Cards

How to apply for the Caixa Mais card

The Caixa Mais card has an exclusive points program that offers you an initial bonus of 2,000 points when paying your first bill. To request it is simple, just go to the nearest bank branch or correspondent. See more details here.

Advertisement

Caixa Mais: see how to request your Caixa card

After all, are you looking to know how to request your Caixa Mais card? Firstly, know that it has several benefits exclusive to the bank and the brand. Plus, it's definitely a great option for anyone who wants a nice, simple card. Therefore, the card has international coverage and a wide acceptance network. Plus, an exclusive points program.

However, it is only possible to request it by going to a bank branch or correspondent. Anyway, we will explain more details in the topics below!

Order online

Firstly, as mentioned in the previous topic, it is not possible to request the card online. Therefore, on the website you will only find information on how to request through the bank branch. Additionally, you can find out how to find an agency closest to you.

Therefore, the documents requested for the request are:

- Identification documents (RG and CPF);

- Proof of address;

- Proof of income.

Request via phone

In fact, although it is not possible to make the request via telephone, the customer can contact the bank to ask any questions. Therefore, call the numbers below:

- Capitals and metropolitan regions: 4004 0104;

- Other locations: 0800 104 0104 .

Request by app

Therefore, as already mentioned, the request can only be made at a bank branch or correspondent. Furthermore, the application can later be used to manage your card functions.

Caixa Mulher card or Caixa Mais card: which one to choose?

So, you've come this far and still have questions? Therefore, Caixa Econômica has several credit card options. Furthermore, they are all aimed at different audiences. Therefore, if Caixa Mais does not meet your needs, check out the characteristics of the Caixa Mulher card.

| Woman Cash Card | Card Cash More | |

| Annuity | Exempt | 12x of R$ 17.25 |

| minimum income | not informed | not informed |

| Flag | Visa or Link | Link |

| Roof | International | International |

| Benefits | Flag benefits and zero annual fees | Points Program and Elo Flex |

How to apply for the Caixa Mulher card

Find out here how to apply for the Caixa Mulher card and enjoy the benefits, such as ZERO annual fees, international coverage and exclusive benefits from the brand.

About the author / Marina Poncio

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

What is the best digital account to apply for a loan?

Do you want to know which is the best digital account to apply for a loan? In this article we will show you 7 options to help you decide. Check out!

Keep Reading

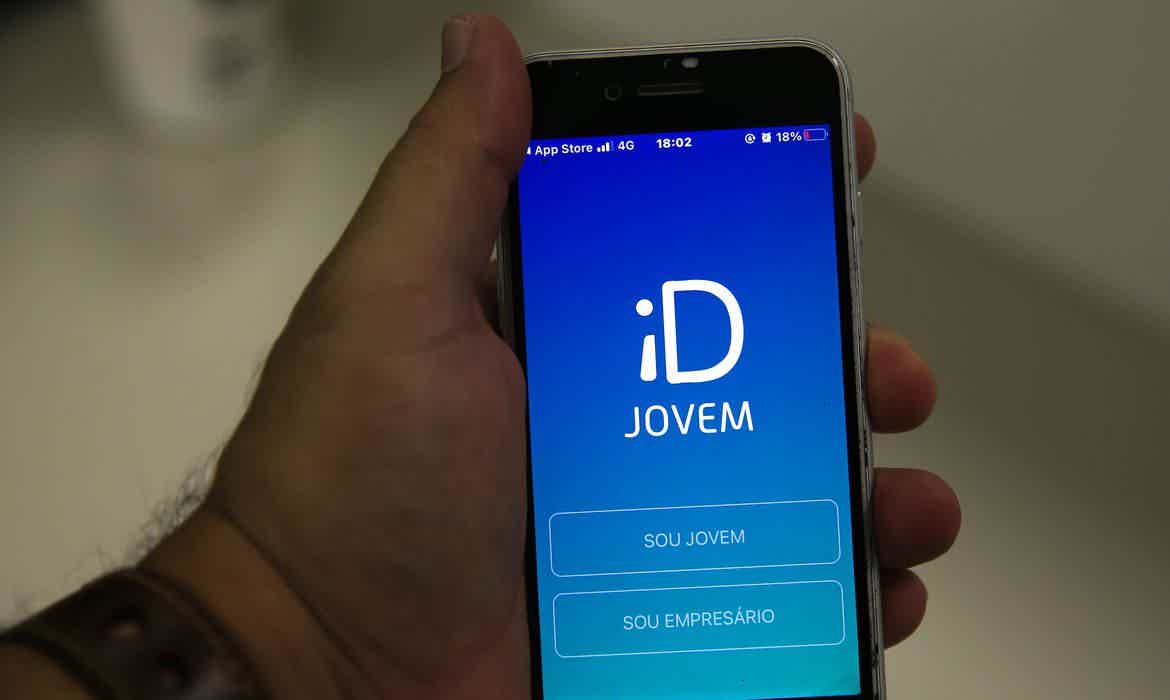

Meet ID Jovem

Find out how ID Jovem works, a Federal Government program for low-income youth between the ages of 15 and 29 registered at CadÚnico. Look!

Keep Reading

3 reliable self-employed loan options

If you are looking for a loan, how about knowing the best loan options for a reliable self-employed person? Read and check!

Keep ReadingYou may also like

SISU 2022 Program: clear your doubts

The SISU program is an excellent opportunity for university students to get a place at the university they've dreamed of! Learn all about the program here.

Keep Reading

Discover Omni credit card

Check out the main characteristics and strengths of the Omni card, such as the Fatura Premiada program, in which you compete weekly for cash prizes through the Federal Lottery. As well as access to insurance and 24-hour assistance. See more here!

Keep Reading

Discover the Banco Invest card

Do you know the Banco Invest card option? Well, Banco Invest brings your credit card with a complete investment platform, perfect for taking care of your money effectively. Interested? So, learn all about this card option here, come with us!

Keep Reading