digital account

How to open account Easy

The Easy account was created by Banco do Brasil, as an alternative account for those who need to keep dollars. That is, people who frequently travel abroad. Be it for traveling or even for business. Therefore, in today's article we will show you how to open your account.

Advertisement

Easy account: request and start collecting your dollars!

The Easy account was created by Banco do Brasil to meet the needs of Brazilians who travel abroad a lot. This is because the account is intended for those who live in Brazil but need to gather dollars.

Therefore, the account offers services such as free withdrawals in the US and money transfer to Brazil. All this without any fee and free of charge. In addition, the Easy account has its own application and can be monitored by Online Banking.

Therefore, in today's article, we will show you how to apply for this account. Continue reading and see the step by step!

open online

To open an Easy account online, you must meet certain requirements. This is because Internet Banking asks for information from the application, for example.

Therefore, opening an account online is available to anyone who:

- have a Social Security Number;

- is an employee of Banco do Brasil;

- CAPES/CNPq scholarship holders who do not have an SSN.

That way, just go to the BB Americas Bank website and click on: How to open an account.

open via phone

Unfortunately, BB Americas Bank does not offer the option to open an account over the phone. However, if you need to contact your agency for any queries, see the Call Center numbers:

For those in the United States: +1-855-377-2555.

For those in Brazil:

- Capitals and metropolitan regions: 4003 1448;

- Other countries: 0800 881 1448.

If you prefer, BB also provides an e-mail address for more general queries about the Easy account service: csc@bbamericas.com.

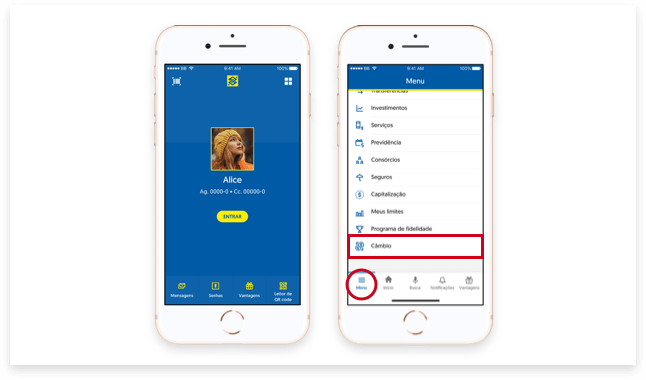

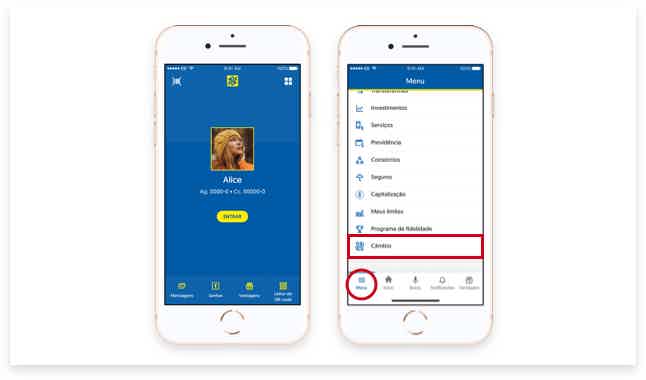

open by application

Opening the Easy account through the app is the easiest way. See the step by step:

- Access your Banco do Brasil application;

- Select the “Exchange” option;

- Go to the “BB Americas Account” option;

- Click on “Open my account”.

From there, you will be directed to the BB Americas Bank page where you can open your account. So, just fill in your information and provide your documents.

In this way, to open an Easy account, you must have a driver's license or ID, and proof of residence in Brazil.

Santander account or Easy account: which one to choose?

Finally, the Easy account is a great option for those who travel a lot and need to save a few dollars. In addition, it has good advantages. Such as the absence of maintenance fee and debit card available for use.

In this way, we will also introduce you to the Santander account! With it, you have access to the Santander SX credit card with the benefits of Vai de Visa or Mastercard Surpreenda. See now!

| Santander account | easy account | |

| open rate | Exempt | Initial deposit of 100 dollars |

| minimum income | not informed | not informed |

| rates | Free if you receive R$1,000 and pay a monthly digital channel bill | free rates |

| credit card | Santander SX | Debit card only |

| Benefits | 10 days interest free on account limit Unlimited withdrawals and transfers | Send money to Brazil easily free withdrawals |

About the author / Leticia Maia

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

What are the technical courses that most employ?

Do you want to know which technical courses are most employed? In today's article, we will answer this and more questions. Check out!

Keep Reading

Get to know all the features of Bradesco Neo.

Discover now all the characteristics, advantages and benefits of Bradesco NEO, and also see if this card is worth it for you.

Keep Reading

Discover the Alfa Financeira payroll loan

Get to know the Alfa Financeira payroll loan and see if this loan is what you need right now! Ah, he's ideal for negatives!

Keep ReadingYou may also like

20 best Mastercard cards with no annual fee

Mastercard cards with no annual fee are excellent options that include Mastercard Surpreenda and more benefits from the issuing bank. Check out!

Keep Reading

Where do you accept Mastercard branded cards? check here

Do you have a Mastercard or do you want to have one but don't know how acceptable it is? So, read this post and check where Mastercard cards are accepted and get all your questions answered.

Keep Reading