Cards

Pan Card or Agibank Card: which one to choose?

To decide between the Pan card or the Agibank card, know that both have exclusive offers for Mastercard customers! Check out!

Advertisement

Pan x Agibank: which is better for your purchases?

At first, the Pan card or Agibank card are easily accessible credit card options, applications to control expenses, with no annual fee, exclusive offers from Mastercard Surpreenda and several other services that value, above all, quality!

So, let's show you a little more about Pan and Agibank cards that have programs such as approximation payment and different card models for you to choose the best option! Check out!

How to apply for your Banco Pan credit card

Find out now the step-by-step process for applying for your Pan bank card, everything can be done 100% via the internet.

How to apply for the Agibank Mastercard card

Find out how to apply for the Agibank bank credit card, the digital inclusion card.

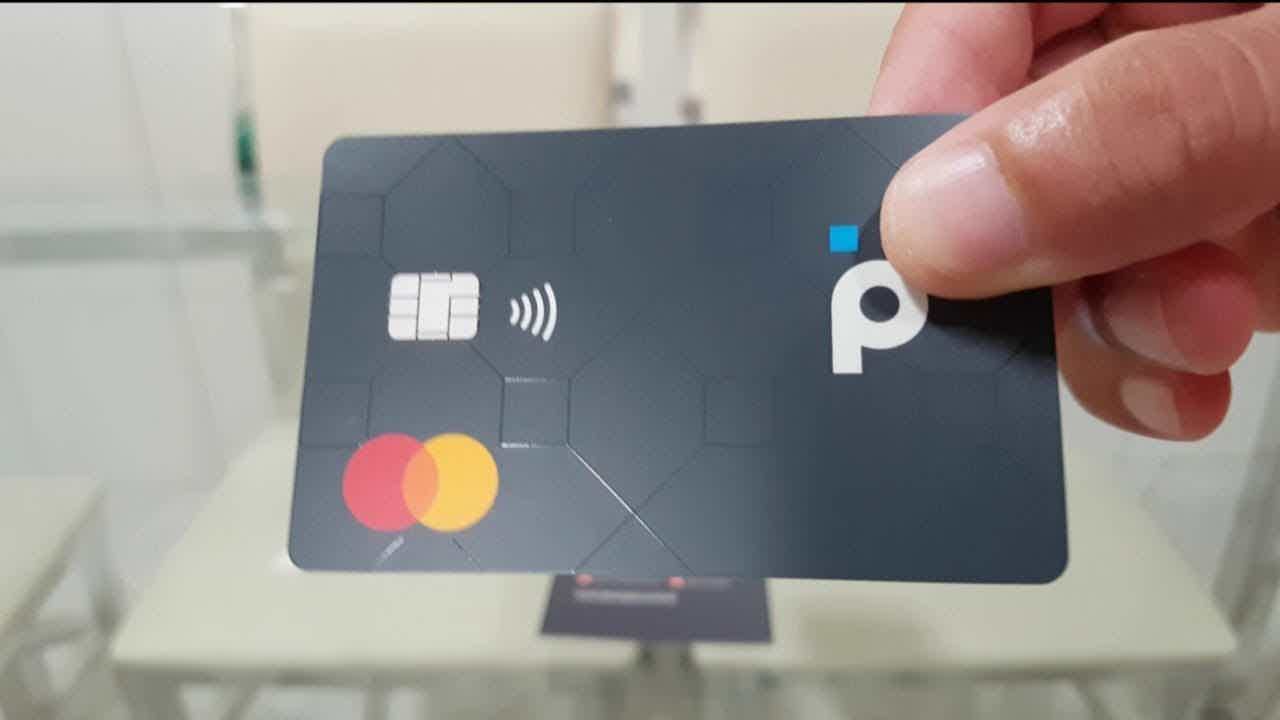

pan card

Since February 2020, Banco Pan has been consolidating its market presence with its newest credit card and digital account. Your account offers a package of benefits ranging from offering cards with Visa or Mastercard flags without fees, to international coverage.

And despite being an easily accessible card, simply applying over the internet through Banco Pan's official website, it is not a good option for people with name restrictions or low credit scores, as Pan's credit analysis is known to be time consuming and rigid.

