abanca Value current account here, which allows you to make withdrawals and transfers without fees, in addition to having a complete set of benefits. Want to know what all these advantages are? So, check out the post below.

Keep Reading