Cards

Renner Card or CEA Card: which is better?

Between Renner card or CEA card, do you know which is the best option? Check out the advantages and disadvantages of each one and choose yours!

Advertisement

Renner or CEA, discover the best card option for you

Are you in doubt between the card Renner or CEA card? Both stores have a credit card that offers their customers more convenience and security when shopping! But don't know which one to choose? To help, check out some characteristics of the two cards below, so you can choose the one that best suits your goals. Let's go?

| Renner | CEA | |

| Minimum Income | is not required | Minimum wage |

| Annuity | 12X of R$11.90 (exempt in months when purchases were made only at Renner stores) | 12x of R$ 18.49 (exempt in months when purchases were made only at CEA stores) |

| Roof | International | International |

| Flag | Mastercard or Visa | Visa |

| Benefits | Mastercard Surprise, Visa Voucher, Discount Club, Table of Benefits, etc. | Discount on first purchaseInsurance and assistance against theftDirect withdrawal at C&A stores and the 24-hour Bank network |

How to apply for the Renner credit card

Learn how to apply for the Renner card step by step and without complications, the process can be 100% online.

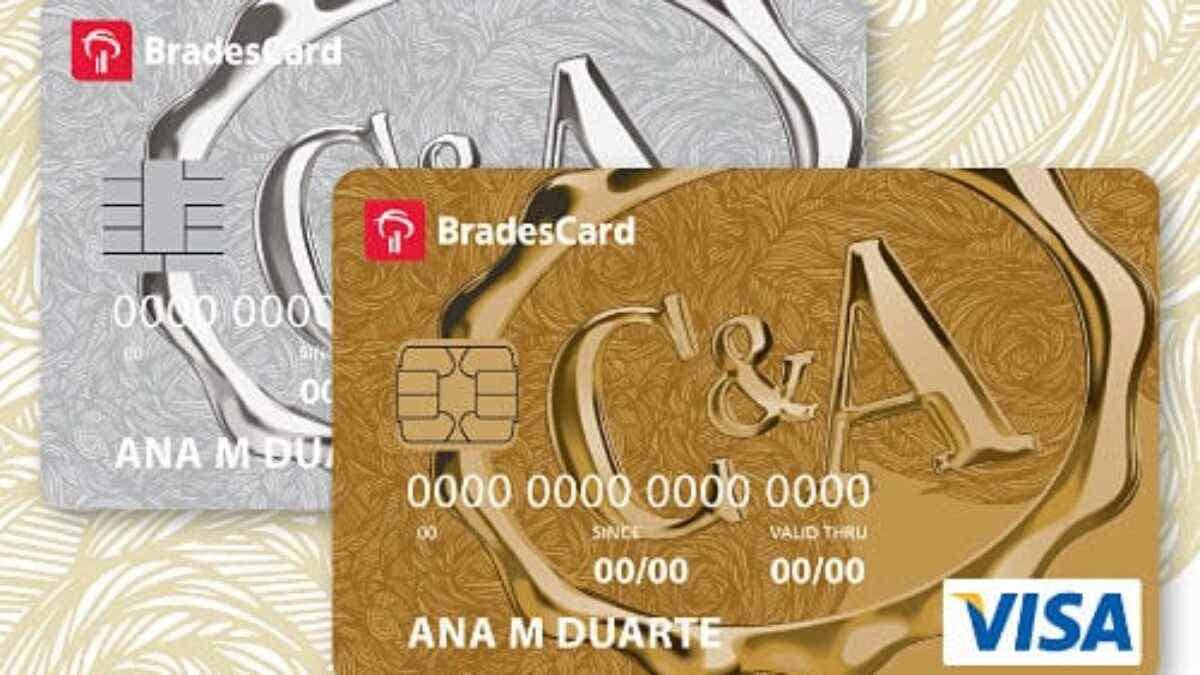

How to apply for the CEA Bradescard card

The CEA Bradescard card allows customers to make purchases with exclusive benefits at any store in the chain.

Discover the Renner card

The Renner credit card has two brands: Visa and Mastercard with international coverage, which give you access to almost all stores and establishments in Brazil and the world. In addition, it has an advantage club that offers a 50% discount at Renner partner stores and several other discounts.

What are the advantages?

- No proof of minimum income required;

- In the Lojas Renner app, you can generate payment slips, check the available limit, check your payment history or access your digital card;

- Protection Insurance;

- Access to the Mastercard Surpreenda or Vai de Visa program, depending on the chosen card;

- Multiple purchase installment options.

What are the downsides?

The main disadvantage of the Renner card is that there is no need to prove a minimum income, which can make it difficult to approve the card.

Discover the CEA card

The CEA card has a Visa flag with international coverage, so the customer has access to the Vai de Visa!

What are the advantages?

- Up to 40 days to pay;

- At CEA stores, purchases can be paid in up to 5 installments without interest or 8 installments with fixed interest and up to 100 days to start paying;

- When paying bills with the CEA card in up to 3 interest-free installments, you can still participate in the Abuse of Rewards program.

- Additional cards;

- Cash withdrawal at CEA stores, Rede Banco 24 Horas or call center in up to 15 fixed installments.

What are the downsides?

The main disadvantage is that to apply for the card it is necessary to go to a physical store in the network in person.

Renner card or CEA card: which one to choose?

The Renner or CEA card are safe and interesting card options with exclusive discounts and offers! So, compare the two options and see which one best suits what you want. But if you are still in doubt, check out two other card options: Americanas card or Magalu card.

Americanas Card or Magalu Card?

Learn a little more about the Lojas Americanas and Magazine Luiza cards, ideal for making purchases in a safe and practical way! Check out!

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

PagBank card or Caixa Mulher card: which one to choose?

If you are looking for a financial product, how about getting to know the PagBank card or Caixa Mulher card? Read this post and check out all about them.

Keep Reading

Impact Bank Card or Superdigital Card: which one to choose?

Either the Impact Bank Card or the Superdigital Card, both have international coverage and the Mastercard brand. Check it out here and choose yours!

Keep Reading

How to apply for the Piki loan

See here how the Piki loan application process works and be able to borrow up to R$2,500.00, which will be credited to your account in 1 business day!

Keep ReadingYou may also like

Financial education for children: 5 tips for parents

Did you know that you can start teaching your children about financial education from an early age? That's right! After all, as soon as she learns to count, she can already begin to understand how money works. Want to know more and check out tips that help a lot? Then read the post below.

Keep Reading

5 brokerages for small investors

With brokerages for small investors, you can enjoy lower rates and easier conditions for your financial life. Continue reading and find out which brokers make up our list.

Keep Reading

How to earn extra income online?

If you're looking for a way to earn extra income online and don't know where to start, we've brought you 10 amazing options! With little or no investment, you can increase your income and you can start 2022 with money in your pocket! Want to know more? Check it out here!

Keep Reading