digital account

How to open MuPay digital account

The MuPay digital account offers several advantages for those who make purchases on the Grupo Muffato network and its opening can be done completely online through the application. Learn more about this process here.

Advertisement

MuPay digital account: open the account without leaving home

The MuPay digital account is a solution created by Grupo Muffato to offer advantages in purchases made on the network.

Thus, from the account, you can have cashback on purchases and receive change in currencies directly in your digital account balance.

| open rate | Exempt |

| minimum income | not informed |

| rates | TED/DOC transfer: R$ 3.00 Withdrawal: R$ 7.00 Ticket issue: R$ 1.70 |

| credit card | only virtual |

| Benefits | Cashback on market purchases Earn your purchase change on the account Access discounts and free shipping on the network's virtual store |

In this way, you can carry out your market purchases accessing more interesting advantages than in other digital accounts.

If you liked this option, check out in the post below how the process of creating a MuPay digital account works! We already advance that you don't even have to leave the house to perform the opening!

open online

As much as the opening of the account happens in a completely digital way, today it is still not possible to open the account on its official website.

The MuPay digital account can only be opened from its application, which is available for both Android and iOS devices.

But, from the official website of the MuPay digital account, you can see the main information and also have access to the links to go to the main app stores and, thus, download the app.

open via phone

In short, the main ways to open a MuPay digital account are through digital channels. Therefore, it is not possible to open an account via a telephone call.

But if you want to talk to a group attendant, you can contact the number 0800 200 8110, which is the SAC of the digital account.

open by application

To make your life easier, the MuPay digital account is opened completely digitally from its official application.

To do this, you just need to download it on your cell phone and register by following the informed steps. Here they will ask for your personal information and photo of your document for security verification.

With that, in just a few minutes and without bureaucracy, you can easily create your MuPay digital account!

Nubank digital account or MuPay digital account: which one to choose?

As much as the MuPay digital account offers great benefits, there may be the possibility that this option does not offer everything you need in your daily life.

However, there are other digital account options for you to open. One of them, which is the best known, is the Nubank digital account.

From there, your money yields more than savings and you can access a credit card to pay for your purchases in installments.

Therefore, if you liked the Nubank option, check out the following article on how to open this digital account.

| Nubank digital account | MuPay digital account | |

| Minimum Income | not informed | not informed |

| Monthly cost | Free | Free |

| credit card | Yes | only virtual |

| Benefits | Discount when paying in advance Solve everything through the app Earn more than savings | Cashback on market purchases Earn your purchase change on the account Access discounts and free shipping on the network's virtual store |

How to open Nubank digital account

See here how easy it is to have this account to enjoy benefits, such as a credit card with no annual fee and much more!

About the author / Leticia Jordan

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Jeitto Loan or Creditas Loan: which is better?

Don't know whether to choose the Jeitto loan or the Creditas loan? So, see in this post a complete comparison between these two!

Keep Reading

Discover the free courses Prime Cursos

Get to know the options of the free Prime courses, their advantages and characteristics. And enjoy 100% classes online without leaving your home.

Keep Reading

Reseller: how to make money by reselling products?

Check out all the main reseller programs in Brazil and conquer your financial freedom with them. Choose one now and be a reseller!

Keep ReadingYou may also like

What are government bonds and how to invest

Learn all about government bonds and start building your emergency reserve as soon as possible to have greater financial security.

Keep Reading

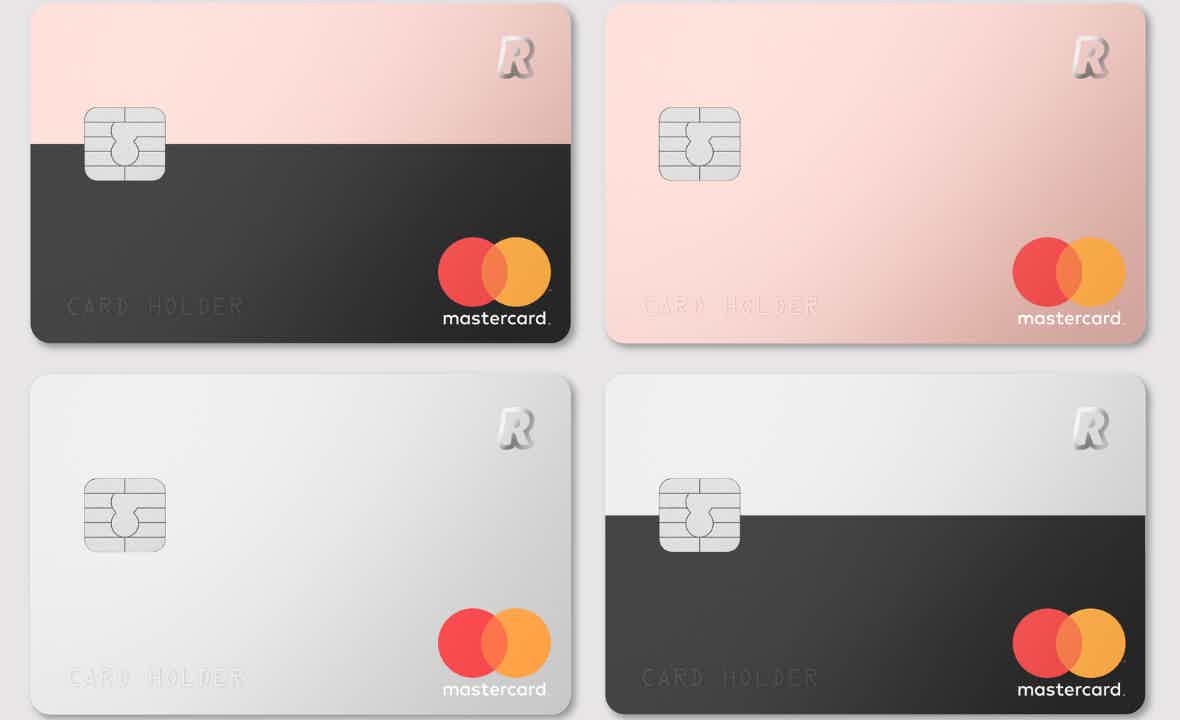

10 card options with no annual fee 2022

Are you looking for a card with no annual fee and that offers you several benefits? In today's post, we'll give you ten options that will help you when deciding on the ideal card.

Keep Reading

Revolut Premium Credit Card: What is Revolut Premium?

How about a card that allows withdrawals and transfers abroad and does not charge fees for doing so? So get to know the Revolut Premium card and enjoy!

Keep Reading