digital account

How to open a Next Joy account

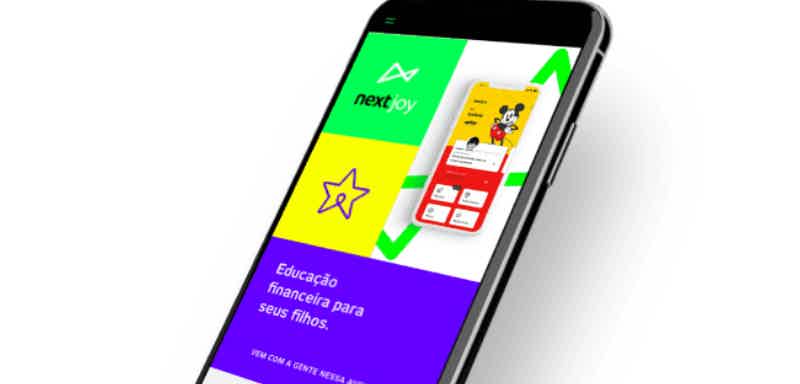

Banco Next, in partnership with Bradesco, launched the free Next Joy account, 100%, aimed at the public under 17 years of age. The account aims to offer its users autonomy and financial education. Learn here how to open the account through the website or application.

Advertisement

Next Joy Account: check out how to open yours

The Next Joy account is very simple to create, because Next and Bradesco, as Financial Institutions, want to make this whole process even more agile for parents and guardians of children under 17 years of age.

Therefore, we also want to bring you the most effective way to carry out the process of opening your account. So, we developed a very informative and clear step-by-step on how to open a Next Joy account either through the Next app or website.

So what you have to do is just keep reading this content until the end and you can leave here with your Next Joy account open and ready to be used.

open online

At first, as with many banks, the most accessible way to open an account is through the bank's website. Here's how to proceed:

- Access the website;

- Then, click on the option “I want to be Next”;

- After that, you will be redirected;

- Fill out the form that will appear on your screen with all the information;

- Remember to put the updated information;

- After that, just wait for Bradesco's approval to arrive;

- It can arrive by message, phone or email, so stay tuned.

See how simple it is? Remember to provide correct information, as if any information happens to be wrong, the analysis process may take longer than expected.

Anyway, just follow the step by step as written and everything will work out. Now let's see if we can open the account over the phone!

open via phone

It is not possible to request the opening of an account over the phone. However, to get in touch with Next, it is necessary to use the same customer service number used for queries, clarifications and other functions. See the number below.

- Call center: 0800 275 6498.

open by application

Finally, there is still the possibility to apply your account through the bank application. In this sense, we will see how simple it is to open the account and how to do it directly from your cell phone.

Follow the step by step:

- Access the Bradesco application;

- Then log into your account;

- After that, go to the account menu in the left corner;

- Go to more services;

- Select the Next Joy option;

- Fill in the requested information;

- Submit the request and wait for approval.

Ready! Now just wait for Bradesco bank to approve your account. Remembering that after you receive approval, just log out and log in, and then read the QR Code within the application to definitely open the account on the minor's device.

Inter Kids Account or Next Joy Account: which one to choose?

Like Next Joy, the Inter Kids account has good conditions to offer to minors, with the same objective of helping parents with their children's financial autonomy.

Therefore, if you still have doubts about which account is the best, get to know the main features of the Inter Kids account and choose the best option.

| Inter Kids account | Next Joy account | |

| Minimum Income | not required | not required |

| Monthly cost | Free | Free |

| credit/debit card | Yes | Yes |

| Benefits | Free and digital 100% account, free deposits via boleto. | Free, unlimited free transfers, partner discount offers. |

How to open an Inter Kids account

Open your account through the website or app. All free and digital 100%!

About the author / Marina Poncio

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

What to do with your first paycheck?

Are you in doubt about how to best use your first salary? Check out our tips on how to manage your money here!

Keep Reading

Get to know FGV's free courses

Check out in this article how the free FGV courses work in practice and what advantages you can get by taking them.

Keep Reading

BMG Consigned Loan or C6 Consig Loan: which is better?

Are you in doubt between BMG payroll loan or C6 payroll loan? In this article we will show you the details. Check out!

Keep ReadingYou may also like

Online Sim Loan: Simple, Fast and Digital 100%

Are you looking for a loan with attractive rates, quick cash and a good reputation? Then online Sim loan is a good alternative for you. To learn more about it and how it works, just continue reading and check it out.

Keep Reading

Check out how to sign up for Desenrola Brasil and clear your name

Desenrola Brasil Limpa Nome: Program that offers the chance to clear your name and renegotiate debts. Conquer your financial freedom with this unique opportunity. Know more!

Keep Reading

How to save money with the new function of the Nubank app

Every time roxinho releases a new feature to make life easier for its customers. This time, it's the save money function. Nubank helping you with financial education. Learn more below!

Keep Reading