Banco Pan has an application on its digital account, available for Android and iOS, with various functions such as loans and requests for an emergency limit increase, as well as bill payments and financial transfers.

Therefore, the Pan card is a card that brings security, transparency and comfort to users, as well as the contactless technology (approximation payment) that has become a great ally when it comes to valuing the safety of users.

Agibank card

Well, the Agibank credit card is a card that belongs to the Agibank bank, created through requests from the bank's own customers, has a debit and credit function and international coverage, that is, it can be used for purchases in Brazil and abroad .

Another function of this card is that it can only be used by people who have an account at Agibank. That is, it is necessary to create an account at Agibank, to then proceed with the card application. There are several advantages such as annuity exemption in the first year of using the Agibank card.

Applying for an Agibank card is very simple. Just download the Agibank app, available for Android and iOS, click on “create account” and fill in all your personal data. After that, just proceed and apply for the card.

What are the advantages of the Pan card?

So, let's get to know the advantages of the Pan bank credit card: At first, the first advantage is that the card is linked to a free digital account, free of charge or with very low costs.

Furthermore, the credit limit available on the Pan card may vary depending on your personal profile. Another advantage is that the card has two flags, that is, you choose whether you want the Visa or Mastercard flag. Also, it allows you to make up to 30 transactions per month.

Finally, there is also the contactless technology, approximation payment, which makes the Pan card safer for you to make your purchases. Therefore, the Pan card brings security, comfort and optimization when shopping!

What are the advantages of the Agibank card?

Well, among the advantages of the Agibank card we have:

- Payment with QR code

- And in addition, you can also receive salary through the checking account

- Withdrawals at Banco24Horas

- Direct payment to people

- secure digital account

- Pay slips and many other benefits

Therefore, the Agibank card has several functions in the application to provide a safe, affordable card with everything you need!

What are the disadvantages of the Pan card?

Well, the biggest disadvantage of the Pan card is the need for credit analysis. This is because, for people with a low or negative score, the chances of refusal are high. It is a bank famous for taking its time in credit analysis and being very rigid.

And in addition, another negative point of the Pan card is the fees charged for services offered such as financial transfers. Therefore, make a good analysis before applying for the Pan card.

What are the disadvantages of the Agibank card?

At first, these are the biggest cons of the Agibank card: The card's annual fee is high and some services provided have high fees, such as withdrawals and payment of limited accounts. Other disadvantages are CBDs:

This is because CDBs from R$1000.00 (without liquidity) and CDBs with liquidity from R$10000.00. Once again, research other credit and prepaid cards, as well as analyze your financial life to see if it's worth it.

Pan Card or Agibank Card: which one to choose?

Well then, the Pan Card or the Agibank Card are credit card options for those looking for comfort, a card that has approximation payments and a digital account to make life easier for customers. However, the disadvantages are not few either, it is worth researching!

But if you're still having doubts, we've separated another analysis for you to take a look at the recommended content below!

Saraiva Card or Pan Card?

Whether the Saraiva card or the Pan card, both have annuity exemption and international flag. Check out more information about them here!

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

All About Credjet: The Place for Fast Borrowing

Are you in need of quick cash? How about getting to know Credjet, a bank correspondent that offers personal loans to anyone in need?

Keep Reading

Get to know the Decolar Santander credit card

Find out in this post everything about the Decolar Santander credit card and learn about the main advantages it can offer you!

Keep Reading

Discover the Itaú payroll loan

Understand how Itaú payroll loan works and start paying only 90 days from now with lower interest rates than the traditional loan. Look!

Keep ReadingYou may also like

7 advantages of the Méliuz Mastercard card

With the Méliuz Mastercard credit card, you have access to the benefits of the Platinum brand, the cashback program and are also exempt from the annual fee. Want to know more about this plastic? So, keep reading and check it out!

Keep Reading

Step by step to get a loan for MEI

Are you MEI and want to apply for a loan? Then check out our article with all the information and tips to help you.

Keep Reading

Discover the Amazon Visa Credit Card

Are you an Amazon customer and still don't know the Amazon Visa credit card? So, read this post and find out how it is possible to have discounts and rewards on your purchases, both on the website and in other stores through this financial product.

Keep Reading