Cards

PagBank Card or Next Card: which one is better?

Do you want to know two credit cards that allow you to make purchases in national and international stores, as well as manage your expenses through an application? So, check out everything about the PagBank card or Next card.

Advertisement

PagBank x Next: find out which one to choose

If you are looking for a credit card with no annual fee, no proof of income, international coverage and a Visa or Mastercard brand, don't worry, because today we have two credit cards with all these requirements for you to apply for: the Pagbank card or Next card.

So, continue reading the text so you can compare the advantages and disadvantages of the cards and decide which of the two options is best for you.

How to apply for Pagbank card

See how to request PagBank that gives you exclusive discounts and digital and streaming services, as well as exemption from minimum income and annuity.

How to apply for the Next card step by step

Find out now the exact step by step for you to order the Next card without ado, the process is 100% online.

| Pagbank | Next | |

| Minimum Income | not required | not required |

| Annuity | Exempt | Exempt |

| Flag | MasterCard | Visa |

| Roof | International | International |

| Benefits | Spending only from the balance available on the card Card recharge through account balance, bank slip, deposit or online debit Digital and streaming services | Annuity Exemption Credibility Security Exclusive discounts and offers Cashback Livelo |

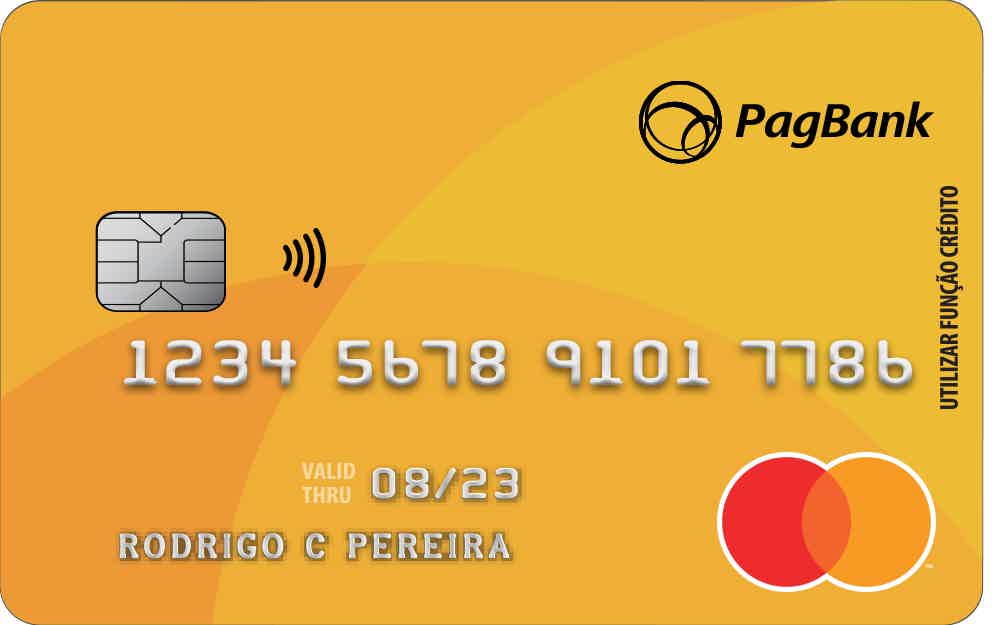

PagBank card

The PagBank credit card is international, meaning you can use it anywhere in the world, and you need to have a digital account to access the card.

Furthermore, using the card you can make purchases, pay bills and use various services on the PagBank digital platform.

On the other hand, you do not need to prove income to access the card, nor do you need to pay an annual fee, and it may also be negative, as the institution does not carry out credit analysis as it is a pre-paid card, in which You need to have a balance to use it.

Therefore, to learn a little more about this card, continue reading.

next card

Well, the Next card is a card launched by Next, a fully digital bank and a strong competitor to Inter and Nubank.

And, what's more, downloading the Next app is very easy, just install it on your cell phone, available for Android and iOS, and create a free digital account. Then, simply apply for the card and wait for the credit analysis.

Furthermore, the Next card is an international card, has a Visa brand, cashback program, Vai de Visa program and several other advantages for users.

What are the advantages of the PagBank card?

So, the PagBank card is an international card, which also has the Mastercard brand and access to the Mastercard Surpreenda program.

And, in addition, through the PagBank card you can use various services from the PagBank digital account, this helps to simplify your financial life, as it is a prepaid card and to use it you need to have a balance in your digital account.

So, if you are looking for a card that allows you to spend, but also save, the PagBank card could be a good alternative for you. Additionally, you can shop anywhere in the world with various discounts from partner companies.

What are the advantages of the Next card?

Well, the Next card has several advantages, the first of which is the fact that it has credibility, security and the various free services offered by the Next digital bank.

Furthermore, requesting the card is very simple, just install the application on your cell phone, available for Android and iOS, and create your digital account. After that, just apply for the card and it will undergo a credit analysis. If approved, you will be able to enjoy all the benefits.

You also have access to the bank's entire infrastructure with discounts at several partner companies, as well as control and planning of expenses through the application. And you can still pay bills, make purchases and various other services.

What are the disadvantages of the PagBank card?

The PagBank card also has disadvantages, for example, if you are someone who likes to pay in installments, this card is not for you.

This is because it is a card that works as credit, but as if it were debit, as the amounts are deducted immediately.

And, in addition, withdrawals are also charged, just as it does not have a virtual card for online purchases.

Therefore, before applying for the PagBank card, check the other options on the market to see the best alternative for you.

What are the disadvantages of the Next card?

Well, despite being a card full of advantages, the Next card also has some disadvantages, for example, to register there is a fee of R$30.

And, in addition, for people who have a fee-free plan, there is only one free TED available, meaning for other transfers you will need to pay a fee.

Just as there is some difficulty in unlocking the Next card and the credit function is also more difficult to accept, this is because the debit function is immediately released.

Therefore, before choosing to apply for this card, look at the disadvantages to see if it is a good alternative for you.

PagBank Card or Next Card: which one to choose?

The PagBank card or Next card are two great credit card options offered under the Mastercard and Visa brands. This is because you can have access to several advantage programs such as Mastercard Surpreenda and Vai de Visa, respectively. It also has international coverage and you can also access the application to manage your expenses.

But, if you still have doubts, see another card comparison below.

Saraiva card or BBB card: which is better?

Either the Saraiva card or the BBB card, both are international credit cards, with no fees and benefits program. So check it out.

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

The best credit card of 2023: find out here!

Check out a full review of multiple cards and find the best credit card for you. Still see the step by step to request it.

Keep Reading

More advantages of the Serasa eCred Loan

The Serasa eCred Loan is a great option for those with negative credit, with several online credit types with financial institutions. meet

Keep Reading

Discover the uConecte personal loan

The uConecte personal loan is approved in a few hours and is ideal for those who need money quickly. Check more here!

Keep ReadingYou may also like

How to open Top Account

The Top digital account is a great alternative for anyone who wants to organize their finances and not pay abusive fees for it. To learn more about and how to request yours, just continue reading the article and check it out!

Keep Reading

How to open account at Crypto.com brokerage

To invest in cryptocurrencies safely, nothing better than having a safe and respected broker like Crypo.com. Check then how to open your account on this exchange.

Keep Reading

Find out about the Itaú loan without consulting the SPC/Serasa

Having your name registered with credit restriction bodies like the SPC is a headache, isn't it? And if you need a loan, even worse! But, we have good news: the Itaú payroll loan does not consult the SPC or Serasa. Know more!

Keep Reading