Cards

Riachuelo Card or CEA Card: which one to choose?

Between the Riachuelo card or the CEA card, do you know which is the best option? Well, today we're going to show you the pros and cons of these cards! Check it out!

Advertisement

Riachuelo x CEA: find out which one to choose

Initially, Riachuelo or CEA are part of the group of large clothing stores in Brazil. This is because they have quality products such as clothes, watches, shoes, mobile devices, among others, and thus the demand for these stores is high!

Well, stores also have a shopping card to make shopping more practical, as well as when shopping at partner establishments that accept Visa and Mastercard, making this moment more interesting!

So, the Riachuelo card or CEA card are credit card options for customers who want comfort and security when making their purchases! Therefore, below we will show some features of both cards. Check it out:

How to apply for your Riachuelo credit card

Discover in this article some features of the Riachuelo card and how to request it step by step in a simple way and 100% online.

How to apply for the Renner credit card

Learn how to apply for the Renner card step by step and without complications, the process can be 100% online.

| creek | CEA | |

| Minimum Income | R$1,045 reais | Minimum wage |

| Annuity | Exempt or R$87.00 reais | R$ 221.88 |

| Roof | National | International |

| Flag | Visa or Mastercard | VISA |

| Benefits | Exclusive discounts and promotions at Riachuelo stores Mastercard Surprise | Discount on first purchase differentiated installment plan Theft insurance and assistance Direct withdrawal at C&A stores and the 24-hour Bank network |

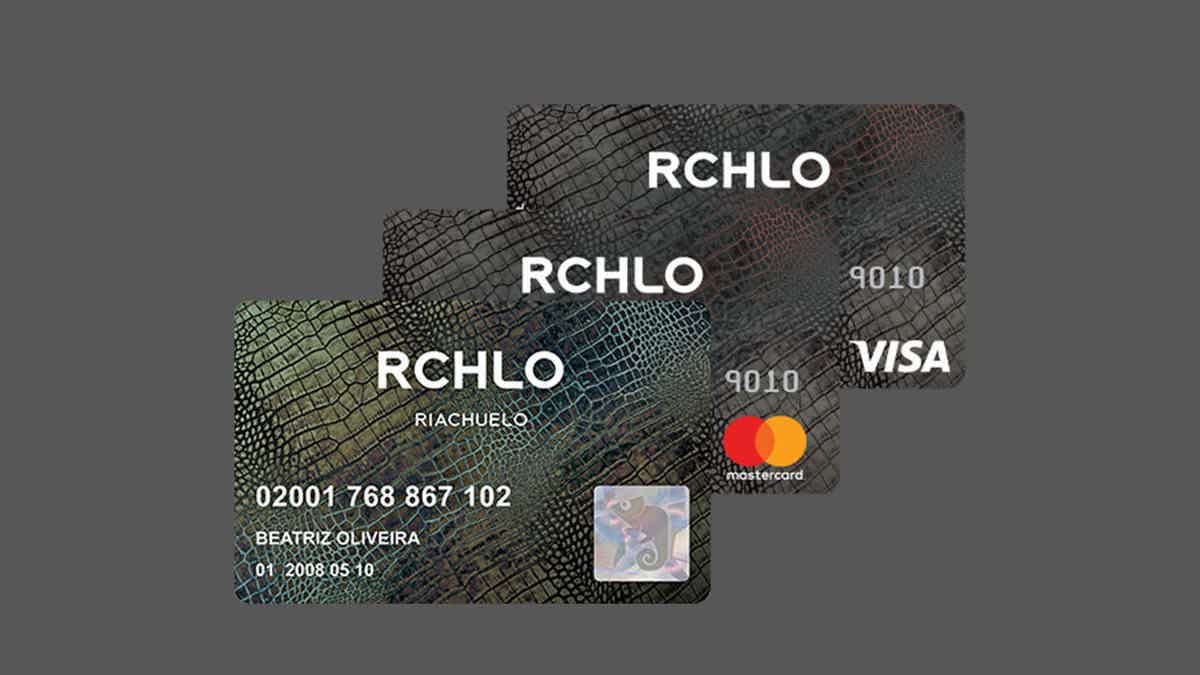

Riachuelo Card

So, the Riachuelo card is ideal for consumers who like to shop at the chain's stores. This is because, with the card, you can make purchases, apply for personal credit, make agreements and installments and even set up automatic debit for bills!

