Cards

Saraiva Card or Santander SX Card?

To decide between the Saraiva or Santander SX card, know that both have points programs and international flags. Know more!

Advertisement

Saraiva vs Santander SX: which is better for your purchases?

Initially, the Saraiva card and the Santander SX card are two credit card options that aim to bring more comfort, security and confidence to customers who choose to use these credit cards that seek, above all, to bring convenience to users. .

Then, we'll show you the advantages, as well as the disadvantages of these cards, so that you can choose the one that best suits your needs! Therefore, below we will show some characteristics of the two cards. Check out:

How to apply for Saraiva card step by step?

Find out now everything you need to know to apply for a Saraiva credit card. Follow the step-by-step process to apply for your card.

| Hail | Santander SX | |

| Minimum Income | not required | R$ 500.00 for account holders R$ 1,045.00 for non-account holders |

| Annuity | free | 12x of R$ 33.25 (Exempt for invoices above R$100) |

| Roof | International | International |

| Flag | Visa | Visa/Mastercard |

| Benefits | Free membership and subscription Discounts at Saraiva's bookstore network Free add-on cards Mileage and discount programs | Sphere Partners with up to 50% discount Visa Gold Benefits Possibility of zeroing the annuity Up to 5 additional cards |

Santander SX Card

Well then, the Santander SX card is a credit card that came to replace the Santander Free card and, one of its greatest advantages, is the possibility of zeroing the annual fee, which makes this card stand out in relation to to other credit cards.

And in addition, another feature of this card is that it encourages the registration of the PIX key, however, for this registration to be carried out, you need to be a Santander bank account holder. So, despite having an annuity rate, there are ways to reset this rate.

Therefore, the Santander SX card is a card that brings, in essence, the values of the Santander institution, as well as personalized benefits that only Santander SX Visa Gold can offer you.

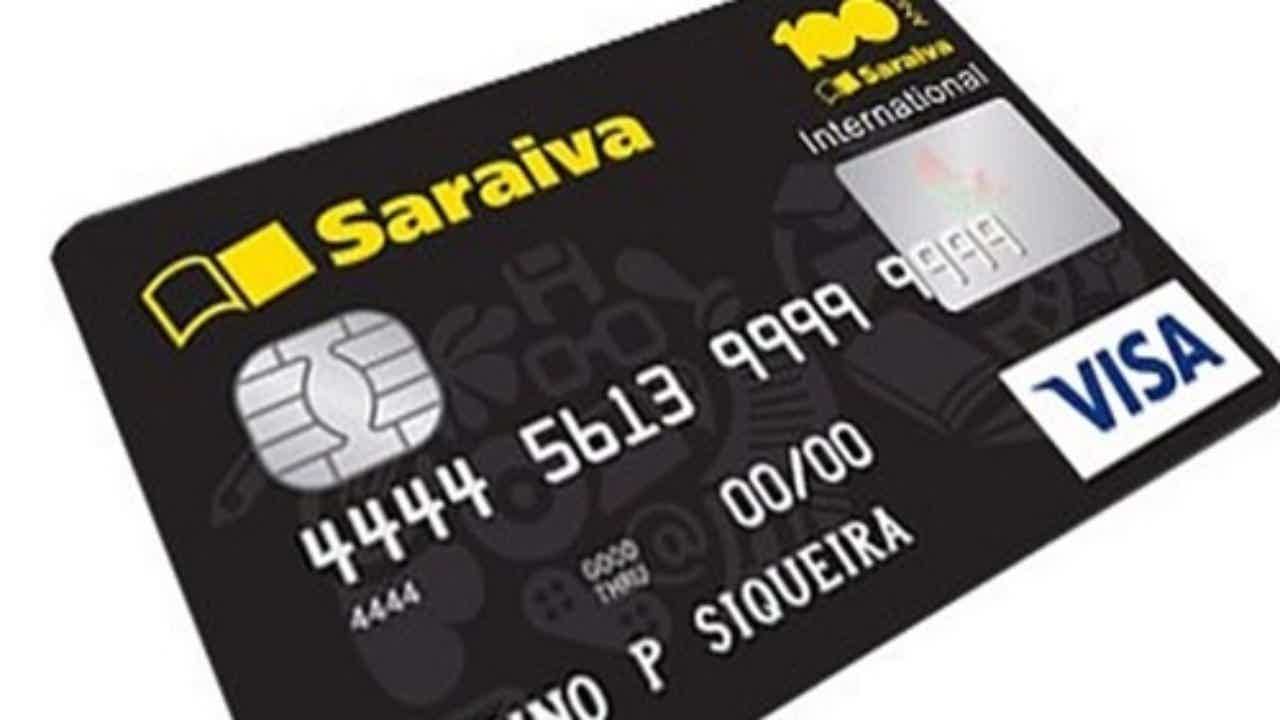

Saraiva card

Initially, the Saraiva bookstore network card was famous for its quick credit card approval, free annual fee, as well as additional cards and various other advantages such as international coverage and benefits inherent to the VISA flag.

