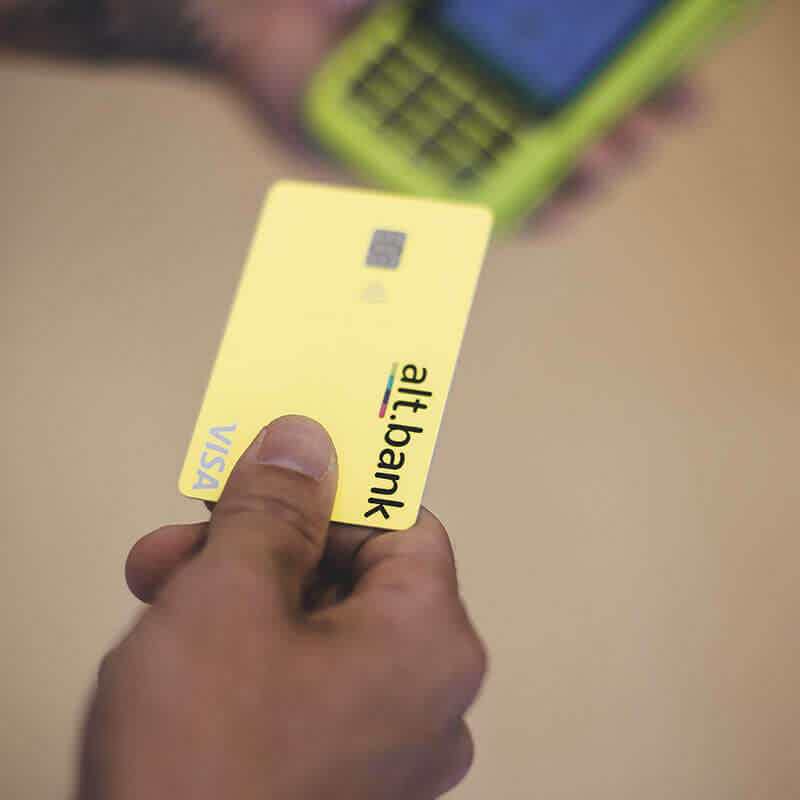

Cards

How to apply for the Alt Bank card

The Alt Bank credit card came to be an affordable option for all Brazilians! In this post, you can see the step-by-step process to access it in advance and thus enjoy its advantages!

Advertisement

Find out how to get early access to the Alt Bank card

The Alt Bank credit card is a great option for those who are negative or do not have a credit history. With it, you can be more in control of your finances and build your credit little by little.

For this, it offers several advantages to its users. Among them, a card with no annual fee and with a discount at several partner stores.

But even though it has numerous advantages, it is still not available to everyone. However, it is possible to guarantee your credit card early access! To achieve this, just check out the step-by-step listed below!

Discover the Alt Bank digital account

Check here the main features and advantages of the Alt Bank digital account.

Order online

Early access to the Alt Bank card is very easy and quick to do. From the card's official website, you can sign up for a waiting list. Thus, you guarantee that you will be one of the first to have the functionality!

To register, you only need to provide your name, mobile phone and email. When you complete your registration, keep an eye on your email. It is through this channel that they will notify you when you will be able to access the feature.

To increase your chances of being one of the first, it's worth creating an Alt Bank account. They have a very simple digital account to create. Thus, whoever owns it, has a better chance of getting the Alt Bank credit card in advance.

Request via phone

It is currently not possible to join the waitlist from the phone. But Alt Bank provides contact for its official call centers to answer questions about the process.

For this, you can contact us via the email and WhatsApp listed below.

- WhatsApp: (11) 2222-1149;

- Email: support@altbank.co.

If you have questions about how your data will be used, stored and protected by Alt Bank, you can contact us at lgpd@altbank.co to clarify your doubts.

Request by app

At the moment, it is also not possible to request the credit function through the Alt Bank application. Even having the digital account, to be on the list it is necessary to access the official website and register through it.

All credit release operations are being carried out centrally on the website. Therefore, the only way to apply for the card is through the website.

Alt Bank card or Neon card: which one to choose?

Now you know everything you need to apply for your Alt Bank credit card! But, there are still other credit card options that might work for you as well.

Another option that exists in the market, which is similar to Alt Bank, is the Neon bank credit card. Like Alt Bank, it also has zero annuity, but it has other interesting features.

See the table below for a comparison between the two.

| Alt Bank Card | neon card | |

| Annuity | Exempt | Exempt |

| minimum income | not informed | not informed |

| Flag | Visa | Visa |

| Roof | International | International |

| Benefits | Yield 100% of the CDI discount in stores Up to 40 days to pay | Approval of purchases even without limit Has automatic debit Simple invoice and limit control |

How to apply for the Neon card

Check out more advantages that the Neon credit card has and see a step by step to apply for yours!

About the author / Leticia Jordan

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Caixa Empresarial loan: how it works

The Caixa Empresarial loan offers interest rates starting at 0.83% per month and up to 60 months to pay! Want to know more? Check out!

Keep Reading

6 card options for negatives 2021

Find out which are the 6 best credit card options on the market and choose the one that best fits your needs.

Keep Reading

How to apply for the BTG Advanced Option card

Find out in this post how you can access the BTG Advanced Options card and all the benefits it can offer.

Keep ReadingYou may also like

How to apply for credit credit

Have you ever thought about getting up to 75,000 euros with an option to pay in 84 installments? So, continue reading and see how to apply for Credibom credit.

Keep Reading

Bradesco Visa Infinite Card or Banrisul Visa Infinite Card: which is better?

Do you want a card with many travel benefits and access to exclusive spaces? Get to know the Bradesco and Banrisul Visa Infinite cards.

Keep Reading

How to apply for C6 Bank card

With the C6 Bank card, you don't have to worry about annuity and account maintenance fees. In addition, you participate in the Átomos and Mastercard Surpreenda programs, in addition to shopping around the world. So, don't miss this opportunity and check out how to request yours here!

Keep Reading