finance

How to negotiate debts online

Have you ever tried to negotiate your debts but failed? Want some extra, quick help? So pay attention because we are going to teach you how to negotiate debts online.

Advertisement

Get out of debt in 2021

Brazil is one of the countries with the highest number of defaulters in the world, which is a big problem, as it directly affects our economy. In this, these people are often looking for ways to negotiate their debts, but how to negotiate debts online?

We already know that the internet came to bring convenience and ease to our daily lives, in a simpler and non-bureaucratic way, but did you know that you can negotiate debts through it?

Today, we're going to show you how you can do this, and give you tips for having a more controlled financial life.

5 tips for negotiating debt online

So, knowing that the internet brings the possibility of negotiating debts online, let's give you some tips for you to do that. Check out:

Analyze your financial planning

And, our first tip is for you to analyze your financial planning.

That's because, whether you're in debt or not, having control over your finances is one of the tips we most often cite here at Senhor Panda.

Well, if you don't keep track of your income and expenses, you could get out of control financially, causing big problems in the future.

So, make a spreadsheet with all your expenses, as well as your monthly income.

In this worksheet, write down as much detail as you can, the exact amount of your income, such as net salary, extra income and other income, and also open expenses, interest, and fines.

After making the worksheet, analyze all the negotiation possibilities with the creditors, so that you arrive with a well-defined proposal.

Remember that in negotiations, the more exact you are in your proposal, the greater the chances that it will be accepted.

Therefore, know exactly what your financial transactions are, and what your current financial situation is, so that you can proceed with your negotiations.

How to query CPF at Serasa

Make a CPF consultation at Serasa today, and learn how to leave your name clean!

Set a portion limit

Another tip is for you to set a limit for the installments when negotiating debts online.

That's because, after doing a financial planning analysis, you'll know exactly how much you can pay monthly.

So, don't wait for your creditor to stipulate a monthly amount, since you are the one who knows your income.

Therefore, it is so important to carry out a financial analysis in detail, and reach the creditor with a closed proposal.

And so, it will be the exact moment for the monthly installment limit to be established, and for you to be able to negotiate your debts, since, if there is a proposal of values that you may not be able to pay, both will be harmed.

Be careful not to fall into a loan scam to negotiate debts online

When negotiating debts online, one of the precautions you need to take is regarding loans made over the internet.

This is because the number of scams is growing in Brazil and in the world, especially in the digital world.

So, when negotiating your debts, choose serious companies that are already known in the market.

To do this, do some research so that the chances of you falling into financial loan scams are reduced.

Review only offers that fit in your pocket

As we mentioned above, after analyzing your financial planning, you will have to choose the values of the monthly installments.

And thus, you will also have greater control of your finances, which also implies when choosing the best negotiation offers.

That is, to make a good choice, it must, above all, fit in your pocket.

This is because the best proposal is not the most advantageous for the creditor, but for the debtor.

So, analyze all the offers calmly, to know exactly which one or which ones are the best offer for you.

Search for companies that are able to negotiate debts online

And, to close our tips, to negotiate debts online, you need to do a search for serious companies able to negotiate.

As we mentioned, there are numerous fraudulent companies, as well as companies committed to customers, so do your market research.

And, one option is to go directly to the official website of your bank or company where you have the debit.

From then on, just click on the “Negocie Aqui” or “Authorized Partners” tab to check partner companies to negotiate debts online.

And if you don't find it, just contact the Help Center directly and ask for more information.

5 companies to negotiate debts online

So, after seeing the best tips, let's now get to know 05 companies to negotiate debts online.

Check out:

Credits

Initially, Creditas is a fintech in the financial services segment created in 2012.

Today, it acts as the main online secured credit platform in Brazil.

It also works with four main products:

- Loan with property guarantee;

- Loan model with vehicle guarantee;

- Private payroll loan and;

- Vehicle financing.

Another advantage of the company is that it allows you to do credit simulations via the computer or cell phone through the Whatsapp application.

It is important to mention that it does not request advance payments in any of its credit modalities.

Well, this is one of the modalities prohibited by the Central Bank, in the interests of consumer safety.

And yet, in addition to security routines, it has encryption, not allowing any interceptor to access consumer data.

Therefore, we could not fail to mention Creditas, as it is, currently on the market, one of the best options for negotiating debts online.

legendary

Another company option to negotiate debts online is Lendico, one of the best in the financial loans segment.

In 2005, Lendico was created to offer customers the best solutions to settle debts, with the lowest rates.

