Cards

Ton Card or Access Card: which is better?

Why not opt for cheap cards, with the possibility of credit purchases and hassle-free ordering online? So, decide between the Ton card or Access card!

Advertisement

Ton x Access: find out which one to choose

Without a doubt, anyone who sells or buys on credit needs a simple and cheap digital account, right? So, how about deciding between the Ton card or Access card?

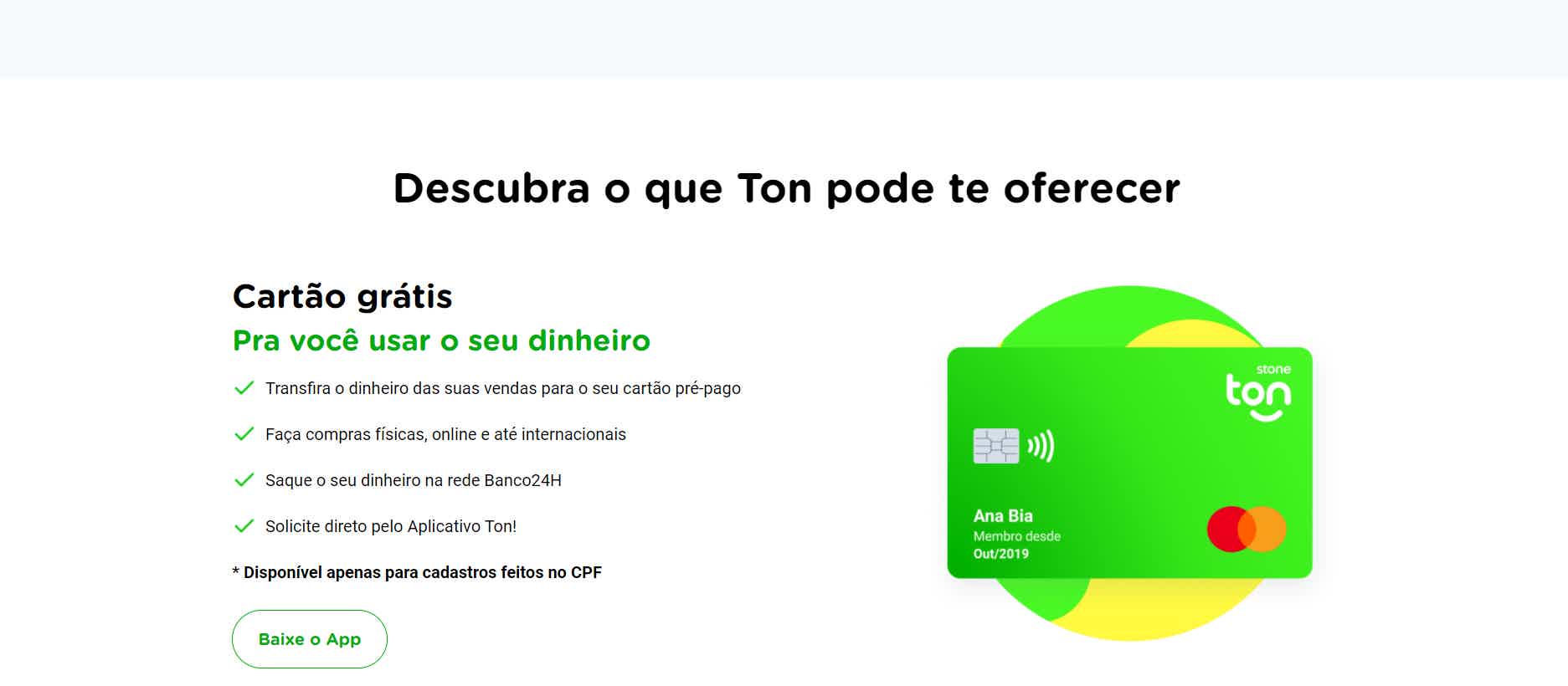

In short, the Ton card is from Stone, focused on offering card machines and digital accounts, without charging an annual fee or any monthly fee, as long as the customer pays the membership fee and fee for each transaction.

On the other hand, the Access card is the chance for those with a bad name to make international purchases again, paying for Netflix, Spotify and any application abroad, for example.

So, how about deciding today between two options that you have requested online, with the chance of not going through any credit analysis and operating a receipts account with the credit modality?

So, without further ado, check out the detailed comparison below and find out which digital credit card will be most useful for you!

How to apply for the Ton card

Why not request a free digital card, with an application for a card machine for CPF sales and a free account? Know more!

How to apply for the Access card

Do you have a bad name and need to buy using a credit card? With this one you can! Have a card with a low annual fee and make international purchases without proof of income

| ton card | Access Card | |

| Minimum Income | not required | not required |

| Annuity | Exempt | 12x of R$ 5.95 |

| Flag | MasterCard | MasterCard |

| Roof | International | International |

| Benefits | Machine without monthly fee Free digital card without charge Buy by debit or credit with money from sales Have a flag and make international purchases Did you need to withdraw? Use the Banco24h network | You don't need to have a bank account to operate No credit analysis or document submission required Customer obtains credit without proof of income Buy in establishments abroad and on the internet Subscribe to Netflix, Spotify and others even with a dirty name Only pay annuity by using the card |

ton card

If you happen to be an entrepreneur or self-employed person who needs to sell in installments or using a debit card, the Ton machine does not require the creation of a CNPJ and also offers a digital card.

