loans

How does Serasa eCred work?

How about having access to the best loan and credit card options in one place? So, check out how Serasa eCred works here!

Advertisement

Serasa eCred: 100% credit online, fast and without bureaucracy

In this post, you will learn how Serasa eCred works and how you can find the best options for loans, credit cards and the like within the site. It's very simple, the platform aims to bring the best options for financial services to the user.

In addition, it makes comparison much easier. That is, within the site we can compare the options and decide which is the best among them to order. Anyway, it really is a platform that helps users a lot, whether negative or not, to apply for a loan or credit card with the lowest rates on the market.

Come and meet right now. Good reading!

How to apply for a Serasa eCred loan

The best loan options for negatives are at Serasa eCred. Check out!

What is Serasa eCred?

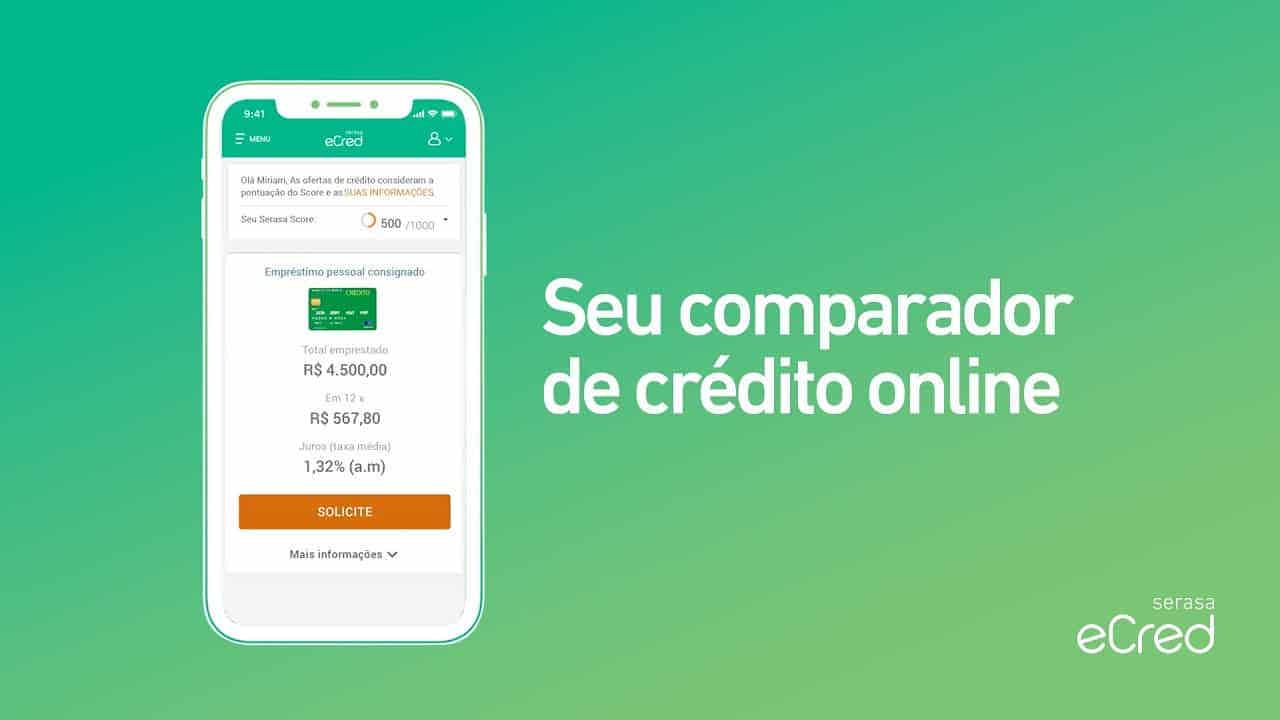

Serasa eCred is a fully digital credit marketplace. But do you know what this type of business does and how it helps ordinary people with regard to credit services?

It's quite simple, it's like a real virtual shopping mall, where you have access to credit cards and loans from Serasa eCred partners, such as banks, fintechs and other finance companies.

Therefore, it is a place where you will find the best deals on loans and credit cards, as well as compare with many options in the market. So you can choose the best one for you.

Remembering that all these tools work fully online and personalized. In this way, the objective is to simplify the entire process and bring better credit experiences to customers.

