digital account

How to open an ABC Personal account

Learn the step-by-step process to open your ABC Personal account without leaving home. Thus, you will have the opportunity to make investments in fixed income funds without paying a fee. Follow the post and learn more!

Advertisement

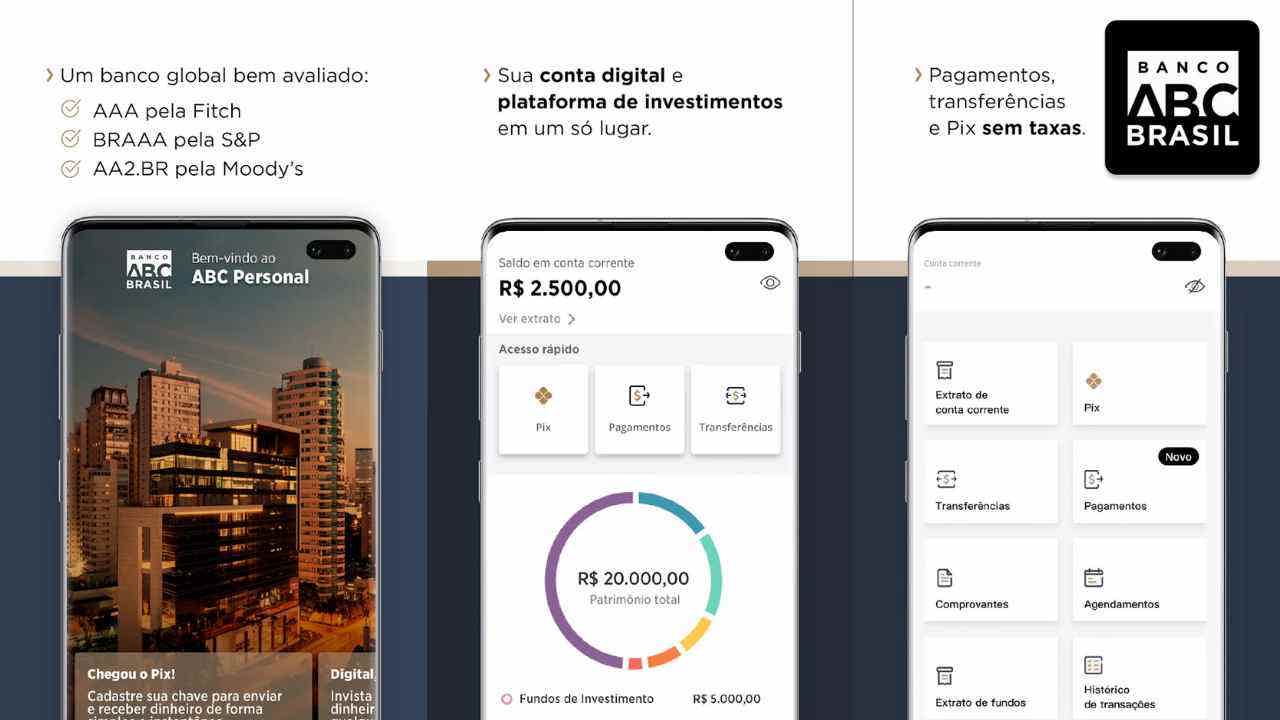

ABC Personal: free digital account that provides opportunities for investments

Learn how to have a free digital account that doesn't charge anything to help you invest in fixed income. So, the ABC Personal account is one of the only ones on the market that works 100% online. In addition, it also provides curatorship for investments.

So follow the post for more details. Let's go!

open account online

First, access the ABC Brasil bank website and locate the ABC Personal account. Then click on the “open your account” field, so you will be directed to a page with information about it. Also, enter your CPF in the right corner. Finally, finish filling out the form.

In conclusion, just wait for approval and start moving. Also, take the opportunity to make transfers, payments and deposits with your digital account.

Open account via phone

It is not possible to open the digital account by phone. However, ABC Brasil offers contact numbers for queries. To do so, you can call 011 3003 4222 or 0800 246 4222.

Open account via app

It is possible to open the account through the application, for this, download the app through the virtual store Google Play or Apple Store. After that, separate the documents to be scanned, as well as access the app and enter your personal data.

Also, validate the cell phone by SMS Token. Finally, take selfies and photos of the documents, to finalize the request. Of course, the process will not take long. If everything is ok, you can start your movements.

Santander Account or ABC Personal Account: which one to choose?

Although the ABC Personal account is interesting, how about getting to know another digital account option? The Santander account has many benefits, such as the possibility of waiving monthly fees, unlimited withdrawals and transfers, and a credit card with waived annual fees under certain conditions.

So, check out the comparison below and have another option to choose the best one.

| Account | Santander | ABC Personal |

| Minimum Income | not informed | not informed |

| Monthly cost | R$ 24.00 | Exempt |

| credit/debit card | Yes | No |

| Account Type | Digital | Digital |

| Benefits | Possibility of exemption from tuition; Unlimited withdrawals and transfers. | Zero maintenance and brokerage fee; Product curation. |

How to open Santander account

Enjoy the Santander account with unlimited transfers and withdrawals, as well as a credit card with no annual fee under conditions. Find out how to open yours here!

Trending Topics

What is the best website for online courses with a certificate?

Want to professionalize without leaving home? Check out this list of the best online course sites with a certificate and start your studies now!

Keep Reading

How to get out of debt in 2021

Are you in debt and don't know what to do? We will teach you how to get out of debt in 2021 and other useful tips.

Keep Reading

How to cancel Bradesco account?

Are you wanting to cancel your Bradesco account? Doing this is not always easy, so check out the steps to carry out the process here.

Keep ReadingYou may also like

Check out Paris Hilton's favorite investments in the cryptocurrency segment!

After achieving fame by participating in a reality show in the early 2000s, Paris Hilton seems to have found her calling in the world of cryptocurrencies and NFTs. Check out the socialite's favorite projects and investments right now.

Keep Reading

Is PicPay credit card good?

In today's post we will talk about the PicPay credit card. The card is free of fees, has a higher yield than savings and also offers cashback. Continue reading and find out if the PicPay card is any good.

Keep Reading

Learn about the CBSS Loan

CBSS loan is a good option with several types of credit for different profiles. Click and learn more about it and its benefits!

Keep Reading