Cards

10 Platinum card options 2022

Check here the advantages and characteristics of the 10 best Platinum card options on the market. As well as learn why these Platinum cards are considered the best of 2022.

Advertisement

Check out the best cards we've separated for you

It is undeniable that having a Platinum category card in your hands makes all the difference, because it has more advantages from the card itself and also from the flag, which can be Visa or Mastercard, for example. On the other hand, these cards are also intended for those with higher incomes and charge a slightly high annual fee. Thus, we have brought you the 10 best Platinum cards of 2022 so that you can choose the best one.

So, read on to find out all about them.

What Are The Best Platinum Cards Of 2022?

Now, let's get to know the Top 10 Platinum Cards of 2022, as follows.

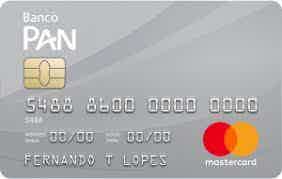

1. Pan Mastercard Platinum

First, let's get to know the Pan Mastercard Platinum card, which is an international credit card that has the Mastercard flag and the Platinum version, so that you can have access to the best advantages of this card category.

Initially, we need to point out that all Pan bank cards basically have the same advantages with few differences between them, so Pan prioritizes providing quality care and services to the customer, no matter which card he chooses.

In this way, with the Pan Mastercard Platinum it would not be different, since it is an international card, that is, you can be in Brazil or in the Maldives and you can use it in your purchases, as well as having a Mastercard flag that is also accepted anywhere of the world.

And, in addition, Pan makes the application available so that customers can control everything that happens with the credit card, such as having access to expenses and the invoice.

As well as the annuity of the Pan Mastercard Platinum card is 12x R$45.00, but participating in the Use More Pay Less Program, you get exemption of up to 100% of the annuity.

In addition, the card also has cashback, that is, with each purchase you make, you receive part of the money back on your invoice for the following month, as well as for every 1 dollar spent with the card, you can accumulate 1.5 points for exchange for products and services with PAN Mais.

| minimum income | R$ 5,000.00 |

| Annuity | 12x of R$45.00 (may be exempt) |

| Flag | MasterCard |

| Roof | International |

| Benefits | Cashback Mastercard Surprise PAN More |

How to apply for a Pan Mastercard Platinum card

Learn how to apply for a Pan Mastercard Platinum card. It is international, has a Mastercard flag, Club Deals, among other exclusive benefits.

2. Itaucard Click Platinum

So, let's now get to know the Itaucard Click Platinum card, which offers the best advantages of an Itaucard in the Platinum category.

Firstly, the Itaucard Click Platinum card is part of the category of the best Platinum cards on the market because it is also part of a trusted institution such as Banco Itaú.

Thus, it is an international card, which means that you can travel with peace of mind that you can continue using the card and it has a Visa or Mastercard flag, which are one of the most accepted in the world.

And, in addition, from the third month of frequent use of the card, you can request an increase in the limit and continue enjoying the benefits.

In addition, you also have access to the Itaucard application. In it, you will be able to access your invoice and make advance payments, check if you have any overdue invoices, make payments and financial transfers, among other transactions.

If you are the type of person who prefers to shop online, but values security, do not worry, as a virtual card is also available that you can generate through the application itself to make online purchases with more security and transparency.

And, still, talking about security, the card also has proximity payment technology, so you don't need to enter a password.

Among other advantages, for every R$1 spent at Shopping Iupp, you earn 3 points that you can exchange for products and services. Just as you also guarantee access to the brand's benefits, such as Extended Warranty and Travel Insurance. In addition to participating in the Iphone forever program and buying your Iphone in up to 21 interest-free installments!

| minimum income | not informed |

| Annuity | Exempt |

| Flag | Visa or Mastercard |

| Roof | International |

| Benefits | Virtual Card + limit |

How to apply for Itaucard Click Visa Platinum card

It has an exclusive app, international coverage and Iupp points program. Learn how to order today.

3. LATAM Pass Platinum

If you are a person who likes to travel frequently and is looking for quality and credible services, the LATAM Pass Platinum card is what you need.

First, the LATAM Pass Platinum card was created through a partnership between Itaú bank and LATAM airline to provide a unique experience for customers, especially those who travel for passion or necessity.

Thus, the card brings several advantages to customers, for example, if you spend R$4,000 per month on the bill, you are exempt from the monthly fee. It is important to note that Platinum cards are ideal for people with higher incomes as they also have higher annual fees.

And, in addition, you also have access to the Iphone forever Program, so, through the Itaú, Itaú Personnalité and Itaucard applications, you can fulfill your dream of buying an Iphone in 21 installments without interest and at your address.

