loans

How will the BPC loan work?

In March, the Federal Government released the contracting of a payroll loan for beneficiaries of the Auxílio Brasil and BPC with interest of around 2% per month and up to 48 months to pay. Know more!

Advertisement

Loan with low interest rates and payroll discount should benefit 52 million Brazilians

For beneficiaries of social programs, some advantages are conferred, and now there is also the advantage of the BPC loan with low interest and payroll deduction. So, see how you can secure credit.

In this article, you will be able to understand how the loan works and if it is already available to hire. Check out!

Is it possible to borrow with BPC?

Yes, it is possible to take out a loan with the benefit of continued installment.

In March of this year, the federal government published a provisional measure that increased the payroll loan margin for policyholders of the General Social Security System, authorizing the contracting of loans through payroll loans for those who receive BPC and Auxílio Brasil.

This means that more than 52 million Brazilians will be able to apply for a payroll loan with lower interest rates and up to 48 months to pay with a direct payroll deduction.

Thus, it is important to highlight that the value of the benefit is a monthly minimum wage and that it is non-transferable.

This measure is part of the Income and Opportunity Program, which is expected to put into practice a series of measures that will make more than R$ 150 billion available in the country's economy.

Among them are the emergency FGTS withdrawal, the anticipation of the thirteenth salary for INSS retirees and the release of credit for negatives.

What is the loan amount for those who receive BPC?

To apply for the loan, BPC or Auxílio Brasil beneficiaries can only commit up to 40% of their monthly income.

In this case, 35% for a personal loan, which is equivalent to R$424.20 and 5% for withdrawals from payroll credit card purchases or debt settlement, which is equivalent to R$60.60.

In addition, the loans will have lower interest rates, around 2% and with a repayment term of up to 48 months.

In this way, it is a great opportunity for BPC and Auxílio Brasil beneficiaries to take out payroll loans to settle debts!

Which bank lends to BPC?

To make the loan, the bank that makes it for BPC is Caixa Econômica Federal. This is because, in fact, the other financial institutions are still not making the loan, as they are resolving internal technical issues.

Thus, only Caixa Econômica has already released access to guarantee payroll loans!

It is important to point out that the BPC is paid to seniors aged 65 or over and disabled people of any age with a minimum wage (R$1,212.00) per month with family income per person equal to or less than 1/4 of minimum wage.

To apply for the BPC, it is necessary to prove income and, in the case of people with disabilities, undergo a medical and social assessment by the INSS, in addition to being registered in the Single Registry. Also, the BPC payment must not be accumulated with another social security benefit.

How to make a loan payable by BPC?

To take out a loan payable by BPC, the beneficiary must look for Caixa Econômica Federal or another financial institution of his trust. Remembering that so far, only Caixa is contracting the loan.

Thus, you will be able to commit up to 40% of your income to pay off the loan installments.

On the other hand, the release date of the loan will depend on each financial institution, because banks are not yet offering the modality, only Caixa Econômica Federal.

Thus, the loan is deducted directly from the beneficiary's payroll and may commit 40% as mentioned earlier.

That way, you still have up to 48 months to settle the debt and the interest is 2% per month. Now that you already know everything about the BPC loan, click on the recommended content below and learn about other benefits from the Federal Government!

Get to know the Benefit Brazil, Light and Gas

Short summary of the post The Federal Government created Auxílio Brasil to replace the Bolsa Família program. In addition, it also created the Gas Aid and the Social Light Tariff.

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Santander Universitário SX credit card: how it works

The Santander Universitário SX card is an international card with exclusive benefits for university students. Check out all about it here!

Keep Reading

How to apply for the Bradesco Universitário card

The Bradesco Universitário card can be requested without bureaucracy. Check here the step by step and enjoy its advantages.

Keep Reading

Get to know the Americanas personal loan

Meet the Americanas personal loan that has up to 70 days to pay and reduced interest rate. Check here all the advantages of this line of credit.

Keep ReadingYou may also like

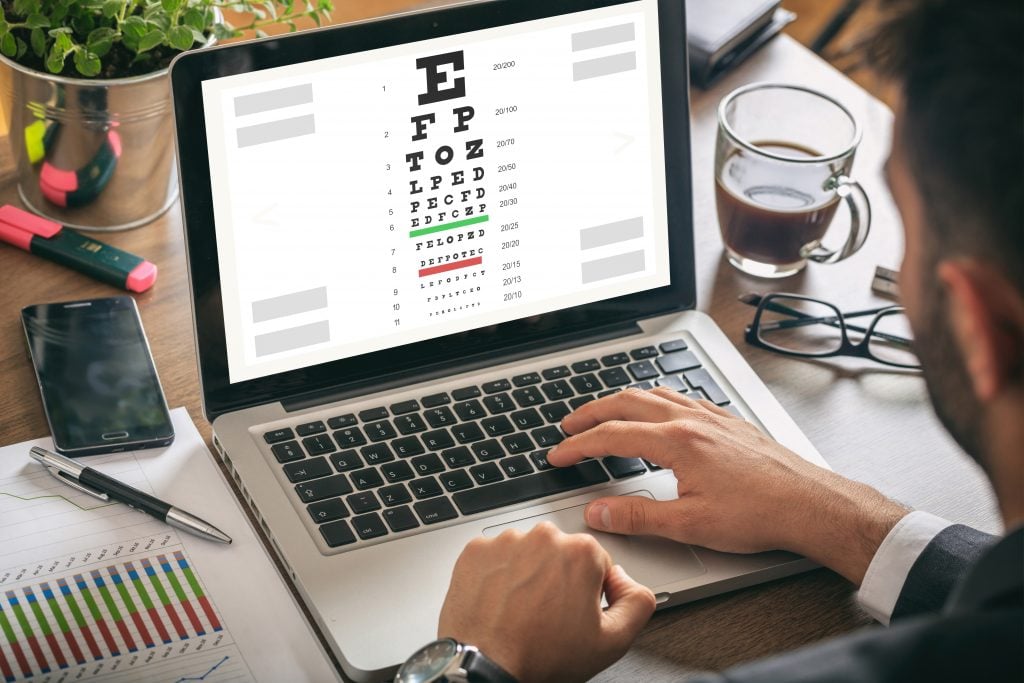

See how to take an online vision test using apps

Online vision tests offer the convenience and speed of assessing your visual acuity and detecting problems early. Download now, monitor your vision and promote efficient eye health without leaving home.

Keep Reading

See how to save at the supermarket and avoid superfluous expenses

According to a survey carried out by Santander bank fintech, Superdigital, Brazilians are increasingly reducing their spending. However, with food inflation, more than a third of the budget is devoted to market purchases.

Keep Reading

How to open Sicoob Yoou Free account

If you like agility and practicality in your day to day, the Sicoob Yoou Free account can be a great ally, from the opening process, which is simplified and 100% digital. Find out how to open your account here.

Keep Reading