Cards

PagBank Card or Superdigital Card: which one to choose?

Do you want to choose between a PagBank card or a Superdigital card? Because both are cards with security, digital account and various offers for users! Check out!

Advertisement

PagBank x Superdigital: find out which one to choose

Initially, the Pagbank card or the Superdigital card are two options for prepaid cards offered by the PagBank and Superdigital bank, which have proposals such as cashback programs, international coverage, that is, you can make purchases in Brazil and abroad.

And besides, they are good card options for people with a dirty name. So, let's show you some features of these cards so you can choose the best option!

How to apply for Pagbank card

If you liked the options and advantages of the Pagbank prepaid card, find out right now how to apply without bureaucracy.

How to apply for the Superdigital credit card

If you have doubts about how to apply for the Superdigital credit card, after this text you will definitely not have any more!

| prepaid Superdigital | prepaid PagBank | |

| minimum income | On request | not required |

| Annuity | Exempt | Exempt |

| Flag | MasterCard | MasterCard |

| Roof | National and international | National and international |

| Benefits | No annual fee and unlimited purchases Control your expenses easily through the app Mastercard Surprise | Control in your hands: spend only the balance available on the card Top up using your account balance, bank slip, deposit or online debit Digital and streaming services Exclusive discounts and benefits |

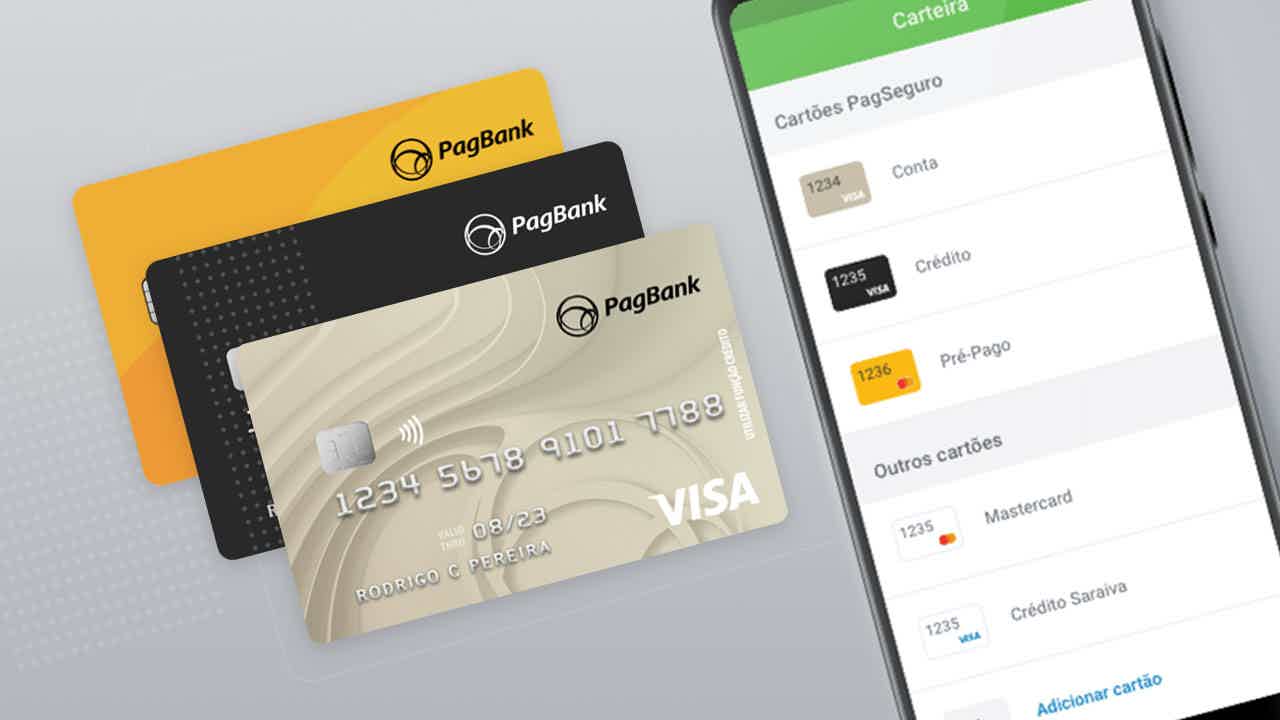

Pagbank card

Well, the PagBank card is a card issued by the Pagbank bank, with several interesting offers such as the absence of an invoice, as well as annuity. That is, it is not necessary to pay fees to keep the card services active.

And in addition, to use the card when shopping, just use it as credit normally in the card machine. However, at the time of purchase, the amounts will be deducted from the balance in the PagBank account. In other words, it works like a debit card!

This means that the card works like a debit card, that is, you need to have a balance in your PagBank account to be able to use it. And only customers who have a PagBank bank account can access the card, which is free and has international coverage.

This card also does not carry out a credit analysis, that is, it does not consult the CPF at the credit bureaus and does not require proof of income, being a great option for negatives. To access PagBank, simply create a free account in the PagBank application. Then choose the “cards” option and request your Pagbank card!

