Cards

How to apply for Oi card

The Oi card is a prepaid card that can be used for everyday purchases and offers good benefits. Check out how to order yours!

Advertisement

Hi prepaid card

The Oi prepaid card in partnership with Banco do Brasil is another option to keep finances under control. After all, the purchase limit is the balance, preventing you from going into debt or having to pay invoices later. In addition, with it in your wallet, you can make payments at various establishments that accept the Mastercard brand.

However, to request prepaid you must be a customer of the operator, whether telephony or TV. So, if you are interested, follow our article and find out below how to order your Oi card and better organize your finances.

Step by step to apply for Oi card

As we mentioned above, the main requirement to apply for the Oi card is to be an active customer of the operator. In addition, it is necessary to prove a minimum income of R$ 800 and have a clean name, if you want to apply for a credit card from the operator.

That way, if you meet all these requirements, just contact the operator to make the request. The good news is that the operator offers several channels for this type of request. So, check out the main ones below:

Apply for card online

One of the most practical ways to apply for prepaid or credit cards is through the operator's official website. The procedure is simple and in just a few minutes you can send the order. See below for step-by-step instructions on how to do this.

- To get started, go to the Oi website.

- Soon after, fill out the form with your CPF and phone number.

- Finally, send the data and wait.

On the Oi website, you can follow the progress of your order in real time. Thus, through it you will know whether the request was approved or not. But, if it is released, the physical card will be sent to the address informed in the registration. Then just unlock and use the features offered by.

Request via phone

Those interested can also make the request by telephone, through the operator's sales center. However, it is important to highlight that the order must only be made by Oi customers. So, check out the contact number below and make your request:

- Sales Center: 0800 095 7095

download app

There is currently no specific application to make the request. However, as it is a service developed in partnership with Banco do Brasil, it is possible to manage accounts via internet banking. So, a good tip is to download the bano app to better manage your accounts.

Olé Card or Oi Card?

So, if you are not a customer of the operator or are looking for other options, it is worth comparing the benefits offered by Oi with others available on the market. Our recommendation is the Olé card issued by Olé Consignado for INSS employees, retirees and pensioners. Also, accept negatives!

Olé is a Visa brand and has stood out for being free of annual fees, cheap rates and accepted in physical and online stores in Brazil and worldwide. So, if you want to know if it's a good option, check out our comparison below and find out which one is ideal for your needs.

| Hi card | Olé card | |

| Minimum Income | R$ 800 | Uninformed |

| Annuity | R$ 288 | Free |

| Flag | MasterCard | Visa |

| Roof | National | International |

| Benefits | charge cell phone Pay bills by cell phone Withdraw from the 24-hour bank network | Withdrawals at ATMsSpecial discounts on Oléal's partner networkIdeal for negatives |

How to apply for the Olé Consignado card

Check out the step-by-step guide on how to apply for the Olé card and enjoy the benefits it offers.

About the author / Lays Brandão

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to increase the value of the Brazil Aid?

Do you want to know if you are entitled to increase the value of the Brazil Aid? We will help you answer this and other questions in this article. Check out!

Keep Reading

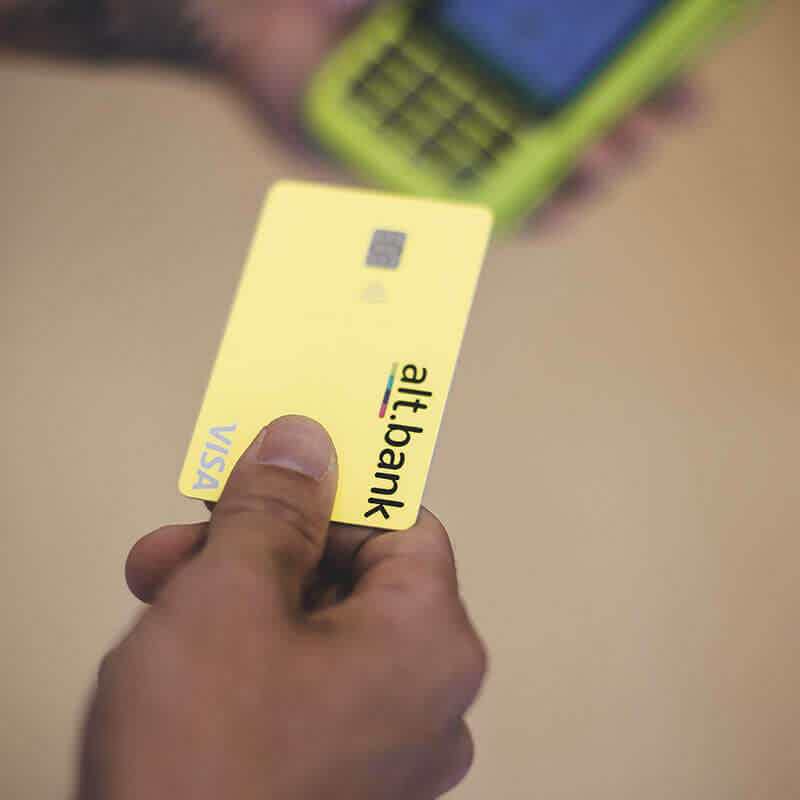

How to apply for the Alt Bank card

Find out in this post how to apply for your Alt Bank credit card in advance and be one of the first to use this feature!

Keep Reading

Site to watch live football: check out the best and don't miss a thing!

Discover the best sites to watch live football. This complete guide provides essential information so you don't miss out!

Keep ReadingYou may also like

How to register for PIS/PASEP

Have you heard about PIS/Pasep, but don't know how to enroll in the programs? Read the post below and see how simple it is to do this process.

Keep Reading

How to apply for the LuizaCred loan

Need quick cash or want to renovate your home appliances? Magazine Luiza offers an online loan with the possibility of paying in up to 72 installments.

Keep Reading

Discover the American Express Gold Credit Card

Do you know American Express Gold? This worldwide famous card is made for those who want advantages and security in one place. If you're looking for this, know that it might be perfect for you. Learn more about him in this post.

Keep Reading