In addition, for every dollar spent on purchases, you earn 2 LATAM Pass points, as well as 3 Upgrade coupons for your trips, you can pay your trips in up to 10 interest-free installments and you also get 30% off LATAM products.

Among other advantages, the card allows payment by approximation and if you are unable to spend the total bill to be exempt from the annuity, if you spend 50% of the recommended amount, you already guarantee 50% of exemption and if you spend it for three consecutive months, you will earn 20,000 bonus points.

| minimum income | R$7,000.00 |

| Annuity | 12x of R$ 51.33 Exempt if you spend R$4,000.00/invoice |

| Flag | Visa or Mastercard |

| Roof | International |

| Benefits | Virtual Card iphone forever points program |

4. Nubank Platinum

Now, let's talk about the Nubank Platinum card, international, free of annuity and with the Mastercard brand.

So, the Nubank Platinum card is an international card and has the Mastercard flag, which is the most accepted flag in the world, so you don't have to worry about where you are and how to pay for your purchases, because Nubank can be accepted anywhere of the world.

And, in addition, like other Nubank cards, it is free of annual fees, which is one of the most outstanding features of this card.

In addition, you can control everything that happens with your card through the Nubank application, for example, checking the invoice and monthly expenses.

Among other advantages of the Mastercard brand, you have access to travel consulting, international offers, concierge, medical emergency insurance during travel, corkage exemption and Mastercard Surprise, which is the Mastercard Program accepted in all categories.

| minimum income | not required |

| Annuity | Exempt |

| Flag | MasterCard |

| Roof | International |

| Benefits | Mastercard Surprise Concierge |

5. Itaucard CVC Platinum

So, let's get to know another Itaú bank card: the Itaucard CVC Platinum card. It is intended for people who travel frequently. The card is international, accepts approximation payments and has a minimum income among the smallest in the market.

Like the other Itaucard cards, the Itaucard CVC Platinum has very similar advantages but focused on customers who travel frequently using CVC services, so you have several advantages such as discounts and exclusive CVC conditions.

And, in addition, the card has a Points Program, which means that for every R$ 3 spent on purchases, you earn 1 point in the Mais CVC Program, and if you are traveling, the score is worth twice as much, that is, when instead of earning 1 point, you earn 2 points for every R$3 spent.

Furthermore, the annuity is 12x of R$24.00, but spending R$3,500 per invoice you get exemption from the monthly fee of the annuity or spending R$2,500.00, you get 50% exemption.

Plus, you have access to all the benefits of Visa Platinum such as Emergency Insurance, Price Protection, Rental Vehicle Insurance and Free Valet in Restaurants and Shopping Malls.

Among other advantages, the card accepts approximation payments and you can control all movements through the Itaucard application.

| minimum income | R$800.00 |

| Annuity | 12x of R$24.00 Exempt if you spend R$3,500.00/invoice |

| Flag | Visa |

| Roof | International |

| Benefits | points program Approach and Pay |

6. Sicredi Platinum

Now, let's get to know the Sicredi Platinum card, made available by the Sicredi credit union.

Initially, the Sicredi Platinum card is a financial product created by the cooperative to pay more attention to customers who seek its services. Thus, it is an international card and has two flag options: Mastercard and Visa, you just have to choose the one you like best.

Furthermore, if you opt for the Mastercard brand, you will have access to the Mastercard Surpreenda program and all the other advantages of Mastercard Platinum, such as corkage exemption. On the other hand, if you opt for the Visa brand, you will have access to the Vai de Visa program, concierge and all the other benefits of the brand.

And, in addition, the card also has a rewards program, that is, the more you use the card, the more you accumulate points that you can exchange for products and services. Thus, Sicredi loses nothing to other financial institutions.

| minimum income | not informed |

| Annuity | not informed |

| Flag | Mastercard or Visa |

| Roof | International |

| Benefits | Rewards Program |

7. Bradesco Visa Platinum

Let's talk now about Bradesco Visa Platinum. It is international, has a Visa flag and also gives you 50% discounts in cinemas and at Teatro Bradesco.

If you are looking for a credit card issued by a reliable and credible institution that offers several advantages, such as discounts at cinemas, theaters and restaurants, the Bradesco Visa Platinum card is the best option for you.

That's because issued by Bradesco, the card is international and gives you 50% off Cinemark tickets, as well as 50% at Teatro Bradesco and discounts on the best restaurants. In addition, you also participate in Visa Concierge and Vai de Visa.

And, in addition, using Bradesco Visa Platinum your Livelo points turn into products, trips or cash back in your account.

| minimum income | not informed |

| Annuity | 12x of R$ 36.25 |

| Flag | Visa |

| Roof | International |

| Benefits | Discounts on cinemas and theater Concierge |

8. Uniprime Platinum

So, let's talk now about the Uniprime Platinum card, issued by the Uniprime credit union.

