loans

How to borrow online?

Taking out a loan online is a practical and quick way to get the credit you need. Learn how to do it and discover 5 great options!

Advertisement

Choose the best online loan in 2021

When the bills are tight and those old debts are starting to become a problem, the loan becomes one of the best options! That's why today, we're going to teach you how to borrow online, to help you get out of that snowball!

So read on to learn how to apply! Check out!

Evaluate the options available

So, the first step in learning how to borrow online is to evaluate and compare the available options.

This is because there are several options on the market with different terms and interest rates, as well as exclusive conditions that vary according to the customer's profile.

So, before opting for the first option that appears, make a good analysis of all available options according to your financial history!

Perform online loan simulation

Well, the second step to make the request is to carry out an online loan simulation!

This is because, through the simulation, you will be able to have more clarity of the amounts with the interest that will be paid in the months of the loan.

As well as, you can plan according to the deadlines for payment!

Choose the form of payment

Another part of the request is, the choice of payment method!

At this time, you will choose how many months the loan will be paid, remembering that interest rates also directly affect the number of installments.

Submit the documents for the loan online

So now we come to the stage of submitting documents for the online loan.

In this, just send proof of income, proof of residence, as well as original documents such as RG, CNH, CPF and other documents that are requested.

Wait for the credit analysis

Finally, you will need to wait for the credit analysis that will be carried out by the financial institution. And, in case of approval, in a few hours, your credit will be available in the informed account!

What is the best online loan available?

So, let's get to know 05 online loan options! Check out!

way

So, the Jeitto personal loan works as a secure and fast release loan! That's because, it works with amounts of up to R$150 reais and is ideal for paying bills and recharging mobile phones!

And in addition, the Jeitto loan can be requested through the application that works like a credit card. For this, the due date of the invoice is established in advance and occurs every tenth day, with the bill generated by the application itself!

And best of all, Jeitto does not charge monthly or annual fees, and a single fee is charged for payment of slips!

How to apply for the Jeitto loan

Do you want to learn how to apply for the Jeitto personal loan with quick and immediate release? Then continue reading to learn the step by step!

Simplify

Well, Simplic's online loan works in the personal and payroll loan modalities and offers a maximum loan amount of R$3,500.

Furthermore, there is no minimum amount to be able to apply for the loan and it has interest of 17.90% per year in up to 12 installments.

So, to apply for a loan at Simplic, just access the lender's website and simulate the amount you want to receive. After that, just click on “Order Now”. Ready!

How to apply for the Simplic loan

Do you want to learn how to apply for the Simplic loan with extended terms, quick release and ideal for negatives? Then continue reading to learn the step by step!

YES

So, the SIM loan works as a personal loan in the modalities without guarantee and with vehicle and motorcycle guarantee.

In this regard, he does not have a minimum loan amount for hiring and has interest of 17.88% per year, which can be paid in up to 24 installments!

And in addition, it helps you negotiate your debts from the simulation and contracting to the discharge of the SIM online loan!

To apply for the SIM loan, just access the website and perform a quick simulation. Then, with approval, you will receive the amounts in your account within 3 days.

How to Apply for a Loan

Want to know how to apply for a quick and easy loan? So find out right now how to do it at Sim, the best on the market.

Superdigital

Well, the Superdigital loan can also be done through the website and without any bureaucracy!

That's because, it has a super fast credit analysis and has reduced interest rates of around 1.6% per month in up to 18x!

And in addition, the amounts are discounted right after the signing of the contract without the need for minimum amounts and, not even offering a guarantee!

On this loan, the better your credit score, the lower the interest rates.

Therefore, if you are looking for a super accessible bank, as well as an intuitive website to apply for your loan, Superdigital is the best option for you to hire!

Diamond

So, Losango also offers the 100% online loan modality, without bureaucracy, safe and simple!

In this, just go to Losango's official website, simulate the loan, apply for credit and then wait for the creditor's credit analysis.

And so, in case of approval, just wait up to 2 business days for the release of the credit in the account made available by you! But if you want one more extra option, how about checking out our article on the BV Financeira online loan?

Discover the BV Financeira personal loan

Get to know the BV Financeira personal loan and see if this loan is what you need right now! Ah, it is released in up to 1 business day! Check out!

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to apply for the Banco do Brasil car consortium

To hire the Banco do Brasil automobile consortium, just go to one of the bank's branches. The process is simple and without bureaucracy. Check out!

Keep Reading

Petrobras Contest: find out about the public notice and learn how to apply

Click here to see everything about the 2023 Petrobras tender. All vacancies, dates, remuneration and documents you need are explained.

Keep Reading

BPC: What is needed to apply?

Learn all about what you need to do to register and receive a minimum wage per month through BPC!

Keep ReadingYou may also like

Withdrawal-termination: what is it and how to opt for it?

Termination withdrawal is an exclusive benefit for workers dismissed without just cause or who have entered into an agreement. To learn more about how it works and how to join, just keep reading.

Keep Reading

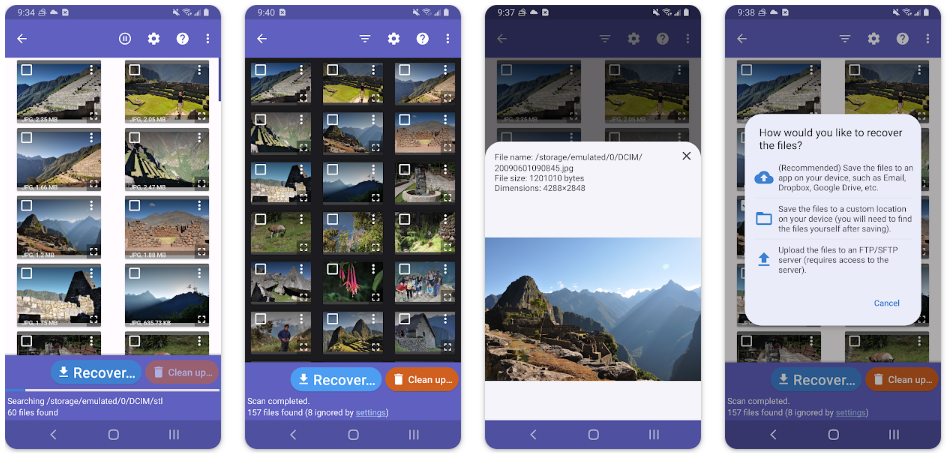

Diskdigger: how to recover deleted photos from your cell phone with the application

DiskDigger is the ultimate solution to recover lost photos and images on your device. Learn how to download the app and never lose an important photo again! At the end of the article, we direct you to the download page.

Keep Reading

How to apply for the Porto Seguro real estate consortium

Through an online or in-person procedure, you request your Porto Seguro real estate consortium and make your dream of home ownership come true. See more here.

Keep Reading