Cards

Discover the best Vai de Visa cards 2021

If you are looking for a good credit card that has a Visa flag and participates in the Vai de Visa program, check out the 07 best Vai de Visa cards of 2021 here.

Advertisement

Find out which are the financial products with access to the Visa flag program

So, in the search for credit cards that offer a brand that has good benefits, Vai de Visa cards are at the top of the best. So, today, we have brought you the 07 best cards so that you can choose the best option. Let's go!

What is the Vai de Visa program and how does it work?

Therefore, Vai de Visa is a program that offers discounts and advantages on products offered by Visa brand partner establishments.

Thus, when applying for a card with the Visa flag, you just need to register for the Vai de Visa program and you will have access to a voucher, discount codes and several other advantages, as we will see later.

What are the benefits of the program?

Well, the Vai de Visa program offers several advantages, for example, discounts and promotions on products from partner establishments.

And, in addition, you also support the Visa cause without paying absolutely anything, as well as having a points program, that is, points that you can exchange for products in several stores.

What are the best Vai de Visa cards?

So, check out the 07 best Vai de Visa cards below.

Santander SX

So, the Santander SX card is a financial product that can be issued both under Visa and Mastercard.

And, in addition, it has an annuity in the amount of R$ 399.00 for the holder (or R$ 33.25 per month) and an amount of R$ 200.00 for each dependent or additional account.

On the other hand, whenever you spend an invoice above R$100.00, Santander waives the monthly fee for the respective month.

But, if you want to become completely exempt from the annuity, just become a Santander bank account holder and register your PIX key, so you will have a quality card in your hands without having to worry about paying an annuity, but just enjoying all the advantages.

Therefore, if you are looking for a card that offers discounts at Esfera stores, the Vai de Visa program, as well as discounts at partner stores and the possibility of waiving the annuity, Santander has what you need in an international card.

| minimum income | R$ 500.00 for account holders R$ 1,045.00 for non-account holders |

| Annuity | R$ 399.00 (exempt if you join the PIX system or with a minimum spend of R$ 100.00) |

| Flag | Visa or Mastercard |

| Roof | International |

| Benefits | Discounts at Esfera partner stores |

How to apply for the Santander SX card

Learn how to apply for the Santander SX card following the step by step described in the post.

trigger

Well, the Trigg card is an international financial product, that is, with it you can shop in national and foreign stores, physical or digital.

And, in addition, the card has the Visa flag, allowing you to have access to various programs and benefits, such as the Vai de Visa program.

In addition, to apply for the Trigg card, you do not need to prove your income, making it an accessible card for people with a dirty name and low credit score.

Furthermore, the card offers the Trigger Band bracelet, which allows you to make your purchases in complete safety and convenience, as well as making payments through the Samsung Pay application, simply by registering the card in the application.

Therefore, the Trigg card is a financial product that combines technology with the security and convenience you need in a credit card.

| minimum income | not required |

| Annuity | 12x of R$ 10.90 |

| Flag | Visa |

| Roof | International |

| Benefits | Cashback, card app, Vai de Visa program |

Next

So, the Next card is a financial product launched by the digital bank Next, which was created by the Bradesco bank, but, unlike the latter, it does not have a physical branch.

Thus, the Next card can be accessed through the Next application. It does not require proof of minimum income, that is, it is an accessible card for negatives and people who have a low credit score.

And, in addition, the card has international coverage, that is, you can make purchases in national and international establishments.

In addition, you can make withdrawals at ATMs through the Banco24Horas network, as well as having a program in which you can exchange points for products.

Therefore, the Next card is a great option if you are looking for a financial product with a digital application where you can carry out all card transactions through it.

| minimum income | not required |

| Annuity | Exempt |

| Flag | Visa |

| Roof | International |

| Benefits | Exclusive discounts and offers, cashback, Livelo, Vai de Visa program |

How to apply for the Next card

Find out now the exact step by step for you to order the Next card without ado, the process is 100% online.

type

Well, the Digio credit card is another financial product that has a Visa flag, so you can enjoy all its advantages, such as the Vai de Visa program.

And, in addition, the card is international, that is, you can shop in national and international stores, with more than 40 million establishments worldwide.

Furthermore, the Digio card does not have a debit function, which is one of the disadvantages of this card.

On the other hand, to apply for the Digio card, you do not need to be a Digio customer, you just need to apply for the card.

Therefore, if you are looking for a card without revolving interest with several advantages, such as the Vai de Visa program and access to the Digio Store, the Digio card is what you need.

| minimum income | not required |

| Annuity | Exempt |

| Flag | Visa |

| Roof | International |

| Benefits | No revolving interest, Vai de Visa program, Digio Store, Clube de Pontos |

How to apply for Digi card

The Digio card has been successful among digital bank cards. So, see today how to get it and get rid of the annuity without giving up benefits.

