Cards

Trigg Card or Next Card: which is better?

Are you in doubt between the Trigg card or the Next card? Both are great credit card options with international coverage. Check out all its benefits here!

Advertisement

Trigg x Next: find out which one to choose

Don't know whether to choose between the Trigg card or the Next card? Check below its advantages and disadvantages and find out which is the best choice for you!

First, it is worth remembering that both are credit cards with international coverage. In addition, both have a Visa flag, which allows the user to participate in their benefit programs, such as Vai de Visa. Furthermore, both the Trigg card and the Next card offer cashback programs for their customers.

However, each card has its particularities. The Trigg card offers two forms of approximation payment, bringing a lot of technology to the lives of its customers. The Next card, on the other hand, does not charge an annuity and its withdrawals are unlimited throughout Brazil.

Want to learn more about cards and find out which one is best for you? Keep reading and check it out!

How to Apply for a Next Credit Card

There's no denying it: anyone who knows the facilities and benefits of the Next Visa International card is very tempted to apply for it. So don't waste time and order yours soon!

| trigger | Next | |

| minimum income | not required | not required |

| Annuity | 10.90/month | Free |

| Flag | Visa | Visa |

| Roof | International | International |

| Benefits | Cashback, Trigger Band bracelet | Cashback, Roadside Assistance Service |

Trigg Card

The Trigg card is a modern credit card, which has several advantages. Its international coverage allows the user to make purchases in Brazil and abroad. In addition, the Visa brand allows the customer to register for its benefit programs, such as Vai de Visa.

In order to apply, proof of income is not required. Thus, it is ideal for those with a low score, but would like to have a credit card. Also, this process is completely online and free.

In addition, the card seeks to make life easier for customers through technology. This is because it has two methods of payment by approximation. One of them is the Trigger Band bracelet, which allows you to pay for your purchases in a practical and safe way.

Another option is through the Samsung Pay app. To use it, just register the card in the app and make payments with your cell phone. Incredible technology, isn't it?

Want to be sure you're making the right decision in your choice? Read on to find out even more about each card's features!

next card

The Next card is a debit and credit card with international coverage. In addition, its Visa flag allows the user to have several benefits and discounts. For example, the Travel Assistance Service and access to Vai de Visa and Visa Checkout programs.

The card is offered by the digital bank Next, a financial institution created by Bradesco. Thus, it is a safe option for those looking for a new card. Banco Next is completely digital and free. Therefore, its services are very interesting for those who want comfort and ease in their purchases and transactions.

In this way, the Next card application and its functions are controlled by the application or the institution's website, all without leaving the comfort of your home. Quite an advantage, isn't it? Remembering that the app is available for both Android and iOS.

The card has a great benefit: there is no annual fee. Thus, it is possible to enjoy its debit and credit function without paying any fee for it. Furthermore, proof of income is not required.

Therefore, there are many facilities, which makes the Next card a great card option.

What are the advantages of the Trigg card?

Now, let's know more advantages about the Trigg card. Thus, you will find out if it fits your financial life!

So, a positive point of the card is its cashback program. By participating, you can receive back part of the amount spent on your purchases. The percentage ranges from 0.25% to 1.3% of your total invoice amount. That way, the more you use your Trigg card, the more money you get back!

In addition, there is another way to receive money with your card. Trigg Friends is a friend referral program. With it, you can earn up to R$ 600.00! The more friends you refer, the greater your cashback.

Finally, another advantage is that you will have access to a virtual card as soon as your application is approved. This way, you can buy online even before the physical card arrives at your home.

What are the advantages of the Next card?

Now, how about getting to know some more advantages of the Next card? Continue reading and check it out!

Well, as we mentioned earlier, the Next card is 100% digital, which makes everyday life a lot easier, right? Also, there is no annual fee, which is charged by most traditional credit cards.

Another benefit is that the user can make unlimited and free transfers to any Bradesco or Next account. In addition, you can make a free transfer per month to any bank.

By the way, withdrawals are also unlimited and can be made at Bradesco and Rede Banco24Horas ATMs throughout Brazil.

Finally, the Next card also has a cashback program. In it, you get a certain amount back when you make purchases with your card. And the partnership is made with more than 200 brands. A great way to save a little money!

What are the disadvantages of the Trigg card?

Well, let's now talk about some disadvantages of the Trigg card. Thus, you will have all the necessary information to make the best decision!

A negative point of the card is the charge of an annuity fee in the amount of R$ 10.90 per month. In addition, there are also charges for some of their services. So keep an eye out so you don't have any surprises. Domestic withdrawals are R$ 9.99 and international withdrawals are R$ 10.00. Furthermore, issuing the card costs R$ 29.90 per unit.

Another disadvantage is that there is credit analysis to get your credit card. So if you don't have a high score, you may not be approved. However, if this happens, you can order the Trigg card again after 90 days.

What are the disadvantages of the Next card?

Now, we are going to present some of the disadvantages of the Next card so that you can be sure that you are making the right choice for your financial life.

One of the negative points is that the card's credit function undergoes an analysis of your profile, carried out when opening an account. Therefore, it will not be possible to use the function if it is not approved.