And in addition, on this platform, consumers can borrow from R$2500 to R$50,000 to pay off their debts.

So, if you want one more option to negotiate debts, Lendico is among the best.

Right Deal

Another company to negotiate debts, is Accord Certo, which operates in the online debt renegotiation segment.

And so, it acts as an intermediary between the consumer and the company with which he has financial debts.

That is, through the Right Agreement, the consumer gets discounts of up to 90% on the total amount of the debt.

And, in addition, the process is completely online, with all the security and protection of consumer data.

Among the Accord Certo partner companies are:

- Clear;

- Santander;

- Safe harbor;

- Pernambuco stores;

- Itaú;

- Financial BV;

- Unic;

- Renner stores;

- ALIVE;

- Casas Bahia, and many others.

So, it's one more option for a company that helps customers negotiate their debts, pay off outstanding debts, and clear their name.

quit now

And, our fourth company for debt renegotiation is QuiteJá.

This company is 100% digital and online, that is, all negotiations between consumers and the company are done over the internet.

So, it is a model that brings more convenience and ease to customers, in addition to security.

That is, all agreements are made through the website, and the customer receives an SMS or e-mail about the available proposals.

Therefore, QuiteJá is yet another option for a company in the segment that provides security to customers when negotiating debts.

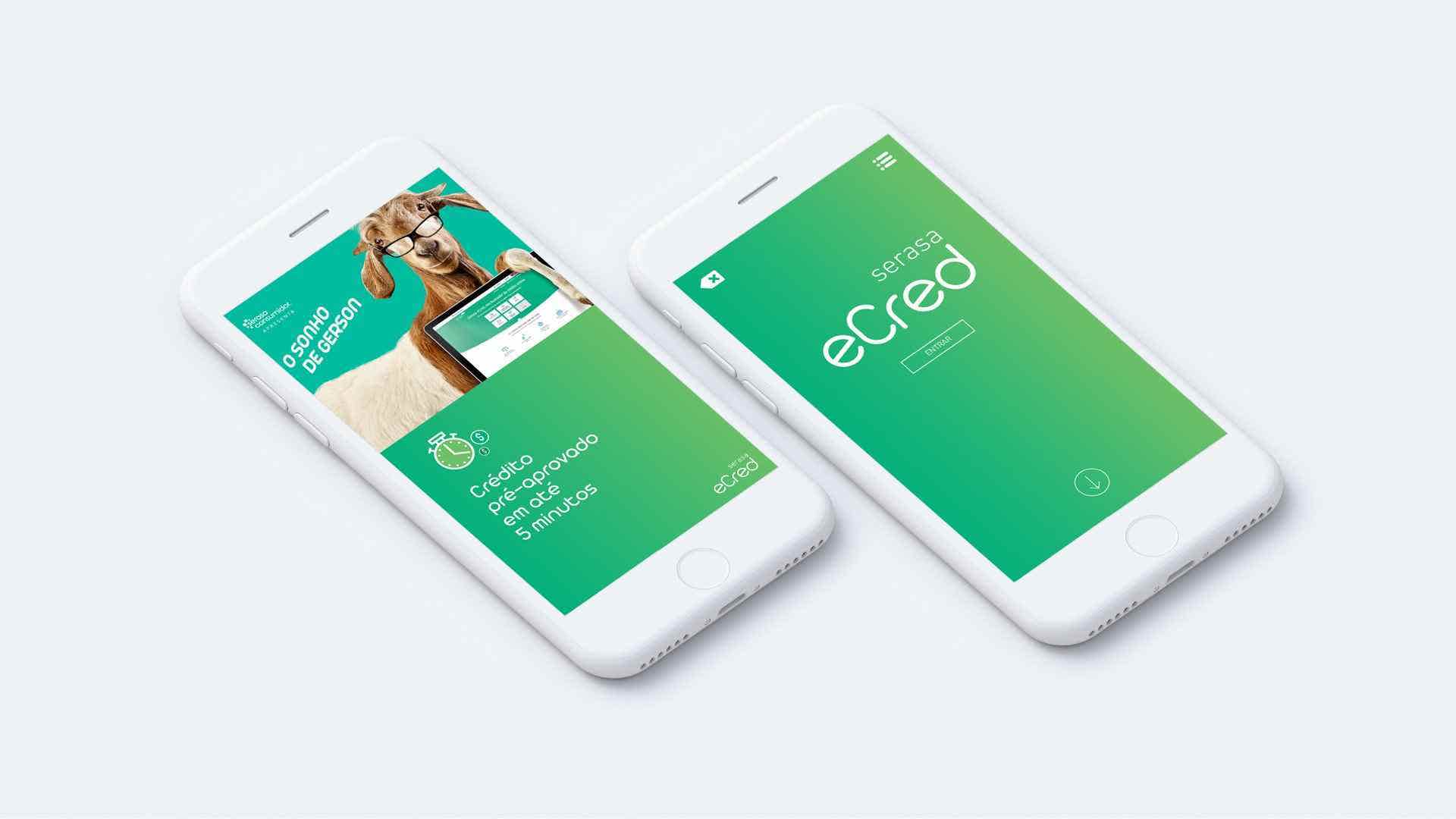

Serasa Ecred

And finally, let's talk about Serasa eCred.

This credit marketplace is a kind of virtual shopping center for negotiation offers.

This is because there are several offers of loans and credit cards from several partner companies, which seek the best solutions for customers.

Therefore, it is yet another company in the segment that seeks to offer the best credit proposals.

What are the advantages of negotiating debts online?

There are numerous advantages in negotiating an unpaid debt, but negotiating debts online also brings other advantages such as:

- Speed and convenience: All negotiations are carried out without you having to go to the company, being able to do it in the comfort of your home;

- Transaction security: Trusted companies in the market follow the recommended security standards to protect your data and information;

- Flexibility: It allows for greater flexibility of schedules, since everything will be done digitally, being available 24 hours a day.

Therefore, these are just some of the advantages of negotiating debts over the internet.

Which debt should I negotiate first?

This is a very frequent question for debtors: If I have more than one overdue debt, which one should I prioritize?

So let's understand, first of all, that the debt to be given priority will not necessarily be the one with the highest value.

That's because, priority debts should be those with the highest interest, for example, credit card revolving credit and overdraft.

Therefore, when choosing the debt for renegotiation, pay attention to the interest and fines arising from it, and then make your choice.

