Cards

8 cards for retirees 2021

If you are already retired and still don't know which is the best credit card option. Rest assured, as we have selected 08 cards for retirees that are among the best on the market. They have annuity exemption, international coverage, absence of SPC and SERASA consultation and several other advantages! Check out!

Advertisement

Discover the cards and choose the best offer

Initially, in Brazil, there are currently around 30.7 million retirees, that is, people who are no longer in the job market and these people are looking for cards every day that can facilitate and bring more convenience to their financial life. Therefore, today we selected 8 retirement cards for you to choose the best offer.

So, if you are looking for an absence of consultation with credit agencies, such as SPC and SERASA, exemption from annuity charges and practicality when paying bills. Continue reading and check it out!

What are the best card options for retirees in 2021?

First, let's introduce the 8 best cards for retirees available on the market. So follow along!

1. Pan

So, the Pan card is the ideal credit card to help you go shopping and also save money every month.

This is because it has excellent services and several exclusive proposals for customers who apply for a credit card at Banco Pan.

And, in addition, in 2020, the Pan card was chosen as one of the best credit cards on the market and is also an ideal financial product for retirees and people with a dirty name. But that's because he doesn't consult the SPC and SERASA.

Furthermore, on the other hand, this card can also be issued under the Visa flag, and you also have international coverage, that is, you can shop in national and international stores.

In addition, you are guaranteed access to a very personalized application to help you control all your expenses and have access to your invoices.

Just as you do not pay a membership or annuity fee and only need the income of a minimum wage, as the payment of the invoice is deducted directly from the customer's paycheck or benefit. In addition, it has interest of only 3% per month.

| minimum income | Minimum wage |

| Annuity | Exempt |

| Flag | Visa |

| Roof | International |

| Benefits | Easy approval; International coverage; rewards programs |

How to apply for the Pan Consigned Card

Do you want to know how to apply for the ideal Pan payroll card for retirees without annuity and international coverage? So check it out.

2. BMG

Well then, the BMG Card is an ideal financial product for retirees and also people with a dirty name. This is because it is not necessary to prove income, just as the institution does not consult the SPC and SERASA.

And, in addition, the card is made for civil servants, retirees and INSS pensioners, because the payment of the minimum invoice is deducted directly from the payroll.

On the other hand, the card has the Mastercard brand and has several advantages, such as the Mastercard Surpreenda program, as well as discounts at partner companies.

In addition, it has international coverage, as well as unlimited and free withdrawals through Banco24Horas ATMs.

By the way, you get a credit limit in a very simple way even if you are negative, as the institution offers exclusive conditions for this category of people. So this is too much, isn't it?

| minimum income | Minimum wage |

| Annuity | Exempt |

| Flag | MasterCard |

| Roof | International |

| Benefits | Discounts; Mastercard Surprise; International coverage; Cashback Program |

How to apply for BMG card for negatives?

The BMG credit card for negatives is a card that offers ease of approval and can be personalized. Find out how to apply here!

3. Cetelem

So, the Banco Cetelem card is also an ideal card for retirees, depending on the amount of your benefit or monthly salary. In addition, a credit limit will be made available that can be used for purchases in commercial establishments, withdrawals and payment of bills.

And, in addition, the invoice amounts will be deducted directly from the payroll limited to the assignable margin of 5%, that is, it allows you to use only 5% for spending with the card.

Finally, the card's interest rates are also quite attractive, hovering around 5% and, in the case of retirees and pensioners, 2,35%. That is, it is a great option for those who want quality services at reduced prices.

| minimum income | Minimum wage |

| Annuity | Exempt |

| Flag | MasterCard |

| Roof | National |

| Benefits | Mastercard Surprise; National Coverage; Low interest of 2,35% per month; Duty free |

How to apply for the Cetelem Payroll Card

Zero annuity and benefits for you. Request Cetelem now and use this step by step to order yours from home.

4. Simple Box

So, the Caixa Simples card is a financial product intended for INSS retirees or pensioners under 75 years of age, deducting the minimum amount of the monthly card bill directly from the paycheck or INSS benefit.

And in addition, this card also offers several advantages for customers, such as interest rates that are up to 5x lower than traditional cards.

Just as it does not consult credit protection bodies, such as SPC and SERASA, and provides quality services to customers that only Caixa Econômica Federal provides.

Finally, another important consideration to be made is that the limit corresponds to the margin of 5% of the full amount received. That is, you will never have the entire amount deducted from your paycheck or INSS benefit, leaving it your responsibility to pay the remainder of the invoice through a bank slip.

| minimum income | not required |

| Annuity | Exempt |

| Flag | Link |

| Roof | International |

| Benefits | Without consultation with the SPC and Serasa; Lower interest; Clube Elo Mania Caixa |

How to apply for the Caixa Simples card

The long-awaited time has come to find out how to apply for your Caixa Simples card, ideal for INSS retirees and pensioners with negative annuity fees.

