Cards

How to apply for Sou Barato Visa card

Do you want to learn how to apply for the Sou Cheap Visa card with extended terms, quick release and cashback program? Then continue reading to learn the step by step!

Advertisement

Sou Barato Visa Card

So, the Sou Barato visa credit card has exclusive offers, unique installment conditions and a cashback program ideal for you who love exchanging products for accumulated points! But, it charges an annual fee and minimum income!

So, today we will teach you how to request this card completely online and without bureaucracy! Well, keep reading!

Order online

So, to apply online, just go to the Sou Barato website with the documents in hand. Then fill out the form and wait for 15 days!

So, just wait for the credit analysis to be carried out and that's it! Finally, you just need to wait for the Sou Barato credit card to arrive at your home!

Request via phone

Therefore, you cannot request the Sou Barato card over the phone. However, you can contact the Cetelem bank numbers to ask questions: Telephone: 4004 7990 (capitals and metropolitan regions) or 0800 704 1166 (other locations), from Monday to Saturday, from 8:00 am to 10:00 pm.

Request by app

Unfortunately, Cetelem bank does not yet have an application to request the Sou Barato card. This is because the entire process is carried out through the official Sou Barato website! Therefore, visit the official website to access all information about the card!

Superdigital card or Sou Barato Visa card: which one to choose?

So, both cards have very interesting proposals for Superdigital and Sou Barato customers, as well as security and comfort for customers of these banks! Therefore, below see a comparative table between them:

| Superdigital Card | Sou Barato Visa Card | |

| Minimum Income | not required | Minimum wage |

| Annuity | ZERO annuity spending R$ 500/year or R$ 9.90/month | 12x R$ 10.99 (12x R$ 15.99 in the 2nd year) |

| Flag | MasterCard | Visa |

| Roof | International | national |

| Benefits | Without consultation with SPC and Serasa, Mastercard Surprise | exclusive offers Cahshback to exchange for products 10 installments without interest |

Finally, below is recommended content on how to request the Superdigital card! Check out!

How to apply for the Superdigital credit card

If you have doubts about how to apply for the Superdigital credit card, after this text you will definitely not have any more!

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Federal Police Contest: starting salary of R$ 10 thousand

The Federal Police contest for 2022 has already been requested. Check here some information about the process and learn what to study.

Keep Reading

How to apply for unemployment insurance? Check out the process!

Check out the step-by-step on how to apply for unemployment insurance, and understand the prerequisites to receive the benefit. See more details!

Keep Reading

How to send resume to SBT? check here

Find out how to send your resume to SBT and thus take advantage of the open opportunities to receive salaries between R$ 2 thousand and R$ 6 thousand!

Keep ReadingYou may also like

Get to know the Clear brokerage

Want to invest in stocks but don't know where to start. So, read this post and learn all about the investment brokerage that has zero fee for variable income.

Keep Reading

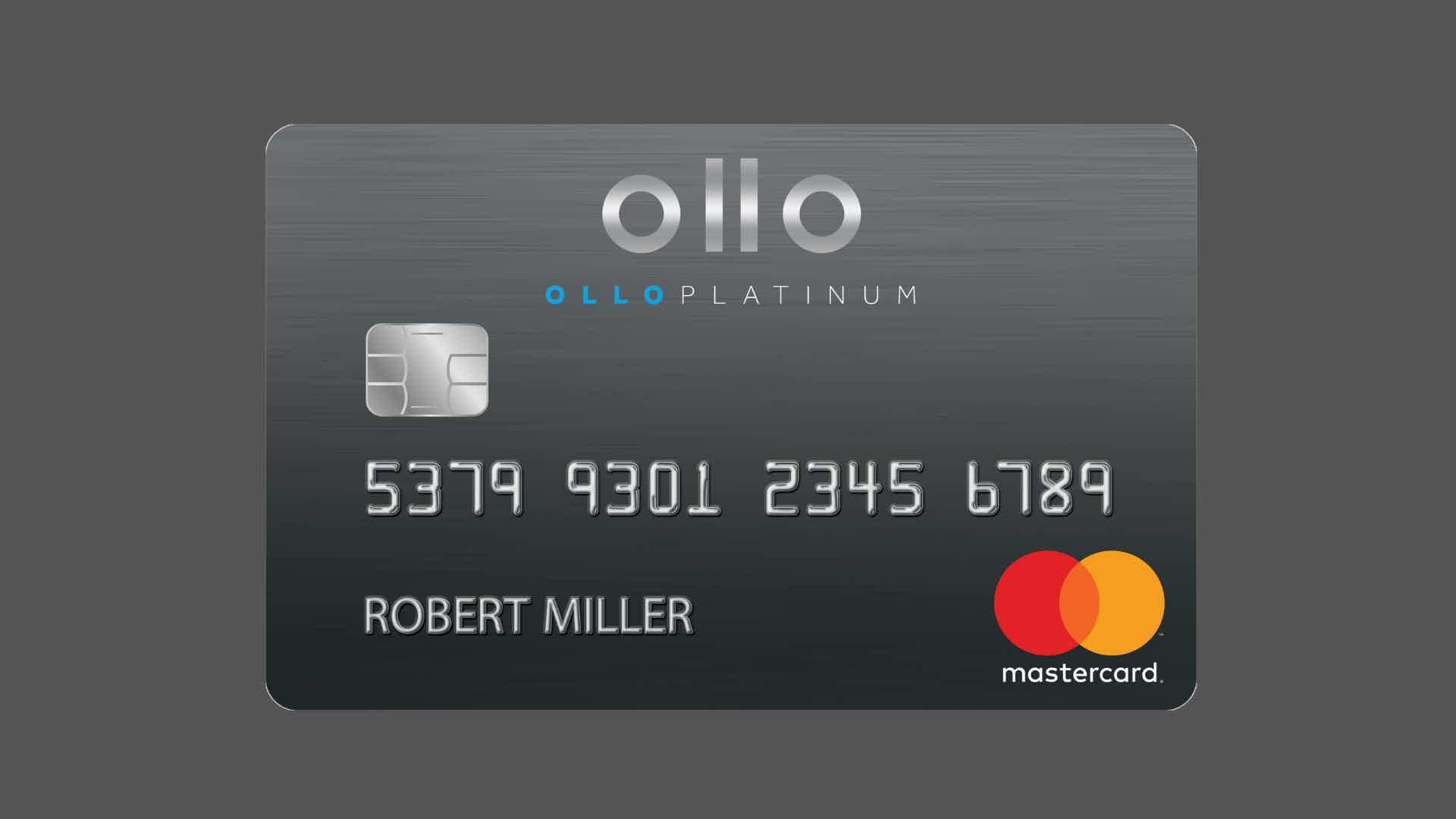

How to apply for Ollo Platinum card

The Ollo Platinum card has no annual fee, no foreign transaction fees or other hidden fees. Furthermore, it is international, and you can use it for your shopping or traveling. Want to know how to request yours? Check it out here!

Keep Reading

Everything you need to know to take out a new payroll loan

The payroll loan depends on the consignable margin. In 2021, this margin was changed to 40%. Want to know more about how to apply for the new payroll loan? Continue reading and check it out!

Keep Reading