In addition, some services are charged, although the customer does not need to worry about the annual fee. For example, there is a charge of R$ 30.00 when registering to start a relationship with Banco Next. In addition to a fee of R$ 3.00 to receive the debit card at home.

Knowing all the characteristics of the card makes it much easier to make the most appropriate decision, right?

Trigg Card or Next Card: which one to choose?

Now you know the two cards and their positive and negative points. Therefore, you can choose the best option for you and your financial life: Trigg card or Next card? Both have exclusive benefits and are great possibilities!

So, the Trigg card has the Trigg Friends program, in which you can earn money by referring friends. In addition, it invests in technology, such as approximation payments, to make life easier for customers. The Next card has no annual fee and you can manage your entire account through the application.

Therefore, knowing all its characteristics, it is already possible to choose what is best for your financial life! Still in doubt? So, check out our post below and get to know other cards!

Bradesco Neo Card or Next Card: which one is better?

Be it the Bradesco Neo card or the Next Card, both seek to offer quality services and have international coverage! Check out!

Trending Topics

How to enroll in Educa Mais Brasil courses?

Do you want to improve in your area of expertise? Discover the free Educa Mais Brasil courses and choose the subject of your choice, check it out!

Keep Reading

Uber Eats Delivery Driver: What you need to know

Do you want an income with your smartphone, car, motorcycle or bicycle? So understand how to become an Uber Eats delivery man and start earning money!

Keep Reading

How to apply for Santander student credit

See in this post how you can apply for up to R$180,000.00 in Santander student credit to make your studies a reality!

Keep ReadingYou may also like

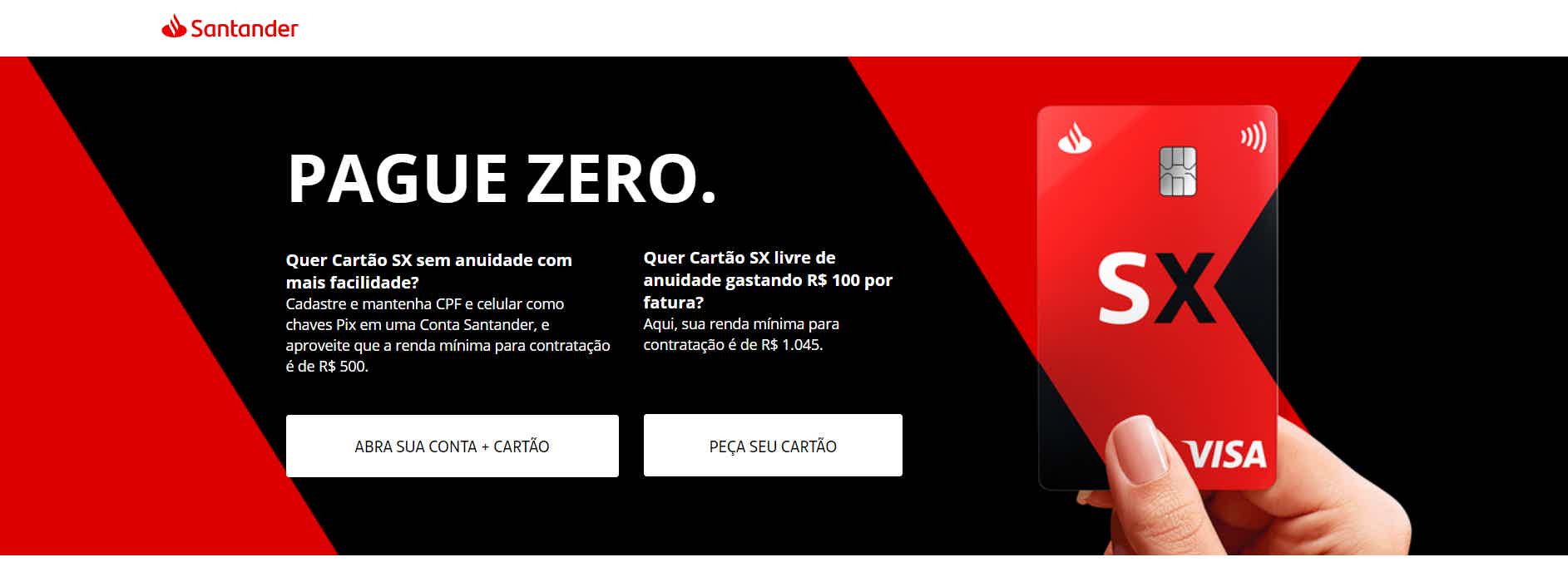

How to apply for the Santander SX card

Now Santander Free is Santander SX. Therefore, find out how to request it and be exempt from the annual fee, in addition to several other benefits from the bank and the Visa or Mastercard brand.

Keep Reading

Find out about Child Care Subsidy

In case of illness or accident, don't worry if you need to take a break from work. To do this, you can apply for the Child Care Grant if you meet the requirements. Meet them here.

Keep Reading

How to apply for the Family Salary

The Family Salary benefit was designed for employees under the CLT regime who have children under 14 or children with physical disabilities. Find out how to apply here.

Keep Reading