digital account

How to open an Ame Digital account

The Ame Digital account is a great option for anyone who wants cashback, free transfers and a credit card with no annual fee. In this article, you will see how to open the account in just a few steps. Read on!

Advertisement

Ame Digital account: download the Super App and start using it!

At first, Ame is well known for its cashback services. But, with the Super App, this platform also became an account. The Ame Digital account. Therefore, you have all financial services in the palm of your hand.

In this sense, it is also possible to contract a prepaid card and also a credit card with no annual fee. By the way, both cards have the Mastercard flag and are international. The credit version also participates in the Mastercard Surpreenda program.

In addition, in the Super App of the Ame Digital account you can also apply for a loan. Just go through the credit analysis and receive the best loan offers for your financial profile.

Furthermore, if you want to know how to open an Ame account, read on to find out!

open online

Basically, to open a digital account you need to have the Super App application. In this way, it is possible to access the Ame website and get the link to download the application.

Unfortunately, it is not possible to open an account through the website alone, or without having the app downloaded on one of your devices.

open via phone

As we mentioned, to open the account you must already have the application downloaded. That is, it is the only way to get the Ame Digital account.

In this sense, it is still not possible to open an account over the phone. However, Ame provides a Call Center for all regions of Brazil. See number: 4003-2120.

open by application

Finally, the only way to open your Ame Digital account is directly through the application. With that, just download the Super App from your app store. The app is available for both Android and iOS.

After downloading, you will need to register. If you already use Ame as a cashback platform, this process can be even easier. In this sense, the institution asks for some basic information for registration.

You must provide your CPF and also some document with photo. As well as doing the usual face checks of a digital account. With all that done, you can start using your Ame Digital account.

Santander account or Ame Digital account: which one to choose?

Finally, now you know the Ame Digital account. This payment account that offers cashback, credit card and even a special personal loan line.

But if you still want to know some more options, we will also show you the Santander Account. In short, it is the digital account of the traditional Banco Santander. By the way, it is linked to the Santander SX credit card.

See the differences below and choose the one that works best for you:

| Santander account | Ame Digital account | |

| open rate | does not have | free |

| minimum income | not informed | It is not necessary |

| rates | Zero tariff for those who receive up to R$1000 in Santander | Exempt |

| credit card | Santander SX | No annual fee and international |

| Benefits | unlimited withdrawals unlimited transfers | cashback account International prepaid card |

How to open Santander account

Card with no annual fee and full digital account: see how to open your Santander account.

About the author / Leticia Maia

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

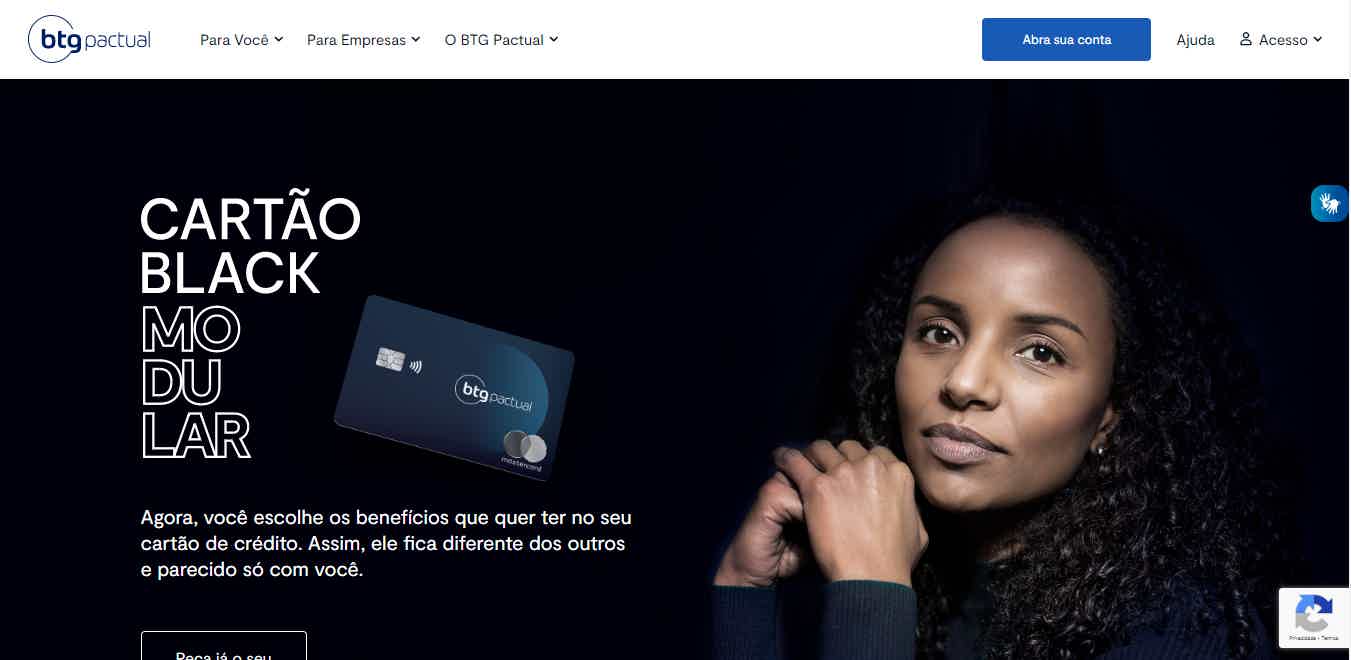

Get to know the BTG Option Black credit card

Find out in this post all about the BTG Option Black credit card and see if it really suits your lifestyle!

Keep Reading

Online eye exam: discover the best apps to test your vision

Discover a modern and convenient way to monitor your vision anywhere using an online eye exam app.

Keep Reading

Itaucard Click Card Review 2021

Check out our Itaucard Click card review and find out about this product that does not charge an annual fee and also offers international coverage! See more here!

Keep ReadingYou may also like

Financial control worksheet: how to assemble

Learn how to set up a financial control worksheet and start changing your life today.

Keep Reading

Discover the Best Non-Resident current account

If you are looking for a complete current account, with no maintenance fee and free intrabank transfers, the Best Non-Resident account is a great alternative. To learn about this option, continue reading with us!

Keep Reading

Get to know the Benefit Brazil, Light and Gas

The Auxílio Brasil, Luz e Gás benefit aims to guarantee more dignity and quality of life for families in situations of poverty and extreme poverty. Learn all about it here.

Keep Reading