What are the advantages of negotiating a debt?

We have already mentioned the advantages of negotiating a debt online, but what are the advantages of negotiating a debt? Check out:

Interest Reduction

And, the first advantage in debt renegotiation is the reduction of interest and other fees in their payment.

That's because most late debts accrue interest and fines, bringing even more problems to debtors.

However, when renegotiating, these rates tend to drop dramatically, which is a great advantage for these debtors.

The debt is stable

Another advantage in renegotiating debts is that the debt stops growing, becoming stable.

And, likewise, interest and fines for delays also cease, since the main reason for their existence is non-payment of debt.

That is, no other amount will be added to the amounts that are already being paid by you.

Therefore, renegotiating a debt causes it to lose the instability of overdue debts.

financial organization

Another advantage in renegotiating overdue debts is the financial organization of all your debts.

Because, as soon as the debts are settled, the process of getting financially organized also becomes simpler.

So, paying off debts is a process that, despite being a little complicated, will be worth it.

When negotiating your outstanding debts, remember to always have a spreadsheet with you with all your overdue debts, to know exactly which ones are being paid off.

This is because, if you fail to pay a debt, to pay one that could wait a little longer, you may incur losses.

So keeping all your financial transactions is the best alternative to keeping an organized financial life.

Therefore, negotiating debts online is a simpler way for you to resolve all your financial issues.

What is an emergency reserve?

Do you have an emergency reserve? So you need to know the importance of it, and make yours from TODAY!

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Discover the DigioGrana personal loan

Get to know the DigioGrana personal loan and see how easy it is to take out. And you have interest from 2.97% per month and installments of up to 24 months.

Keep Reading

5 best practices about credit card installments

How about knowing how credit card installments work and what to do to not compromise your income? So, click here and check it out!

Keep Reading

How to apply for the CBSS loan

Do you want to learn how to apply for the Digio loan, formerly CBSS? Then continue reading to learn the step by step!

Keep ReadingYou may also like

How to apply for the Havan Card

Get to know the Havan credit card that gives you several advantages, without annuity exemption and has international coverage.

Keep Reading

Will Bank Card or Nubank Card: which one is better?

Nowadays, deciding on a card is getting more and more difficult. A practice that can help at this time is to look at comparisons between the models you are interested in. Do you want to know more about the Will Bank card and Nubank? Read on!

Keep Reading

Get to know the Porto Seguro real estate consortium

With the Porto Seguro consortium, buying your own home is easier than you might think. Do you want to see it? So, check out the full review we prepared on the subject below!

Keep Reading