Cards

How to apply for banQi card

The banQi prepaid card has no annual fee and offers 1% cashback. The time has come to find out how to request yours. We already told you that the process is very simple. Find out step by step in this article!

Advertisement

banQi: apply without needing credit approval

If you need a card to shop online, but don't want to lose control of your finances: apply for your BanQI card. BanQI is a fintech, created in 2018 in partnership with Via Varejo. In 2020, the company reached one million downloads of the platform. Since then, BanQI has continued to grow.

The BanQI prepaid card doesn't even require credit approval. All you need to do is open your BanQi digital account. Afterwards, you must make a deposit of at least R$10.00. And that's it, you can now request your prepaid card and start making your purchases. In this article, see the step-by-step guide to request yours.

Order online

On the BanQi website, it is not possible to request the card. However, all information about the prepaid card is available there. So, you can resolve all your doubts before requesting the financial product.

Request via phone

It is not yet possible to request the BanQi card over the phone. But, if you need to get in touch by phone, the company has some available:

- 3003 3283 for capitals and metropolitan regions;

- 0800 205 3283 for other regions;

- (11) 3003 0811 to contact us via WhatsApp.

Request by app

Requesting through the app is the easiest way to get your BanQi card quickly. Follow the step by step:

- Open your BanQi digital account;

- Make a deposit of at least R$10.00 (Pix, deposit, or deposit at one of the Casas Bahia stores);

- Wait for the money to arrive in the account;

- Go to the “Cards” tab;

- Request your physical card.

After that, your card will arrive at your home within 15 working days. Meanwhile, you can use the virtual card to make your purchases.

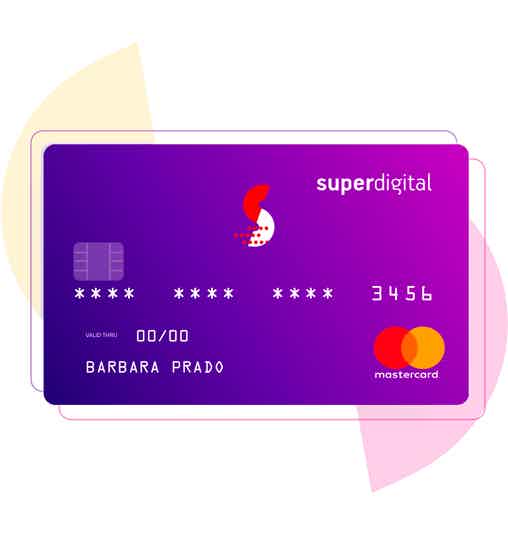

Superdigital card or banQI card: which one to choose?

If you think the banQi card doesn't meet your needs, that's okay. Also discover the Superdigital prepaid card and decide which option is best for you.

| Superdigital | banQI | |

| Annuity | Exempt | Exempt |

| minimum income | not required | not required |

| Flag | MasterCard | MasterCard |

| Roof | International | International |

| Benefits | Mastercard Surprise Program; Benefits associated with the flag. | 1% Cashback; Greater spending control. |

How to apply for the Superdigital credit card

If you are looking for a card with a digital account that accepts negative payments, the Superdigital card may be ideal. Understand here how to order yours!

About the author / Leticia Maia

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to anticipate FGTS by BV? See the process

See how to anticipate FGTS through BV and check out the special conditions you can access in this loan modality!

Keep Reading

How to apply for the Bradesco Clube Angeloni Visa card

Do you want to know how to contract the Bradesco Clube Angeloni Visa card? In this article we will explain it step by step. See now!

Keep Reading

All about Caixa's Real Estate Financing

Want to buy a property and don't know which bank to choose? Find out now about Caixa's real estate financing, the number 1 credit on the market.

Keep ReadingYou may also like

How to create your Pension Plan

A private pension plan can be a great choice for your future and for your stability after retirement. Learn more about it.

Keep Reading

How to apply for Abanca Personal Credit

Have you ever thought about having a loan of €75,000 to boost your dreams and only needing to repay the bank in 84 months? See here how to apply for Abanca Personal Credit and enjoy advantages like these.

Keep Reading

New feature allows the customer to track cashback income at Nubank Ultravioleta

Nubank announced last week that customers who have the Ultravioleta card will now have access to the income history of all cashback earned on purchases. Check more here!

Keep Reading