Cards

Santander 1 2 3 Card or Access Card: which one is better?

Choose between the Santander 1 2 3 card or the Acesso card and find ways to buy using credit both in Brazil and abroad. Both cards are international with the Mastercard brand, but they also have different characteristics. Want to know what they are? So read this post and check it out!

Advertisement

Santander 1 2 3 x Access: discover which one to choose

Choose between the Santander 1 2 3 card or the Acesso card and buy again on credit, with a 50% discount on annuity, in addition to international purchases. Meet!

How about comparing the Santander 1 2 3 card and the Acesso card with us, understanding the Brazilian economic scenario?

Undeniably, we are living in an atypical moment, where banks and financial institutions are offering chances for negatives, mainly because of the pandemic. Unexpectedly, more than 63 million Brazilians have had their names negative since the first confirmed case of covid-19, according to Serasa.

Thinking about it, many banks are giving up denying requests to people with low scores or dirty names, for example. However, the biggest ones are still very resistant, so there are prepaid cards, which do not require proof of income and facilitate credit purchases, such as the Acesso card.

Furthermore, there are also increasingly exclusive credit cards for those who have never been near the SPC/Serasa, among them the Santander 1 2 3 card, which requires a high minimum income, but in return has many benefits for customers, including them, the tripling of accumulated points.

Let's compare!

How to apply for the Santander card 1 2 3

This Banco Santander card is made for those who want to accumulate points, as it offers the possibility of tripling points through international purchases!

How to apply for the Access card

The Acesso prepaid card does not require proof of income or clean name, as well as it has few fees and more chances of buying online and subscribing to services!

| Santander Card 1 2 3 | Access Card | |

| Minimum Income | R$4 thousand, but Santander Van Gogh or Select customers are also entitled | not required |

| Annuity | 12x R$ 35.50 (with possibility of discount up to 50%) | 12x of R$ 5.95 (whenever there is a recharge) |

| Flag | MasterCard | MasterCard |

| Roof | national or international | National and international |

| Benefits | Mastercard brand benefits | Low price annuity, as well as other fees |

Santander Card 1 2 3

Undoubtedly, Banco Santander cards have different types for each income profile and, now, discover the Santander 1 2 3 card, created for high incomes, but accessible with benefits that were previously given to older profiles in the bank and with high incomes. much larger than those mentioned.

Just to exemplify, those with income from R$4,000.00 can apply for the card, paying a monthly annuity of R$35.50. In addition, it is possible to triple the earning of points with a dollar spent on international purchases, however, every dollar spent has one point.

Furthermore, this is a credit card with several possibilities, with up to five free additional cards and discounts of up to 50% on the annuity when there are monthly expenses of up to a thousand reais of the credit limit, which makes this value low and even more accessible.

Finally, Santander 1 2 3 card customers still have an application to carry out their day-to-day transactions, with the participation of Mastercard brand advantages programs and extended insurance for any purchase made with the credit limit, therefore, if you have clean name and compatible income, the decision between the Santander 1 2 3 card and the Acesso card becomes easier.

Access Card

Even if your name is negative, you can enjoy the benefits of the credit modality through prepaid cards, which offer the possibility of subscribing to services such as Netflix, Spotify, Amazon Prime and even ride-hailing and food apps.

Above all, the Acesso card is ideal for those who need to pay by credit and don't have many commitments related to the bank, for example. This is because there is no need to open a bank account, just acquire the card, activate it and move its functions in the Access application.

Furthermore, it is a prepaid card that can work as a financial planning tool, as you can spend it based on the recharge amount and you will never be charged for invoices, fees or installments to be paid, as you can leave it just like the streaming subscriptions card, for example.

Finally, it's like having a credit card without the option to pay in installments, but which serves in different ways, such as payments in online stores and in other countries, for example. Thus, it is much more peaceful to take advantage of promotions and offers! So, if you are negative and you are thinking of deciding between the Santander 123 card and the Acesso card, this will be the choice.