And what's more, with the Private Label card, you don't pay an annual fee to keep using the card and you still get your first purchase with around 10% discount! Awesome, right?

So, let's learn a little more about this card that gives you the right to buy watches, cell phones, clothes, shoes and much more!

CEA card

Well, the CEA card was created to be used by customers who frequently shop at the chain's stores and want to have discounts and exclusive offers when making purchases!

So, the card also helps when managing payments and having credit in the market through a super intuitive application, as it has the Visa flag and international coverage, that is, you can make purchases in establishments in Brazil and around the world and still have access to the Vai de Visa program!

What are the advantages of the Riachuelo card?

So, among the advantages of the Riachuelo card, the first one is the fact that it has two brands, Visa or Mastercard, that is, you choose the brand that is best for you!

And on top of that, you can also have access to 3 additional credit cards for whoever you want, and you can pay for your purchase in up to 5 interest-free installments or 8 interest-bearing installments!

Another advantage is that you can apply for personal credit through Midway Financial and pay the bill in 70 days without interest! Therefore, it is a card with exclusive advantages and that also gives you insurance options to protect your card!

What are the advantages of the CEA card?

Well, one of the first advantages of the CEA card concerns the card limit, which is two, one for withdrawals and the other for purchases, bringing more flexibility and practicality to customers.

And in addition, you can also pay bills with the card in up to 3 interest-free installments and you can also participate in the Abuse das Recompensas program and have access to additional cards and cash withdrawals at CEA stores, Rede Banco 24 Horas or call centers in up to 15 fixed installments!

Another advantage is that you have a secure card, with a chip and a modern design to make purchases at any CEA store in Brazil and abroad with up to 40 days to pay in up to 5 interest-free installments or 8 installments with fixed interest and up to 100 days to start paying!

Therefore, the CEA card has several very interesting proposals for customers, you just have to choose the one you think is best!

What are the disadvantages of the Riachuelo card?

Among the disadvantages, the biggest one is the fact that the card can only be requested in person, that is, you need to go to one of the Riachuelo stores to request the card!

And in addition, it has high cost rates compared to other cards on the market, with interest rates reaching up to 376,74% per year, as well as an annual fee of R$87.00!

Therefore, before opting for this card, analyze the pros and cons to find out if it is a good option for you!

What are the disadvantages of the CEA card?

So, one of the big disadvantages of the CEA card is the fact that it cannot be requested online.

This is because you need to go in person to a physical CEA store to apply for the credit card, which can be a hindrance since most credit cards can currently be requested online in a digital 100% process!

Riachuelo Card or CEA Card: which one to choose?

Well, the Riachuelo card or CEA card are safe and interesting card options with discounts and exclusive offers!

So, compare the two options and see which one best suits what you want! Then, try out the cards and let us know how it went!

But if you want, how about checking out another interesting comparison between cards below? Just click and continue reading!

Americanas Card or Magalu Card?

Learn a little more about the Lojas Americanas and Magazine Luiza cards, ideal for making purchases in a safe and practical way! Check out!

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How do you consult Vale Gas by CPF?

Find out how to consult Vale Gás through the CPF, see the benefit amounts, payment dates and if you are entitled to assistance, check it out!

Keep Reading

If you can, avoid: find out which are the 15 most dangerous cities in the world

Among the most dangerous cities in the world, there are only two outside Latin America: the United States and South Africa. To learn more, read the text.

Keep Reading

How to apply for the Bradesco Elo Mais card

Learn here how to apply for the Bradesco Elo Mais card. It's easy, fast and without bureaucracy, that is, it's a card full of advantages for you. Check out!

Keep ReadingYou may also like

How to apply for the Nubank card?

Apply now for your Nubank credit card. Follow the steps and choose one of the ways below to request your Roxinho.

Keep Reading

Discover the current account CGD Conta Azul

Want an account that gives you access to cards, transfers, term deposits, insurance and more? If so, take the opportunity to get to know the CGD Azul current account, ideal for those who want to start thinking about the future and have more security. Learn more in the post below.

Keep Reading

7 advantages of Carrefour that you need to know

Discover 7 advantages of the Carrefour group credit card that you need to know about right now.

Keep Reading