5. Daycoval

Well, the Daycoval card is a payroll-deductible financial product, that is, the minimum amount of the card bill is deducted from the customer's benefit or paycheck.

This is because, in this way, the chances of default by the customer are completely reduced, that is, it is a security for customers and for the financial institution.

And, in addition, the Daycoval card is a financial product intended for INSS retirees or pensioners and has very attractive interest rates and several other benefits, such as unlimited withdrawals on the Banco24Horas network, as well as no annuity charge.

| minimum income | Minimum wage |

| Annuity | Exempt |

| Flag | MasterCard |

| Roof | International |

| Benefits | No Consultation with SPC/SERASA; Lowest interest rates on the market; Minimum payment deducted from the payroll; Withdrawals on the Banco24Horas network |

How to apply for the Daycoval card

Do you want to know how to apply for the Daycoval payroll card? If so, then read this text and be closer to the card with the lowest interest rates on the market!

6. Mercantile

So, the Mercantil payroll card is a card that works as follows: initially, you just open an account at Banco Mercantil.

Then, just put your benefit or salary in the account and, finally, this benefit will be responsible for guaranteeing the payment of the invoice.

And, in addition, you can request the card with a limit of up to 5% of your income, being a great payment option in which the minimum amount of the invoice is paid through direct debit.

Retirees, pensioners, civil servants, employees of private companies and members of the Armed Forces can also apply for this card.

| minimum income | subject to review |

| Annuity | Exempt |

| Flag | not informed |

| Roof | International |

| Benefits | Lower interest rates; digital invoice |

How to apply for the Mercantil Bank Payroll Card

See now how to apply for the Banco Mercantil payroll card with low interest rates, ideal for retirees and pensioners and civil servants.

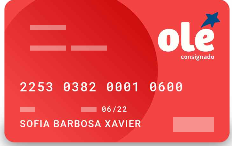

7. Olé Consignado

Well, if you are retired and have name restriction or low credit score, the Olé Consignado card may be the solution you need.

But that's because the Olé Consignado card is a financial product aimed at INSS retirees and pensioners, in addition to public servants.

In addition, it works by deducting the minimum invoice amount from the customer's paycheck or the INSS benefit.

Thus, you guarantee rates up to 5x lower than conventional credit cards with a consignable margin of 5%.

So, unlike other credit cards for negative credit on the market, at Olé Consignado a cash deposit is required before use.

Finally, Olé payroll does not consult credit agencies, such as SPC and SERASA, being ideal for people with a dirty name. So this is too much, isn't it?

| minimum income | Minimum wage |

| Annuity | Exempt |

| Flag | Visa |

| Roof | International |

| Benefits | Discounts on the Olé partner network; Track everything through the app |

How to apply for the Olé Consignado credit card

You already know what the benefits of the Olé Consignado credit card are, so it's time to find out how to apply for it. After all, he is free of annuity.

8. Banrisul Payroll

So, the Banrisul card is a payroll-deductible financial product in which you receive an invoice every month with the amount deducted directly from the beneficiary's paycheck.

And, in addition, to access the payroll Banrisul, it is necessary to be a beneficiary of the INSS, as well as to be under 76 years of age, have an up-to-date registration with Banrisul and contract the card in the state of receiving the benefit.

Furthermore, another advantage of the Banrisul payroll card is that all cards are issued with a chip, as well as password protection.

This is because, in this way, you are protected against fraud, data theft and any other problems that may occur with your card.

And, in addition, you can control all your card movements also through Internet Banking.

| minimum income | Minimum wage |

| Annuity | Exempt |

| Flag | MasterCard |

| Roof | International |

| Benefits | No consultation at SPC and Serasa; Annuity Exemption |

How to apply for the Banrisul Payroll Card

Banco Banrisul's payroll card has gained popularity, as it has low interest rates, is exempt from annuities and does not require consultation with the SPC or SERASA.

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to open top account

Find out how you can open your Top digital account and thus access all the benefits that only it can offer!

Keep Reading

Lanistar card or Atacadão card: which is better?

Want to know which one to choose between Lanistar card or Atacadão card? So, read this post and discover the advantages and disadvantages of each one!

Keep Reading

What is the best payroll loan 2021?

Choose from the 7 best payroll loan options 2021 and enjoy all the advantages of a credit that accepts negatives. Check out!

Keep ReadingYou may also like

IPTU 2021: everything you need to know

IPTU 2021 is a tax that can cause some doubts and confusion. Therefore, we have gathered information to clear all your doubts. Check out!

Keep Reading

Discover the UCI Housing Credit

Get to know the UCI Mortgage Credit here, with several options of rates and installments so that you can customize the loan the way you need it. Know more!

Keep Reading

How to apply for a loan online Simplic

Do you want a 100% loan online and without bureaucracy? Then, get to know the Simplic loan with up to R$ 3,500 in 12 installments with an interest rate starting at 15,80% per month. Check out!

Keep Reading