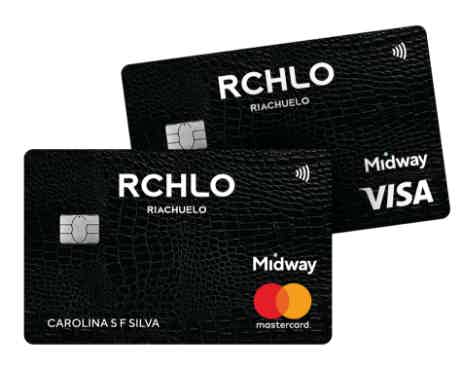

Cards

Riachuelo card, interest-free installments up to 10 installments

Are you a loyal Riachuelo customer and are considering taking out your card? In today's article we will show you the details of this product. Continue reading!

Advertisement

Discover the Riachuelo card with interest-free installments!

If you buy a lot in a store, you've probably already considered getting a chain card. This is because these cards usually have exclusive benefits. Therefore, the Riachuelo card is no different! In today's article, you will learn more about the Riachuelo card with interest-free installments. In this sense, it has three different options and installments in up to 10 interest-free installments. Continue reading and find out more!

| Annuity | Free with store card |

| minimum income | not informed |

| Flag | No flag on store card Visa or Mastercard in other modalities |

| Roof | National |

| Benefits | Payment in up to 10 interest-free installments |

Riachuelo Card: complete analysis

First of all, let's make it clear that the Riachuelo card is offered in different ways. Therefore, the first option is the store card, which is only accepted in the Riachuelo chain. In this sense, this card offers exclusive benefits for negotiating installments and personal credit. In addition, the store also offers a card with the Visa or Mastercard brands. In other words, this card is accepted in several establishments. However, this modality has an annual fee of R$96.00. While the other option is free of annual fees.

Therefore, in this article we will carry out a complete analysis of this card. Keep reading and see if it’s worth it for you!

What is the Riachuelo credit card limit?

In principle, the Riachuelo card limit is decided upon signing up. However, this may vary according to each client's income. Furthermore, depending on the use of the card, this limit can increase significantly. Therefore, the increase depends on timely payment, installments and also the value of purchases.

Advantages of the card

One of the main advantages of the Riachuelo card is its interest-free installments. Therefore, you can make your purchases in the store network and still have exclusive conditions. In this sense, when we talk about the two card types, they both have some benefits in common. For example, in both cases you can control your card spending directly through the app.

Furthermore, it is possible to make purchases at any Riachuelo store nationwide. Furthermore, the card has contactless technology. This way, you make your purchases more quickly and pay only by contact. Furthermore, you can also have discounts on selected products at Riachuelo stores.

Disadvantages of the card

Although the Riachuelo card is a good option for store customers, it also has some disadvantages. For example, only being accepted on national territory can be a negative point. Furthermore, if you choose a card with a Visa or Mastercard brand, you must pay an annual fee of R$96.00. Furthermore, if you are looking for a card with a points program, this is not the case either.

Riachuelo card invoice: how to check

In short, to check your Riachuelo card invoices, simply access the application. In other words, download the Riachuelo card application or the Midway company. This way, you can consult and also pay the invoice.

Riachuelo Card telephone: Customer Service Center number

If you have any questions regarding the card, or want to register a complaint, Riachuelo provides a call center. See the numbers:

- For capitals and metropolitan regions: 3004 5417

- For other locations: 0800 727 4417

- SAC (24 hours and 7 days a week): 0800 721 3344

- SAC Hearing Impaired (24 hours and 7 days a week): 0800 722 0626

Make a Riachuelo card: how to make the card online?

If you want to apply for the Riachuelo card, it can be very simple. However, there is still no possibility of purchasing the store card online. Therefore, you must go to a store in person. But to purchase branded cards, you can purchase directly through the app.

How to apply for your Riachuelo credit card

Request your Riachuelo card now with interest-free installments!

Riachuelo Card: how to get approved?

In short, Riachuelo stores do not carry out credit analysis. Therefore, even those with a low score can apply for the card. However, the company asks for some prerequisites. For example, being over 18 years old, having proof of residence and original documents. In this sense, if these prerequisites are met, the card is automatically approved.

Cash back and points program

Unfortunately, the store's Riachuelo card does not offer any points program. In this sense, to have access to some form of scoring, you need to purchase branded cards. In other words, with the Mastercard or Visa brand. This is because these cards entitle you to the Vai de Visa or Mastercard Surpreenda programs

Therefore, with these programs you receive one point for each purchase made. This way, points can be exchanged for discounts at partner stores.

CEA Card: another credit card option with no annual fee for you

Finally, now you know more about the Riachuelo card with interest-free installments. This way, you can also decide between the two card types. This is because the Riachuelo card offers an option with Visa or Mastercard. However, if you still want to know another option, we will show you the CEA card. With it, you can make your purchases at CEA stores and also have exclusive conditions. See the comparison below:

| CEA card | Riachuelo Card | |

| Annuity | Required | Free with store card |

| minimum income | Minimum wage | not informed |

| Flag | Visa | No brand on store cardVisa or Mastercard in other modalities |

| Roof | national or international | National |

| Benefits | International CardDiscount at Cinemark | Payment in up to 10 interest-free installments |

Therefore, the Riachuelo card could be a good option. Mainly due to the fact that it has easy credit approval. But, to find out about this other card option with no annual fee, click the button below.

How to apply for the C&A Bradescard card

Discover a card option with no annual fee, with exclusive benefits and easy approval.

About the author / Leticia Maia

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Discover the Egoncred online loan

Get to know the Egoncred online loan and see if this loan is what you need right now! Ah, he is ideal for negatives! Check out!

Keep Reading

Discover all Bradesco cards

After all, do you know all Bradesco cards? Be it Elo, Visa or American Express, Bradesco has the ideal card according to your profile.

Keep Reading

How to apply for the Digio loan

Learn how to apply for a Digio loan online and other useful information about this loan, so you can get out of the red!

Keep ReadingYou may also like

How to apply for the Méliuz loan

Méliuz is a platform known for offering discounts and cashback on purchases made on it. But did you know that it also offers a loan? If not yet, find out here how to get your Méliuz loan.

Keep Reading

How to avoid being taxed on Shein: tips for buying without fear

Discover the secrets to shopping at Shein and not being taxed! Save money and rock your style with our infallible tips! If you have already been taxed, then discover the secrets to receiving a refund now.

Keep Reading

Which cryptocurrencies grew the most in March?

The cryptocurrency market, despite being profitable, still suffers from constant volatility. Check out which currencies appreciated the most in March, even with the high dollar, and keep an eye on what to invest this month!

Keep Reading