Cards

Santander Universitário Card or CEA Card: which one to choose?

Decide between the Santander Universitário card or the CEA card and find out which one has an approved limit without proof of income, emergency withdrawals without affecting the purchase limit and lots of discounts!

Advertisement

Santander Universitário x CEA: find out which is best!

In order for you to have a useful, cheap credit card that helps with financial organization, how about choosing between the Santander Universitário card or the CEA card?

While many banks are strict in selecting their customers, Banco Santander offers more flexible proposals, such as the Santander Universitário card, which provides a pre-approved limit without credit analysis and also discounts on monthly payments.

On the other hand, the CEA card comes with a unique proposal, providing the customer with different limits, that is, having a limit for purchases in or outside the store, but also withdrawals from the card without this influencing the amount made available, which is very useful, isn't it?

In short, both are ideal for those looking to pay using credit, especially streaming services such as Netflix and Amazon Prime, but they are also accepted in thousands of establishments with discounts set for a specific audience.

In addition, learn more about these two popular cards, which are easy to approve and apply for without bureaucracy, all done online. So, see the comparison we prepared thinking about your needs.

How to apply for the Santander Universitario card

No need to prove income to get a university credit card, get discounts on monthly fees and pay nothing in fees!

How to apply for the CEA card

Discounts, benefits and interest-free installments are ideal for those who want to buy and spend little!

| Santander University Card | CEA card | |

| Minimum Income | not required | Minimum wage |

| Annuity | 12x of R$ 33.25 | Each option has an annual value, which can reach R$ 245.88 |

| Flag | Visa | Mastercard, Visa or Elo |

| Roof | International | International |

| Benefits | Pay your college tuition fees at a discount Get a pre-approved limit without any income requirement Access Santander benefits and discounts with Esfera partners Get specific extra limit for monthly payments Possibility of exemption from annuity | Always get discounts at C&A stores Pay for emergency withdrawals in up to 24 installments Have two limits, one for credit, one for withdrawal Pay bills and pay in installments without interest within your credit limit |

Santander University Card

Certainly, many students enter universities without any financial support, which makes it very difficult to cover monthly expenses such as transportation, tuition fees and other routine expenses, right?

In this way, university cards were created with young people in mind, who do not have an income and need to study, therefore, Santander's option does not require the student to have a job or be required to present documents for a credit analysis.

Furthermore, the option here also provides support for students to pay their monthly fees by offering an extra limit, as long as the college has an agreement with Santander, which means that there are also possibilities for a discount under the same rule.

Furthermore, students who pay their monthly bills correctly will also have their limit increased, the possibility of paying bills in installments over up to two years and even be exempt from annual fees, as long as a minimum amount is spent each month.

CEA card

Known for being one of the largest retail stores in Brazil, CEA is one of the stores that offers a broader credit card, with a credit brand, the possibility of purchases in other stores and even a double limit, which we will explain in more detail below.

This means that if the customer needs an emergency withdrawal, it can be done without affecting the purchase limit, purchases that are made in stores but also in other locations, on the internet or in physical establishments in other segments.