First, the Uniprime Platinum card is a financial product that has a points program, so when you use the card and accumulate points, you can transfer them to LATAM Pass, TudoAzul and Livelo. In addition, with credit you earn 1.5 points for every dollar and with debit you earn 0.5 points for every dollar you spend.

And, in addition, Uniprime Platinum is international and has the Mastercard brand, which is the most accepted brand in the world, so you have access to all the benefits of the Mastercard brand in the Platinum category, such as Mastercard Surprise and corkage exemption.

In addition, you also get an annuity grace period in the first six months of using the card and from the seventh month of use you can get an annuity exemption, just spend a minimum of R$200 on your Uniprime credit card bill.

So Uniprime Platinum is yet another great Platinum card alternative to have.

| minimum income | not informed |

| Annuity | not informed |

| Flag | MasterCard |

| Roof | International |

| Benefits | Mastercard Platinum Perks points program |

9. Unicred Platinum

Finally, let's talk about Unicred Platinum, also a credit card issued by a credit union.

Firstly, Unicred Platinum is a card that works as a credit and debit card and brings together the best advantages of the Mastercard brand, which is the card's brand.

And, in addition, you can consult everything that happens with your card through the Unicred website, as well as having two credit limits. This is because one will be decided in cash by the cooperative itself and the other in installments, which corresponds to 100% of the cash limit previously defined by the cooperative.

In addition, Unicred Platinum offers a period of up to 40 days for payment of the invoice depending on the day of purchase and the due date of the invoice, as well as the customer can make withdrawals in the credit function and pay the amount in up to 12 installments with interest.

And you can also request an additional card for anyone you want, which is one of the benefits of Unicred Platinum!

| minimum income | not informed |

| Annuity | not informed |

| Flag | MasterCard |

| Roof | International |

| Benefits | Mastercard Platinum Perks two credit limits additional card |

10. Vivo Itaucard Platinum

Now, let's talk about the Vivo Itaucard Platinum card. It is international, has a Visa or Mastercard flag and a cashback program for purchases at Vivo.

So, the Vivo Itaucard Platinum card could not fail to be among the best Platinum cards in 2022 either. This is because it is international and has a Visa or Mastercard flag, that is, you can use the card wherever you are and also enjoy the advantages of the respective flag.

And, in addition, it has a cashback program, so 10% of the value of your purchases at Vivo, invoice payment, recharge or services at Vivo are returned to you in the next invoice. On the other hand, you also receive when you shop at other establishments, but only 0.5%.

Furthermore, the card charges an annual fee of R$30.00 per month, but if you spend more than R$350.00 per month at Vivo, you are exempt from the annuity portion related to the month of the bill spent.

Among other advantages, your limit can be increased from the third month of use of the card, as well as you can pay your purchases in Vivo stores in up to 21 interest-free installments, and you also have exclusive promotions and discounts. And the card has contactless technology to provide more security in your purchases.

| minimum income | R$ 800.00 |

| Annuity | 12x of R$30.00 Exempt if you spend at Vivo R$350.00/invoice |

| Flag | Visa or Mastercard |

| Roof | International |

| Benefits | Cashback + limit |

How to apply for a Vivo Itaucard Platinum card

Learn how to apply for your Vivo Itaucard Cashback Platinum card and take advantage of special discounts and installments at Vivo stores.

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

MP SP contest: step by step to register

Do you want to know how to register for the MP SP contest? Then check out in this post the complete step-by-step to participate in this public contest!

Keep Reading

How to apply for the Sicoob Cabal Classic card

Find out in this post how to apply for the Sicoob Cabal Classic card and find out where you can apply for the card, as well as which documents to present.

Keep Reading

Discover which sales apps to use in 2021

Want to know how to make money with sales app? Read the text below and find out which are the best apps on the market!

Keep ReadingYou may also like

How to apply for the Sicoob Cabal Gold card

The Sicoob Cabal Gold card is a complete option for those who want a resource to pay for their purchases in installments and have access to withdrawals in the credit function. To find out how to apply for the Sicoob card, just continue reading with us!

Keep Reading

Will Bank Card or Caixa SIM Card: which one is better?

A credit card can be the resource that will help you most to organize your financial life, as well as help you in any unforeseen situation that may happen. However, choosing a good credit card is what most influences when maintaining your financial health, isn't it? The Will Bank card or Caixa SIM card are great options for those who want lean cards with the main features for a more fluid payment routine. Learn more about it ahead!

Keep Reading

See how to take an online vision test using apps

Online vision tests offer the convenience and speed of assessing your visual acuity and detecting problems early. Download now, monitor your vision and promote efficient eye health without leaving home.

Keep Reading