There are three PagBank cards available: PagBank Prepaid Card, PagBank Credit Card and PagBank Account Card. In this, each one has a Visa or Mastercard flag, with exclusive offers and programs for each of the cards!

It is important to mention that anyone can access a PagBank card, as long as they have an active PagBank account. And in addition, the card request will also be limited to a PagBank account!

Superdigital Card

Initially, the Superdigital card is a great card for negative people with low scores. That's because he doesn't do credit analysis at credit bureaus and also doesn't require proof of income, that is, even unemployed people can have access to the card.

In this regard, Superdigital offers two models of credit cards: the prepaid Mastercard Internacional and the virtual card. With regard to the prepaid Mastercard Internacional, it allows the user to make purchases anywhere in the world, as well as withdraw funds from Banco 24 Horas networks and also participate in the Mastercard Surpreenda program.

As it is a prepaid card, it means that it works as if it were a debit card, that is, you need to have a balance in your Superdigital account to use it! When shopping, it is used as credit, but it works as if it were a debit!

And in addition, there is also the virtual card that allows you to shop in online stores safely and comfortably, however, there is no withdrawal function on this card! Therefore, the Superdigital card has several models so that you can choose the one you find most interesting!

What are the advantages of the PagBank card?

Well, the PagBank card has several advantages that are similar in all 3 card models. They are: Initially, international coverage, that is, purchases can be made in Brazil and abroad using the card's credit function. In addition, digital and streaming subscriptions, as well as withdrawals on the Banco 24 Horas, Saque e Pague, Rede Plus and Rede Cirrus networks.

Another advantage is that the PagBank card also allows payment by approximation and it is not necessary to have a PagSeguro machine to request the card.

And in addition to these advantages, there are some that are unique to each card. In the case of the PagBank prepaid card, it offers recharges via bank slip or online debit through the PagBank account. Also, it allows free shipping to PagBank customers and has a Mastercard brand that has the Mastercard Surpreenda!

In turn, there is the Pagbank Credit Card, which offers services such as payment of purchases in the credit function; use of the balance of the PagBank account to pay the card bill and balance released on time. And you can also withdraw the limit of the card!

The PagBank Account Card has advantages such as the Vai de Visa program of the Visa brand. It is also possible to move the balance in the account without needing to top up, and there are no costs to request and receive the PagBank card from the PagBank Account.

What are the advantages of the Superdigital card?

So, let's get to know the advantages of the Superdigital card. Initially, the first of these are transfers to other banks that cost R$5.90 and the first is free.

Furthermore, the customer can issue a balance or statement at any ATM in the Banco 24 Horas network for R$2.00, as well as withdrawals at any ATM in the network for R$6.40. Overseas withdrawals via the Cirrus Network, on the other hand, is R$19.90.

You can also access the physical card or 2 copies of the card for R$14.90. And, the ticket issue fee is R$2.90. And in addition to all this, the Superdigital card also entitles you to 1 free monthly withdrawal or transfer to other banks, as well as 1 physical card and 5 additional cards.

What are the disadvantages of the Pagbank card?

So, a disadvantage of the PagBank card is the collection of fees for withdrawing money from the Banco 24 Horas network, which costs R$7.50, as well as the transfer by TED, which costs R$1.99 per month. In this, the customer earns 5 free transfers each month.

What are the disadvantages of the Superdigital card?

Well, the first disadvantage of the Superdigital card is the fact that the user does not have pre-approved credit. That is, you cannot make purchases in installments and you can only make purchases if you have an available balance on your Superdigital account.

And in addition, to have access to the digital account, it is necessary to make purchases above R$500 per month, to become completely exempt from the annuity. That is, the annuity will be charged in the month in which you do not use this amount of R$500.

PagBank Card or Superdigital Card: which one to choose?

Well, the PagBank card or Superdigital card are very interesting card options with offers like more than one card option for each of them. And so, you can choose the one that best meets your needs and expectations!

Therefore, consult your financial situation and choose the best option for you. And if you still have doubts, check out a new card comparison below:

Saraiva Card or Pan Card?

Whether the Saraiva card or the Pan card, both have annuity exemption and international flag. Check out more information about them here!

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to open top account

Find out how you can open your Top digital account and thus access all the benefits that only it can offer!

Keep Reading

Blocked Brazil Aid: what to do to recover the benefit?

Do you know what to do if your Brazil Aid is blocked? and why this happens? Read the article to understand more about it!

Keep Reading

Discover the free Veduca courses

Get to know the free Veduca courses and be surprised by their advantages, such as online courses at no cost, certificate option and much more.

Keep ReadingYou may also like

Nubank opinion polls rewarded users R$600.00 this month

With the aim of improving the experience of its customers when using the application, Nubank conducted two opinion surveys in March. The surveys were offered to selected customers and rewarded R$600.00! Learn more here.

Keep Reading

What is the Superdigital card limit?

As a prepaid credit card, the Superdigital card limit works differently. Check out our content and find out how to consult or increase your limit.

Keep Reading

Why receive FGTS through a digital account?

Here's the question, is it worth it to receive FGTS through a digital account? Initially, we can tell you yes! So, read on and find out all about it.

Keep Reading