What are the advantages of the Santander 1 2 3 card?

Therefore, you can have a credit card that offers good limits and does not abuse fees, and in the long run, you can get a good amount of points and exchange them for numerous products. In addition, see other advantages of the Santander 1 2 3 card below.

- Triple points when you shop internationally;

- Get a lower annuity by spending the minimum amount;

- Participation in Mastercard programs;

- Purchase, extended, and all-use insurance;

- Possibility of not paying annuity.

What are the advantages of the Access card?

In addition to offering a credit card without opening an account, the Acesso card does not lock the customer into using it, for example, as it charges fees only when there are top-ups. So, see other advantages below.

- Request with negative name in the SPC/Serasa;

- No debts, as it is only used when there are recharges;

- Internet transactions with exclusive application;

- Pay fees only when used;

- Participate in the Mastercard Surprise program.

What are the disadvantages of the Santander 1 2 3 card?

Although the advantages are attractive, some restrictions place the Santander 1 2 3 card on a distant level for some people, since it requires the customer to have a minimum income of R$4,000.00.

In addition, it has a high annuity for some financial levels, which is only lower when there are expenses above a thousand reais per month. Therefore, it is not indicated for those who are in default.

Finally, although it is useful for accumulating points, it stops accumulating when the total reaches 500 points, which takes away the customer's interest in continuing to buy to exchange points, for example.

What are the disadvantages of the Access card?

Firstly, there is no way to pay for purchases with prepaid cards in installments, which we can consider as a disadvantage for those who need a credit card, for example.

In addition, the Access card fees, if added together, can generate a high value. Just to exemplify, if monthly recharges are made, the payment of R$ 5.95 must be made as a monthly maintenance fee.

Finally, be aware that to activate the card, you must recharge R$ 100.00 before starting to use it. Furthermore, if you prefer not to recharge this amount, you will still pay R$14.90 to issue the Access card, which can be complicated for some people.

Santander 1 2 3 Card or Access Card: which one to choose?

So, between the Santander 1 2 3 card and the Acesso card, which one did you choose? Although they are credit cards for different profiles, they offer the Mastercard brand and are ideal for those with a good monthly income.

Furthermore, they are good indications for those looking for credit to pay monthly subscriptions and especially to shop online.

While the Santander 1 2 3 card requires a credit analysis and a minimum income, the Acesso card is for negatives who cannot prove income.

So check out all the details calmly and write down each information to decide safely and peacefully.

Finally, if the doubt still exists, don't worry. Next, our team prepared another interesting comparison for your case that can help you choose the best credit card today!

Impact Bank card or Blubank card

With two negative credit cards, the two companies offer options with low rates and even chances to get recharges through loans. Know more!

Trending Topics

1001 Questions: check out how to participate in this program

Find out in this post how the dynamics of the 1001 Questions program works, which is presented by Zeca Camargo on Band every Friday!

Keep Reading

Will Bank card or Caixa Mulher card: which is better?

Will Bank Card or Caixa Mulher Card? What's the best option for you? Both are international and free of annual fees. Check out!

Keep Reading

See how to register for free to resell Natura

Understand how to be a Natura reseller, see all the requirements you need to meet and the entire procedure to become one.