It may seem complicated, but it's not. In the next topic we will explain better how Serara eCred works!

How does the eCred loan work?

Therefore, within the website, the user provides some information and answers some questions that are decisive for the user experience within the platform. That is, how much loan he needs, how many installments he wants to pay, maximum interest rates, among other details.

Thus, the site manages to provide the user with the best loan options according to what he really needs, according to the answers provided in the questionnaires and forms available.

Finally, regarding loan amounts, the interest rate starts at 0.99% per month for most services. In addition, the payment term will vary completely according to the financial institution providing the service. However, this payment term can vary from 3 to 60 months for the full payment of the chosen loan installments.

Regarding the minimum income, it is informed on the website that there is no established income to be able to apply for any of the Serasa eCred loans.

What are the advantages of using it?

Now let’s see some of the advantages of applying for a loan at Serasa eCred:

personalized experience

The experience that the user has is completely personalized, that is, according to the information provided and the questions answered about the desired loan, the site is able to provide the user with the best options according to their needs. Therefore, all options will be directly linked to the user's needs and can be analyzed within the website.

Credit for negatives

According to the information collected, even if you have a negative name and some irregularity in your CPF, you can apply for a loan at Serasa eCred. Therefore, just know how Serasa eCred works and access the site!

reduced rates

Also, as we saw above, the monthly loan fees are initially 0.99% per month. That is, it is one of the lowest rates on the market and, consequently, an advantage for the user.

Simulate your loan for free

Remembering that it's all free. That is, if you have found a loan that suits you, you can do the simulation on the website without paying anything. In this sense, the simulation helps you to know in advance and accurately the amounts that will be paid.

Many options

As we saw initially, all Serasa partners who offer loans will appear on the platform. That is, the customer will have at his disposal many options from different financial institutions.

How long does the Serasa eCred analysis take?

As we saw in the previous topics, we will have access to several loan options from financial institutions, banks and different segments that have partnerships with Serasa eCred.

Therefore, each of the options will have its particularities and specific conditions. That is, one will be different from the other and you must choose the best one.

But regarding the approval time, each of the loans will have its own term. So one can be 1 day, another loan can take more than 5 days to approve the loan.

However, the standard approval period is up to 5 business days for all loans. But this can change according to the type of financial institution that provides the service.

Anyway, but how can we know if we were approved or not? That's what we're going to find out in the next topic!

How do I know if I was approved in Serasa eCred?

It's very simple to understand how Serasa eCred works and find out if we've been approved or not. So just follow the step by step:

- Go to your app store;

- Download the Serasa eCred app (Remembering that the app is completely free);

- After that, open the app;

- Enter the platform with your CPF;

- Also, enter your password.

Ready! Within the application we can follow the approval of our loan and know all the details about the service we have contracted. Remembering that the app helps the user to access loan information quickly and easily.

Anyway, now that we know how Serasa eCred works, just do your simulation on the platform and request yours!

How to apply for the Serasa eCred loan

Reduced rates, negative credit and online 100% approval. Learn to do a simulation.

About the author / Marina Poncio

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

7 personal finance tools

Want to organize your financial life but don't know how to start? Then see 7 personal finance tools that will help you

Keep Reading

Bahamas Card or BTG+ Card: which one to choose?

Decide between the Bahamas card or the BTG+ card, both with installment options, low annual fees and a digital account. Then check out our comparison!

Keep Reading

Discover the Renner credit card

Discover all the characteristics and advantages of the Renner card and see if it is a good option for you or not. Complete article.

Keep ReadingYou may also like

Will Bank card or Americanas card: which is better?

Looking at comparisons can be a great way to decide between two cards you're interested in. That way, you can more easily see which one is most interesting for your profile. Interested? check now the comparison between the Wil Bank card and the Americanas.

Keep Reading

How does Deco Proteste work?

Deco Proteste is an organization that privileges consumer rights and helps people in case of problems with products and services. Check out more information below.

Keep Reading

Discover Omni credit card

Check out the main characteristics and strengths of the Omni card, such as the Fatura Premiada program, in which you compete weekly for cash prizes through the Federal Lottery. As well as access to insurance and 24-hour assistance. See more here!

Keep Reading