And in addition, this card also offers discounts and offers at all Saraiva bookstores, which, for book lovers, is a great investment!

Well, this card was born from the partnership with Banco do Brasil, it has the VISA flag, and all the advantages of the Classic version. And besides, it also allows you to accumulate points on all your purchases, which can become discounts or airline miles on LATAM Pass for you to travel.

Another way to accumulate points is through Saraiva Plus and in the VAI DE VISA program, under the VISA flag. And, as it is issued by Banco do Brasil, this card can only be requested through the OuroCard app for Banco do Brasil customers, which ends up restricting consumers a little.

What are the advantages of the Santander SX card?

Well, let's see the advantages of the Santander card that is part of the Santander financial institution:

- At first, the first advantage of the Santander SX card is the offer to be able to zero the annuity, either by registering the PIX key, or by spending invoices over 100 reais;

- Another advantage of the Santander SX card is the 5 additional cards, which provide more comfort for customers, knowing that they can have other cards in addition to the main one;

- Plus, you can enjoy up to 50% discounts with Esfera partners;

- Another advantage is that the card has the Visa flag and, therefore, the customer can enjoy the benefits of the Visa Gold program.

Therefore, it is a card full of advantages, however, the one that stands out the most is the possibility of zeroing the credit card annuity, with the registration of the PIX key, or, with the invoice values being above R$100. That is, you need to do a good financial analysis to find out if this card is worth it for you.

What are the advantages of the Saraiva card?

Well, let's see the advantages of the Saraiva card:

- At the outset, the first advantage of the Saraiva card is the exemption from annual fees, proof of minimum income, fees or other fees for maintaining or acquiring the card;

- And in addition, the card also has discounts on the entire Saraiva bookstore chain;

- Another advantage is the free additional cards that bring more comfort to customers;

- Furthermore, there is the miles and discounts program for customers, who accumulate points as they make purchases with the Saraiva card;

- Another advantage is access to the OuroCard app from Banco do Brasil, where you can manage all your expenses, financial transactions and much more.

Therefore, it is a card full of advantages, even more so for book lovers who would make a real investment, as they would gain several discounts at the Saraiva bookstore chain. So, don't waste time and see all the offers that the Saraiva card can offer you!

What are the disadvantages of the Santander SX card?

So, one of the disadvantages of the Santander SX credit card is the annual fee charge. This is because there are several models on the market that do not charge an annuity fee.

However, this same card presents proposals for you to be able to zero the annuity rate, which becomes very advantageous. That's because, by registering the PIX key, or even having invoices above R$100, you can reset your annuity rate.

Therefore, the Santander SX card, even at a disadvantage, manages to turn into various offers and discount programs that benefit customers who use the Santander SX card. So do the comparisons to see if this card is for you!

What are the disadvantages of the Saraiva card?

Well, the first disadvantage of the Saraiva card is that because the card is a partner of the bank in Brazil, it becomes more bureaucratic for those who are not account holders at that bank. And in addition, the card request is not carried out at the time of shipment.

For this, the customer needs to wait until the bank decides to approve the request. Therefore, it is necessary to wait a certain period to know if it has been accepted or not. So, the Saraiva card, despite several advantages, also has its negative points.

Saraiva Card or Santander SX Card: which one to choose?

Well, the Saraiva card or Santander SX card are safe and interesting options for accessing a credit card full of advantages for its users, as well as unique and exclusive offer programs that only these cards have.

Therefore, compare the two options and see which one best suits your needs, for example, the Saraiva card gives you access to several discounts on books from the Saraiva network, as well as the Santander card brings an innovative discount program. So check it out and let us know how it went!

Access Card or Protest Card: which one to choose?

To decide between access card or protest card, know that both have an international flag and accept negatives. Check out more in our article!

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Condor Loan or Free Digital Loan: which is better?

Which one to choose between Condor loan or Free Digital loan? In today's article we will help you with this choice. Check out!

Keep Reading

How to apply for the Itaú Latam International card

Learn how to apply for this credit card that promises to bring, due to the partnership between Banco Itaú and Latam.

Keep Reading

See how to get over 1500 reais salary working with customer service

Check now how much a clerk earns, discover all the functions and skills that this professional needs to develop.

Keep ReadingYou may also like

The best card for you is Santander SX

Do you already know the Santander SX card? If not yet, check here the main information about him and explore this credit.

Keep Reading

Use Elo: learn about the benefits program made for you

Nowadays, most Brazilian credit cards are accredited by the Elo brand. In this sense, it offers several benefits to its users. Among them is the Use Elo program. Read the post and learn more about it!

Keep Reading

Discover the Bradesco Visa Infinite card

Do you know the Bradesco Visa Infinite card? He has a great rewards program. So, read on to find out more!

Keep Reading