Cards

How to apply for the Trigg card step by step

Learn how to apply for a Trigg credit card.

Advertisement

Trigg card features

The Trigg card offers simple and efficient ways to make the card.

So, it is possible to request the 100% card online and free of charge, the procedure being very quick and intuitive to do.

The Trigg credit card is perfect for people who like to rely on technology in their daily lives to make their lives easier, as this fintech offers 2 means to make your purchases only by approximation.

This company prides itself on making life easier for its customers through the use of technology. For this, the company offers its customers the use of the Trigger Band Bracelet, which allows the user to make purchases by approximation, that is, you will not need to walk around with your credit card.

This is just the first method that the company has adopted to make life easier for its consumer. It is possible to make your purchases, also by approximation, using the Samsung Pay application on your cell phone.

Advantages of the trigg card

Do not think that practicality is the only advantage of the card! In addition to the standard functionalities that other traditional banks offer, when purchasing the Trigg credit card, the customer has access to the cashback program, which returns 1.3% of the total amount spent on the invoice.

Furthermore, when obtaining the card, you will also have a friend referral program, and through this, you can earn up to R$200 reais.

In addition to everything else, you can also request a personal credit through scheduled withdrawal, use of a barcode to pay the invoice and issue a duplicate of the card.

Finally, the customer also has the Visa brand partnership and international coverage and, like everything else, the application process is very fast, simple and without bureaucracy. The service is digital, therefore, hiring is 100% online.

Order online

First of all, download the Trigg card app.

Then provide your documents, taking a selfie with them, and after that, fill out your registration.

After that, you will undergo a credit analysis, that is, your bank history will be studied to see if, by any chance, your profile is ideal for the company.

If you are accepted, your digital card will be sent to you immediately.

However, your physical card will take a few days to arrive.

Contact via phone

If you have any questions about the card or one of its services, please contact the following numbers:

- Capitals and metropolitan regions: 3003-1025

- Other locations: 0800 326 0808

To apply for your card directly on the company's official website, just click on the link below!

About the author / Gustavo Cezar

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

See how to register for Youth Action

Check out everything about how to register for Ação Jovem. Understand all the requirements and the step by step you need to follow to receive the scholarship

Keep Reading

Discover the Social Water Tariff benefit

With the Social Water Tariff benefit, you get incredible discounts and better quality of life for your family! Learn more right now.

Keep Reading

Prepaid Ourocard Card or University Ourocard Card: which is better?

Wanting to reach young people and those in debt, BB offers the Ourocard Pré-Pago card or the Ourocard Universitário card. Check out all about the options.

Keep ReadingYou may also like

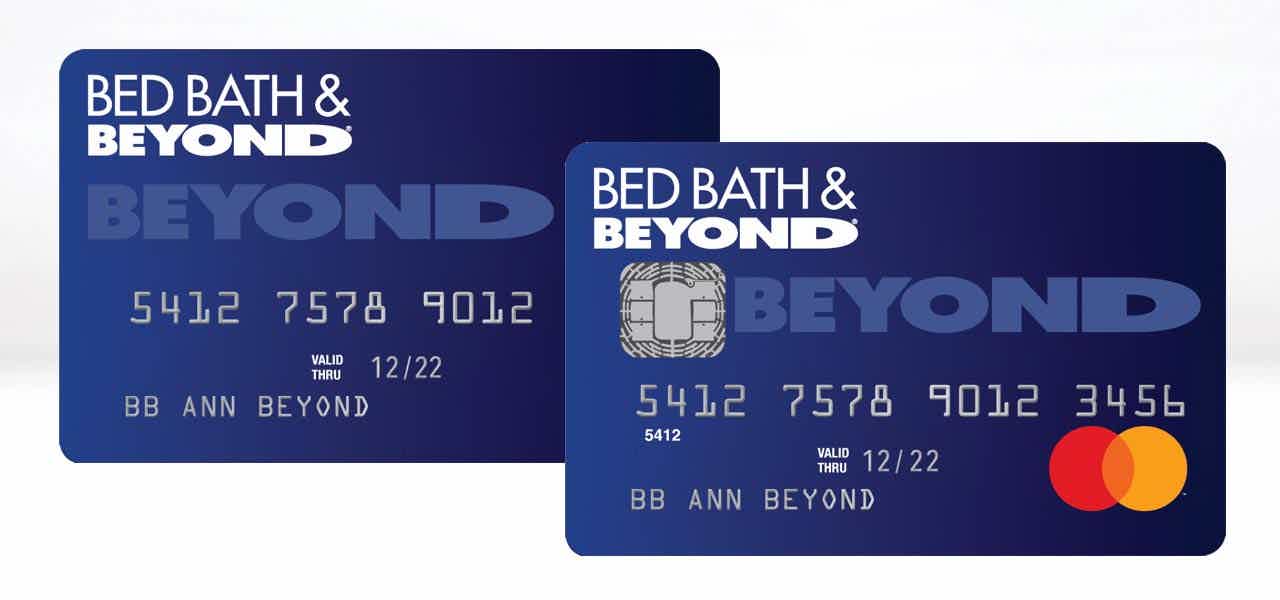

Bed Bath Beyond credit card: how it works

If you like to buy things for your home at a discount and still receive rewards. Then this card is for you. Want to know how it can be yours in just a few steps? So, read this post and check it out!

Keep Reading

How to apply for personal credit: see the best options

Knowing how to apply for a personal loan in Portugal is important! After all, this can be essential to achieving financial goals. Discover how to apply for personal credit intelligently in our comprehensive guide.

Keep Reading

Learn how to earn extra income on weekends

You need money? How about learning how to make extra income on weekends? That's right! There are activities that can help you achieve your goal. Continue reading and check it out!

Keep Reading