Keep ReadingYou may also like

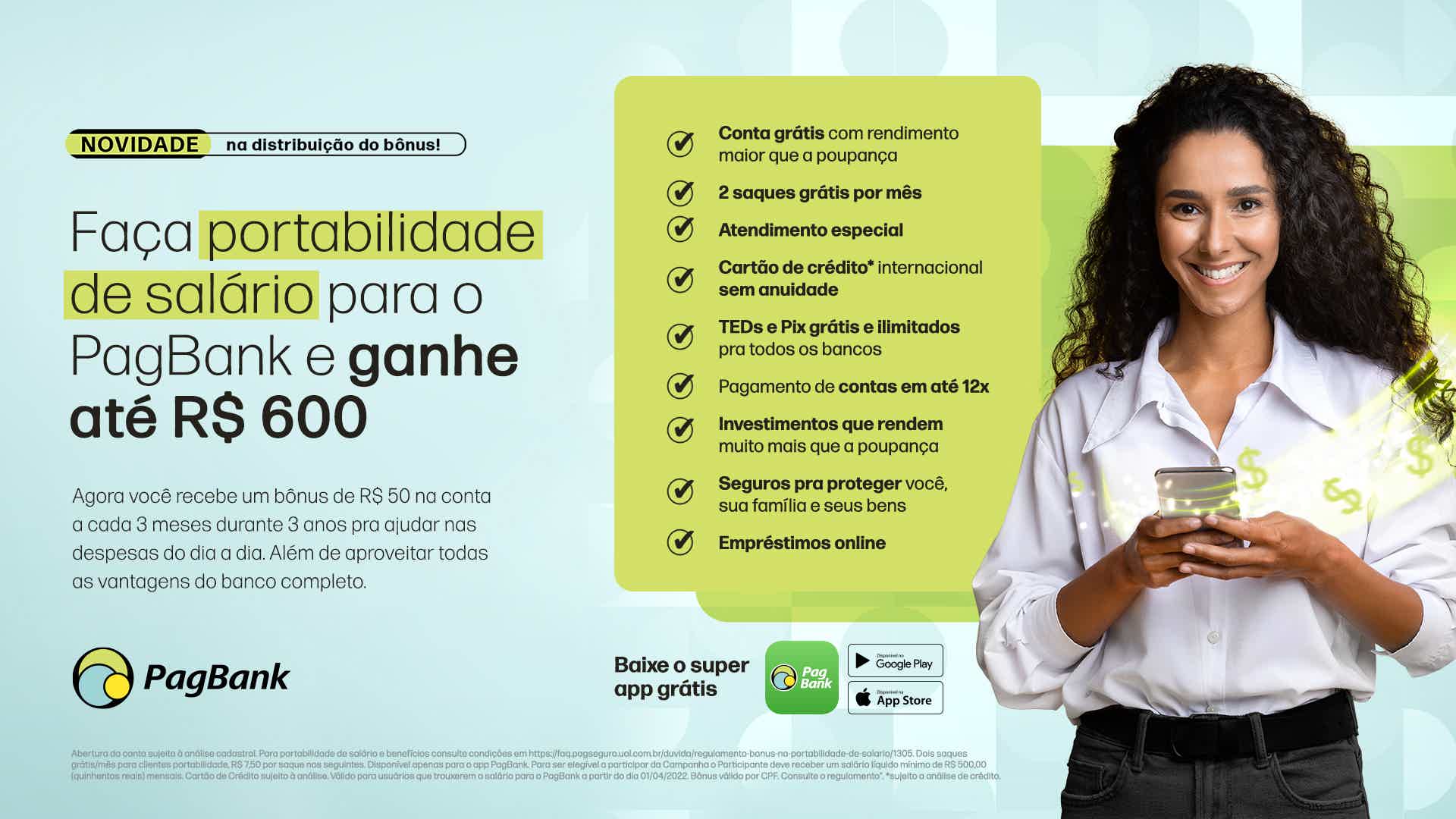

How does the PagBank salary portability bonus work?

Have you ever thought about enjoying the countless benefits that PagBank offers you and also guaranteeing up to R$ 600.00 bonus? So, check out this post and learn more about PagBank salary portability.

Keep Reading

See how to request a duplicate Nubank card in a simple and quick way

Thanks to the technology of digital banks, requesting a duplicate card is no longer a long and bureaucratic process. See right now how to request the issuance of a new Nubank credit card through the app.

Keep Reading

Credit Guarantee Fund: what it is and how it works

Find out everything you need about the FGC, an entity that protects your investments and guarantees the return of your money in case of problems.

Keep Reading