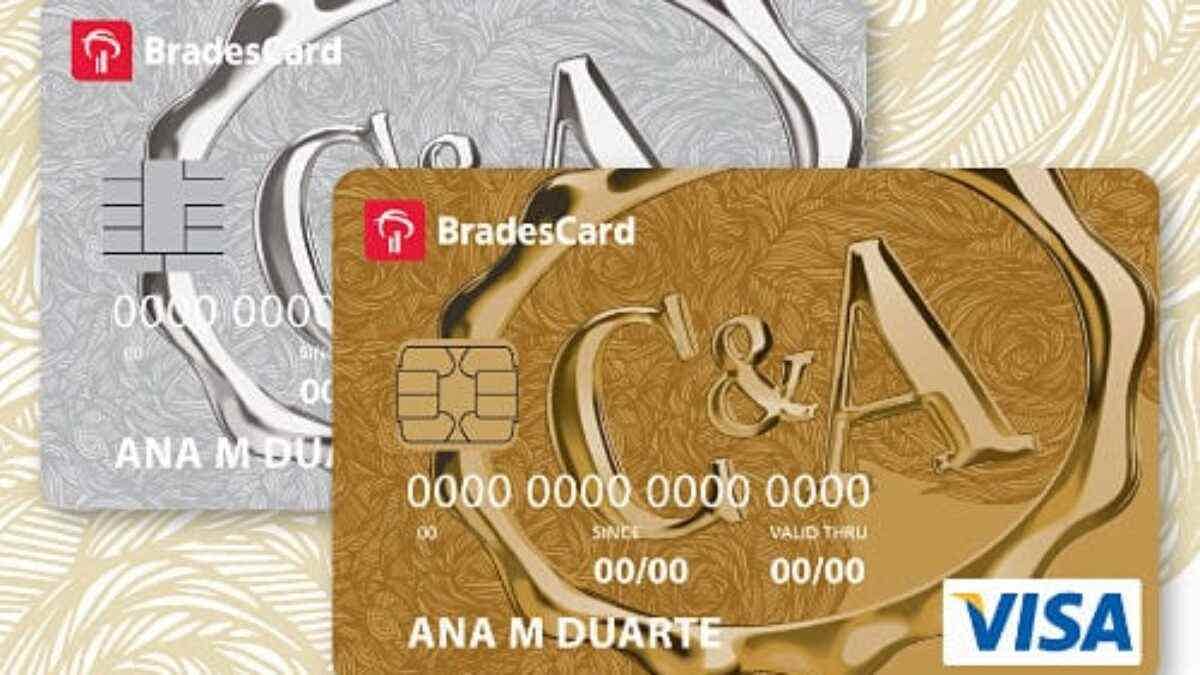

In this way, the CEA card can be useful in many cases, mainly because there are three types available from Bradescard. In contrast to other stores, the customer can choose between Visa, Mastercard or Elo.

In short, discounts reach 10% on the first purchase and interest-free installments reach 5x, and if you choose the Elo option, you will still pay only half for Cinemark tickets and you can also use free Wi-Fi anywhere that offers network availability.

What are the advantages of the Santander Universitário card?

Firstly, offering a credit limit without any proof to an audience that is usually very young is certainly useful, so see more advantages in detail below.

- Open a free account without leaving home;

- Get an extra limit to pay monthly fees and organize your finances;

- Have a weekly list of Santander partner courses and degrees that have discounts;

- Enjoy the benefits of your university account, such as a discount on fees that becomes cell phone credit;

- Plus, get even more discounts while studying for ENEM.

What are the advantages of the CEA card?

In short, the C&A card appears to be interesting because it allows the customer to use it as a normal credit card and after approval, it offers two limits that can be used without one influencing the other, for example, so check out other benefits below.

- Spend on purchases without using a parallel limit, that of withdrawals;

- Pay for withdrawals in up to 24 installments and make transactions on the Banco24H network;

- 100 days to pay for purchases and interest-free installments in up to 5x;

- Pay bills with your credit card and also access installments without fees;

- Enjoy weekly discounts in physical stores and online.

What are the disadvantages of the Santander Universitário card?

Since we are talking about the advantages, it is important to highlight the disadvantages of this university card, which has, among the main criticism, the requirement of minimum spending to avoid charging an annual fee, that is, making at least one hundred reais in purchases to get rid of the fee.

Not only that, you need to understand about the additional extra limit, which does not apply to all cases, since only students at colleges that have an agreement with Santander are approved for this specific benefit for tuition fees, for example.

What are the disadvantages of the CEA card?

Right after you are approved for the CEA card, know that you will have to pay high annual fees, which vary between R$173.00 to R$278.00, regardless of the type chosen, this is the total annual amount to be paid.

There are also fees to pay when you withdraw money from your available limit. The fee can be as high as R$12.00 per withdrawal, which can be a bit heavy on your pocket. In addition, the interest-free installment plan is short compared to other stores, meaning that when you pay in more than 5 installments, you will also incur fees.

Santander Universitário Card or CEA Card: which one to choose?

Finally, were you able to choose between the Santander Universitário card or the CEA card?

Since a credit card does not require proof of income, it has low fees and advantages for students who are experiencing financial difficulties, while the other option is focused on in-store sales and offers two credit limits.

Without a doubt, both can be useful and can be used for purchases in credit mode, regardless of which one it is, such as payments for streaming, food apps or ride-sharing, for example.

Furthermore, don't worry if you haven't found the ideal credit card yet, because while you were checking out this comparison, we prepared another one that is just as detailed with other easily accessible options on the market.

So, click below and stay with us.

Access Card or BTG+ Card

If you have a bad credit rating, choose the access card, but if you can invest, the option is the BTG+ card. Choose one of the two!

Trending Topics

Relationship apps: best options for finding love!

Find love or a new friendship with our selection of the best dating apps. Check it out now!

Keep Reading

5 credit card options with instant approval online

Discover 5 credit card options with immediate and online approval, they do not require a minimum income and do not undergo analysis by credit agencies.

Keep Reading

How much does 200,000 earn in Savings?

In today's article, we're going to tell you how much 200,000 you earn in savings and also explain how it works. Check out all the details!

Keep ReadingYou may also like

ActivoBank Card or N26 Card: which is better?

Looking for a new credit card and don't know which one to choose? Then check out the advantages and disadvantages of the ActivoBank card and the N26 card to choose your favorite.

Keep Reading

Discover the PagBank credit card

In addition to exemption from annual fees and a high limit, the PagBank card has Visa benefits. Therefore, it can be a great option for your everyday shopping. Check below all the details about this financial product.

Keep Reading

How to borrow cell phone credit

Borrowing cell phone credit can save us in some everyday situations. So, if you arrive at the end of the month with no balance on your device and need to make an emergency call, you can request advance credit to continue using your cell phone normally. Know more!

Keep Reading