With this digital card you can make payments with money from sales, which is available within one business day in some cases, upon payment of fees per transaction.

In any case, the Ton customer chooses between one of the company's three plans, which are divided between GigaTon, MegaTon and basic Ton, each with different benefits and payment of a membership fee.

Choose between the T1, T2 and T3 machines, pay a membership fee that can be divided into 12 interest-free installments, in addition, only those who order via CPF have the digital card.

Finally, the Ton card carries out a credit analysis, but states that it is not a prerequisite to have a clean name to make the request, so the tip is to try and wait for approval!

Access Card

Since many negative people suffer from non-approval of credit, prepaid payments come as a light at the end of the tunnel, especially when there is no bureaucracy.

Once the customer orders the Access card online, they do not undergo document evaluation and have a credit card for international purchases or any other, even with a dirty name.

This means that upon recharges to be made, you will be able to discount streaming and application subscriptions without any bureaucracy, paying some pre-defined fees.

Furthermore, the card arrives within an average of fifteen days and is activated as soon as a fee of R$14.90 or R$100.00 is deposited into the digital account, so all you have to do is shop!

What are the advantages of the Ton card?

Not just a digital account, but also an ally in sales, the Ton card offers one of the cheapest machines on the market, providing access to small entrepreneurs, so see the advantages in detail below.

- Do not pay a monthly fee for the machine, just membership fee and transaction fee;

- With the Ton digital card, the customer is free from annual fees;

- Did you receive any sales? Pay for credit card purchases within one business day;

- Even without a machine, download the TapTon app and make sales via cell phone;

- Possibility of release for negative individuals.

What are the advantages of the Access card?

Whether you like it or not, the Acesso card is ideal for those with a dirty name to make international purchases and not be tied to expensive bills, like traditional banks, so check out other details below.

- Pay fees only when there is a top-up;

- Do not undergo credit analysis or any proof of income;

- Make international purchases using credit;

- Pay for Netflix, Spotify and Uber with your credit card;

- Use as an emergency reserve account or for children’s savings.

What are the disadvantages of the Ton card?

Without a doubt, the fees related to the Ton card can be heavy, because only customers with the T3 machine and GigaTon plan can have access to all the benefits, such as Wi-Fi connection and printing of receipts.

To do this, set aside at least R$406.80 to get all the benefits, in addition, the Ton card does not confirm whether negative candidates can apply for the machine and digital card, so it is important to try.

What are the disadvantages of the Access card?

Once you request the Access card, some fees need to be paid, including the usage fee for each recharge, which is charged monthly in the amount of R$5.95. Also, top up R$100.00 so it comes out for free, if not, the fee is R$14.90.

Furthermore, top-ups lower than R$500.00 also have a monthly fee of R$2.50, therefore, for a fee of almost R$9.00 to not be charged monthly, the top-up value must be at least five hundred reais.

Ton Card or Access Card: which one to choose?

Finally, which card would be ideal for you, one that is for negative people or another that encourages small businesses?

In short, the Ton card has a free digital account, offers card machines for individuals and charges fees only for using the machine, with the customer being able to choose between three plans.

On the other hand, the Access card is recommended for those who have a bad name and need to pay via credit by recharging, paying again for subscription plans and other international applications.

So, evaluate your needs and what doesn't affect your financial budget to reach a safe and beneficial decision.

Without a doubt, it's a difficult decision, so don't worry if you haven't found the ideal card yet. Follow us in another comparison and increase your options in the dispute over which is the best credit card!

Hipercard or Digio card

Make purchases with an international credit card without paying any annual fees. In one case, you have 40 days to pay for purchases. Find out more below!

Trending Topics

How to get dream job?

A lot of people wonder how to land their dream job. Therefore, in today's article we will give you tips to achieve this goal. Check out!

Keep Reading

How to apply for the Simplic loan

Do you want to learn how to apply for the Simplic loan with extended terms, quick release and ideal for negatives? Then read on!

Keep Reading

Online PicPay card: with promotional cashback and annuity waiver

Find out in this post the main features of the PicPay card online and see if it is an option worth requesting!

Keep ReadingYou may also like

See how to participate in the 2022 Federal Revenue motorcycle auction

Acquiring a vehicle requires good financial planning so that the value fits into the budget. This causes many people to give up buying because they don't have enough money. However, it is possible to obtain a motorcycle for a price well below the list through the Federal Revenue auction. Understand.

Keep Reading

Understand what the DI rate is and what it is for

Check now what the DI Rate is and understand why it helps to guarantee the security and balance of the banking system in our country.

Keep Reading

Openbank card or CTT card: which is better?

While the CTT card has advantages for those who pay for purchases in installments, the Openbank card is ideal for maintaining greater control over accounts. Want to know which one to choose? Then check out our comparison!

Keep Reading