Cards

7 cards for salaried employees 2021

Are you an employee and still don't know which credit card is the best option for you? Well, don't worry, today we're going to show you the 07 best cards for employees on the market. They have annuity exemption, reduced rates when they are not exempt and Mastercard Surpreenda or Vai de Visa program. As well as international coverage for you to shop inside and outside Brazil. Learn more here!

Advertisement

Discover great card options for you

If you are employed and still don't know which credit card to use, don't worry, we have the solution you need. Here we are going to present the 7 card options for employees that are among the best in the year 2021. This is because they have low interest rates, annuity exemption and several other advantages.

And, in addition, you have fully digital services, in addition to the practicality and credibility provided by these banks. So, read on to check out the available options.

What are the best card options for employees in 2021?

So let's get to know the 07 available options below.

1. Nubank

So, the Nubank card is a financial product that is among the best on the market. In it, you have a Mastercard flag, international coverage and no annual fee.

And, in addition, there are two of the Nubank card: Gold and Platinum. In this regard, Gold is the first card you will receive at home, as it is the standard card.

From there, Nubank analyzes your financial behavior, such as purchase history, consumption, number and anticipation of installments, to make Platinum available in the future.

And, in addition, all the advantages of the Gold card are aimed at guaranteeing the purchased products. On the other hand, in the Platinum version, the advantages are geared towards travel.

Among the advantages of the Nubank card are: absence of annuity; fee exemption; super intuitive application for you to have access to all card transactions; blocking and unblocking the card through the application; approximation payment; Nubank Rewards and several others.

| minimum income | not required |

| Annuity | Exempt |

| Flag | MasterCard |

| Roof | International |

| Benefits | Pre-approved limit of 50 reais, without consultation with the SPC or Serasa, Mastercard Surpreenda |

How to apply for the Nubank card for negatives

Find out right now how to apply for the Nubank card for negatives, the roxinho without annuity that has fallen in love with Brazilians.

2. BTG +

So, the BTG+ card is a relatively new credit financial product, because it was created in September 2020 initially offering a transactional current account, that is, in which customers will be able to carry out salary account portability, money transfer and several other functionalities.

And, in addition, the BTG + card has an application available for Android and iOS. In it, you will have access to several functions.

In addition, you also have access to a program called Loyalty, which is an open platform, where you can choose the loyalty program, whether airline miles or cashback. In that case, the points go directly to your choice.

To access the card, you may or may not have a digital bank account, which is a great opportunity.

There are three models of the BTG+ credit card, all of them Mastercard, in the Black, Advanced Option and Basic Option versions. The card has a credit and debit function and also makes approximation payments.

The fact is that depending on the product, the annuity may be charged, among other fees, and it is important to take this precaution.

And, in addition, you have access to the Virtual First function, which allows you to use the virtual credit card before receiving the physical card at your home.

| minimum income | Depends on the card category, at least R$7 thousand |

| Annuity | Required depending on card category |

| Flag | MasterCard |

| Roof | International |

| Benefits | Virtual First, Loyalty Program (miles or cashback program) |

How to apply for BTG+ credit cards?

Do you want to know how to apply for BTG+ credit cards and have one of the best cashback programs on the market? So, know that you are in the right place!

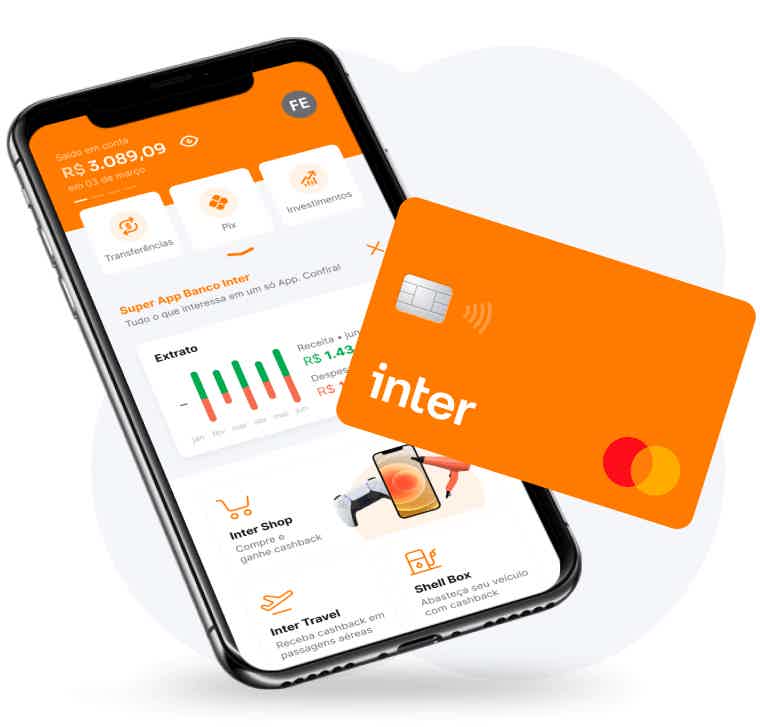

3. Inter

So, the Banco Inter credit card exists in three categories: Gold, Platinum and Black, being an easily approved card for those who have an account at the digital bank.

And, moreover, opening a bank account is very simple, just send an application and wait for Inter's credit analysis.

It is worth mentioning that the Banco Inter credit card has international coverage, Mastercard brand, unlimited free withdrawals at Banco24Horas and contactless technology.

Among other advantages, it also has all the benefits of the Mastercard brand, such as Price Protection, Purchase Protection and Extended Warranty Insurance.

As well as you will be entitled to Masterpass, which is a digital payment service that allows faster checkout.

