Cards

Renner card or Polishop card: which one to choose?

Renner Card or Polishop Card: find out everything about these two cards with exclusive discounts on purchases in physical and online stores. This way, it's easier to choose which one is the best option for you.

Advertisement

Renner x Polishop: find out which one to choose

First of all, the Renner card or Polishop card are shopping cards with exclusive offers for customers who are part of the group of the largest stores in Brazil, Renner and Polishop. And so, it is worth checking out the advantages and disadvantages of these cards.

Well, stores have a card that brings more practicality, convenience, security and discounts to users. So, the Renner card or Polishop card are card options that are worth checking out. Keep reading and find out more!

How to apply for the Renner credit card

Learn how to apply for a Renner card without complications, as the process can be done online.

| Renner | Polishop | |

| Minimum Income | R$ 800.00 | R$ 800.00 |

| Annuity | 12x of R$ 11.90 | 12x of R$ 15.00 |

| Flag | Mastercard/Visa | MasterCard |

| Roof | International | International |

| Benefits | Discounts and exclusive conditions at Renner stores You can choose the payment date and invoice Annual fee waived if you only buy from Renner stores | Mastercard Surprise Program Up to 40 days to pay without interest |

Renner Card

So, the Meu Cartão Renner credit card is a product of Realize Soluções financeiras, a financial institution for credit, financing and investment of Lojas Renner SA

Thus, it provides several advantages in Renner stores and other partner stores, such as international coverage and payment in up to three different ways.

And, in addition, the card has an annual fee of R$11.90 per month, which is charged when the customer uses it to make purchases outside Renner stores!.

In other words, if you only shop at Renner stores, you won't be charged anything. Awesome, right?

Polishop card

Well, Polishop is a highly successful retail chain founded in 1999, which operates online and in physical stores.

One of its main characteristics is the wide variety of practical and creative products that have helped the chain expand over the years, appearing in TV commercials on open and closed networks throughout Brazil.

Soon, it found itself facing digital channels and created its own TV channel. Thus, aiming to improve customer relationships and loyalty, the company launched the Polishop card in 2019.

So, the Polishop card, also known as Experience Card Polishop Itaucard, was created through the partnership between Polishop and Itaú Unibanco and you can use it in more than 250 stores in the Polishop chain spread throughout Brazil.

And the card is Mastercard and the limit will depend on the credit analysis.

What are the advantages of the Renner card?

So, the Renner card offers several advantages, such as the fact that it is an international card, meaning you can make purchases in national and international stores.

Furthermore, you can choose a payment amount between the minimum and the total amount of the invoice, and the limit increases depending on usage and on-time payment of invoices.

Another great advantage is that you get discounts and exclusive payment conditions within Renner stores and you can also use the card in online stores, without having to leave the comfort of your home.

In addition, you gain more flexibility when choosing how to pay, whether by installment or invoice, and the due date.

To top it off, you get free shipping on purchases on the Renner website, as well as four additional cards for the whole family.

What are the advantages of the Polishop card?

The Polishop card has several advantages to bring more convenience, security and loyalty to customers who like to shop at the Polishop network.

And, in addition, the first major benefit is the Polishop Points Program. This is because with it, 5% of purchases are converted into polypoints. One point is equivalent to 1 real and purchases in this system guarantee up to 30% of the value in the next purchase at Polishop.

Another advantage is that the customer who has the card also has up to 40 days to pay the bill without interest, but this will depend on the closing date.

Furthermore, the card allows purchases at several other establishments and withdrawals are an active feature, available at Banco24Horas. And you can request up to four additional cards.

To top off all the benefits, the card features Web Experience, which is an exclusive access platform for customers with several flash offers.

What are the disadvantages of the Renner card?

So, despite having several advantages, Renner also has some disadvantages. For example, if you need to withdraw money with your card, you will be charged a fee.

Furthermore, Renner also charges an annual fee to access the card and, if you need a new card, you will need to pay another fee.

What are the disadvantages of the Polishop card?

Well, one of the biggest disadvantages of the Polishop card is the fact that there is a limit on purchases in the store network.

This is because there are several stores on the market with no annual fees and unlimited limits, so you will not be able to make several impulse purchases or even thought-out purchases on the platform, and you should check in advance what the limit would be for you.

In addition, Banco Itaú Unibanco also performs a credit analysis of the customer to then approve or reject the card application.

Renner Card or Polishop Card: which one to choose?

The Renner card or Polishop card are interesting options for making purchases and having access to discounts and exclusive offers in stores such as Renner and Polishop. Therefore, compare the two options to see which one is best for you.

But, if you want to study other card options, read our recommended content.

Submarino Card or Shoptime Card: which is better?

Submarino Card or Shoptime Card: do you know which one is the best option for a financial credit product? Check it out here!

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

PicPay Card Review 2021

See the PicPay card review we brought you that talks about the international card with cashback, app and no annual fee.

Keep Reading

PagBank card or Nubank card: which one is better?

If you are looking for international coverage, annuity exemption and proof of income, get to know the PagBank card or Nubank card.

Keep Reading

Get to know the Brazil Aid benefit

The Auxílio Brasil benefit is the new aid that will replace the Bolsa Família. In this article we will show you all the details. Check out!

Keep ReadingYou may also like

How to advance FGTS through Banco Inter? look here

If you need quick cash, want to pay fewer fees and not compromise your monthly budget, anticipating FGTS through Banco Inter can be a good option. Throughout the article, check out more about this modality and its main advantages.

Keep Reading

Consortium or Financing: which is better for you

Consortium or Financing? This can be a doubt for many people when they want to acquire a good or service. Read and clear your doubts!

Keep Reading

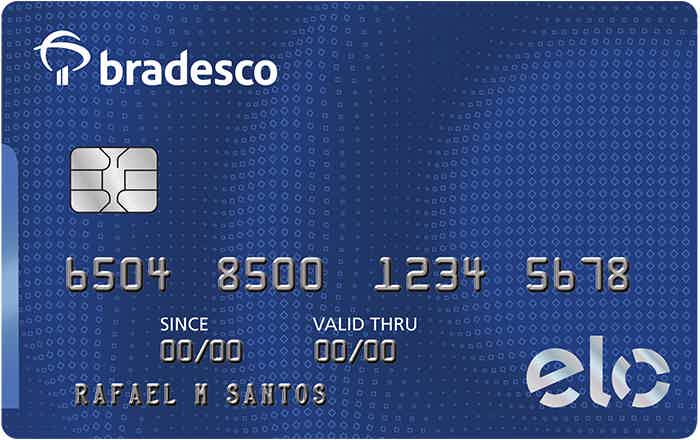

Get to know the Bradesco Elo Internacional Basic card

Do you know the Bradesco Elo Internacional Basic card? He can help you with everyday shopping. Continue reading and find out more!

Keep Reading