Visa Gold Card

So, the Visa Gold credit card is a financial product that is among the best card options on the market, but unfortunately it is not accessible to everyone.

This is because it is a card that needs proof of income of at least R$2,000 in addition to having a rigorous credit analysis compared to other cards on the market.

And, in addition, the card normally charges an annual fee so that you can enjoy advantages such as international coverage.

Thus, through international coverage, you can shop at national and international establishments.

In addition, with the card you have 24-hour assistance in case of emergencies and insurance for free rental vehicles, as well as travel assistance services and emergency withdrawals.

| minimum income | R$ 2,000 |

| Annuity | Depends on card issuer |

| Flag | Visa |

| Roof | International |

| Benefits | Vai de Visa Program, travel assistance, emergency withdrawal |

How to apply for the BV Visa Gold card

The BV Visa Gold card is an option for those looking for an exclusive service and more advantages at the time of purchase. See how to order yours online and without bureaucracy.

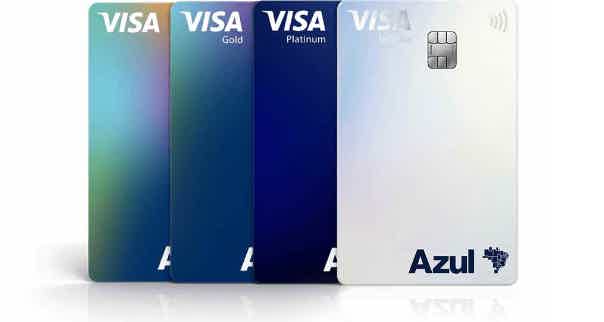

Visa Platinum Card

So, the Visa Platinum card is a financial product that offers a greater line of credit to customers.

Thus, you also have travel benefits, as well as 24-hour personal assistance at your disposal.

And, in addition, it is an international card, that is, you can shop at different establishments around the world.

In addition, it allows withdrawals in local currency at more than one million ATMs accredited to the Visa/Plus network throughout Brazil and the entire world.

It also has offers on hotels, restaurants, entertainment, services and purchases in general, making it a great card for travel.

Therefore, the Visa Platinum card is an excellent card, but unfortunately it is not accessible to everyone. Then see if it fits your needs.

| minimum income | R$ 5,000 |

| Annuity | Depends on card issuer |

| Flag | Visa |

| Roof | International |

| Benefits | Vai de Visa Program, emergency withdrawal, concierge, hotel and restaurant discounts |

How to apply for the Magalu Card

Learn how to apply for the Magalu card, the Magazine Luiza network card, ideal for shopping on Magalu websites and in the app with various discounts! Check out!

Visa Infinite Card

Well then, the Visa Infinite card is one of the cards with the highest minimum income being R$15 thousand, so it is not an accessible card for everyone.

And, in addition, the card annual fee is usually high, that is, if you are looking for a card without an annual fee, it is not the best option.

In addition, the card has a Visa brand and you can participate in all the benefits of the brand, such as the Vai de Visa program.

So, the Visa Infinite card is also a financial product with programs compatible with digital wallets, such as: Samsung Pay, Google Pay and Apple Pay.

In addition, it can also be used to make contactless payments, as well as allowing withdrawals in local currency and also access to various travel benefits. Too much isn't it?

Therefore, the Visa Infinite card is a financial product full of advantages, but it is not accessible to everyone, so check the requirements before opting for this card, so as not to have your application rejected.

| minimum income | R$ 15 thousand |

| Annuity | Depends on card issuer |

| Flag | Visa |

| Roof | International |

| Benefits | Vai de Visa program, concierge, LoungeKey lounge at airports, travel insurance |

How to apply for the Visa Infinite Blue Card

In this article, you will find out how to apply for the Azul credit card step by step, the process can be 100% online and it is very simple.

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Happn app: find a love near you

The Happn app wants real connections between you and those who have crossed paths with you on a daily basis. Here we explain everything!

Keep Reading

How does the Gshow Who Wants to Be a Millionaire program work?

Ever heard of Gshow Who Wants to Be a Millionaire? This framework works from questions and answers. See more in this article!

Keep Reading

Discover the Jeitto personal loan

Get to know the Jeitto personal loan and see if this loan is what you need right now! Ah, he has immediate release! Check out!

Keep ReadingYou may also like

Who can apply for a payroll loan?

The payroll loan is a line of credit especially aimed at INSS beneficiaries and public servants. However, some institutions offer the opportunity to hire workers under the CLT regime. Check more here!

Keep Reading

How to open an Abanca Minimum Services account

For those who need to make withdrawals, transfers, direct debits and payments, the Abanca Serviços Mínimos current account is the ideal solution with a low annual cost. Check in the following post how to open yours.

Keep Reading

How to apply for the Disal consortium

If realizing the dream of a brand new car is one of your goals, be sure to check out how to apply for the Disal consortium. So just check out the post below!

Keep Reading