Among the Inter categories, the card has some singularities, for example, the Mastercard Gold is ideal to be a starter card.

On the other hand, there is the Mastercard Platinum card, which is a more intermediate model. However, to have access to it, investments of at least R$50,000.00 in the bank are required.

Finally, there is the Mastercard Black card, considered Inter's best card.

So, if you invest R$50,000 in Inter, you can request the Platinum card with unlimited access to VIP lounges at airports in Brazil and around the world that belong to the LoungeKey program, in addition to up to four additional cards. Too much, isn't it?

| minimum income | depends on the category |

| Annuity | Free |

| Flag | MasterCard |

| Roof | International |

| Benefits | Mastercard Benefits, Cashback Program |

How to apply for Inter credit card

Do you want to know how to apply for an Inter credit card? So, read our text and find out all about this annual fee-free card and digital 100%!

4. C6 Bank

So, C6 Bank is a fintech that was created in 2018, with the aim of becoming one of the largest companies in Brazil, competing directly with Nubank, Neon and Inter.

And, in addition, despite not having a physical agency, it provides highly optimized, secure and transparent digital services.

In it, you have access to everything through the application, which is available on Google Play and the App Store.

Thus, after applying for the card, you will receive the digital and physical version in the comfort of your home, guaranteeing access to all credit and debit functions.

Among the advantages of the card are the absence of an annual fee, as well as the exemption of other fees, such as the issue fee and account maintenance. Oh, and all transactions are free!

| minimum income | Free |

| Annuity | Free |

| Flag | MasterCard |

| Roof | International |

| Benefits | Mastercard Surprise, Discounts and Offers, C6 Triggy |

How to apply for the C6 Bank credit card

Find out now in this article how to apply for your C6 Bank card free of various fees and, with Mastercard Surpreenda, international coverage and C6 Triggy.

5. pan

So, if you are looking for a credit card that will help you save a certain amount per month, the Pan card is the option you need.

That's because, in 2020, the Pan card was chosen as one of the best credit cards on the market and it helps you when making payroll loans, financing and investments of up to R$100.00 reais.

And, in addition, the card can be issued by the Visa brand and also by the Mastercard brand. In addition, you still have international coverage and a very technological application to help you control all your expenses and have access to your invoices.

| minimum income | depends on the category |

| Annuity | depends on the category |

| Flag | Visa or Mastercard |

| Roof | International |

| Benefits | PAN Mais, Offers, Mastercard Surprise, Go Visa |

How to apply for your Banco Pan credit card

Find out now the step-by-step process for applying for your Banco Pan card, everything can be done 100% via the internet.

6. Santander SX

So, the Santander SX card is a financial product issued by the Santander bank through the Visa and Mastercard Gold flags.

And, in addition, it has an annuity of R$399 for the holder (or R$33.25 per month) and an amount of R$200 for each dependent or additional account.

On the other hand, whenever the amount of your monthly bill is equal to or greater than R$100, you become exempt from the monthly installment of the annuity.

So, Santander sought to optimize the services offered by the bank to also join the wave of digital banks, bringing all the credibility and seriousness of the institution.

Another advantage is that the card does not oblige the customer to have a Santander bank account, but if you have an account at the institution, you may be exempt from the annuity on this card, simply registering with the Pix key.

| minimum income | R$ 500 for account holders R$ 1,045 for non-account holders |

| Annuity | R$ 399 or 12x R$33.25 (Exempt if you join the PIX system or with a minimum spend of R$ 100) |

| Flag | Visa or Mastercard |

| Roof | International |

| Benefits | Discounts at Esfera partner stores |

How to apply for the Santander SX card

Find out how to apply for the Santander SX card by following this step-by-step guide. In it, you have access to Visa or Mastercard flags, international coverage and discounts.

7. Neon

So, the Neon card is also among the best credit card options available in the market.

This is because it is an ideal card for you if you are looking for autonomy, practicality and technology.

And, in addition, you will be exempt from various fees, including annuity. It even has international coverage, that is, you can shop in national and international stores. Furthermore, the flag is Visa.

That is, with it you will be able to access almost all partner stores and establishments in Brazil and the world. And yet, you have access to a super intuitive and practical application.

| minimum income | Free |

| Annuity | Free |

| Flag | Visa |

| Roof | International |

| Benefits | Application, discounts, fee waiver |

How to apply for the Neon card

Learn how to apply for the Neon credit card, which is growing every day in the Brazilian market.

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to find the best cashier jobs

Select one of the best cashier jobs. Learn to stand out in the selection process to reach your opportunity!

Keep Reading

How to advance FGTS through Agibank? Check the process

Learn how to anticipate the FGTS through Agibank and what special conditions this bank can offer you in this credit modality!

Keep Reading

How to apply for Homemaker Aid

Do you know how to apply for Housewife Aid? The process is quite simple! Read this post and find out how it works.

Keep ReadingYou may also like

Online C6 Bank card: no annual fee and CDB with zero brokerage

How to order the C6 Bank card online? What are the benefits? And the limit? If these are questions you often ask, be sure to check out the full review we've prepared for you. Continue reading and learn more.

Keep Reading

How to open a current account CEMAH Minimum Services

With the CEMAH Minimum Services current account, you do not pay to make withdrawals at the counter and have access to a reduced maintenance fee. Learn here how to open your registration.

Keep Reading

Discover the EuroBic Prime current account

Want to make a current account and don't know which one to choose? Then get to know the EuroBic Prime account, with fee-free SEPA + interbank transfers and find out if it's ideal for you. See more information below.

Keep Reading