Cards

PagBank card or Caixa Mulher card: which one to choose?

If you are a woman, how about getting to know a card created exclusively for you with more than 20 advantages? But if you are a man, do you want to know about an international card with a digital account and the Mastercard Surpreenda program? Then, get to know the PagBank card or Caixa Mulher card.

Advertisement

PagBank x Caixa Mulher: find out which one to choose

If you are looking for a card that offers good features and benefits for everyday use, the PagBank card or Caixa Mulher card may be the alternative you need to have a great credit card in your hands.

So today, we’ve brought these two cards so you can compare how they work, their advantages, and disadvantages to see which one best suits your needs. Let’s go!

How to apply for Pagbank card

See how to request PagBank that gives you exclusive discounts and digital and streaming services, as well as exemption from minimum income and annuity.

How to apply for a Caixa woman card

Learn today how to apply for your Caixa Mulher card and be surprised by the benefits of this credit alternative!

| Pagbank | Cashier Woman | |

| Minimum Income | not required | Minimum wage |

| Annuity | Exempt | Exempt |

| Flag | MasterCard | Link |

| Roof | International | International |

| Benefits | Spending only from the balance available on the card Card recharge through account balance, bank slip, deposit or online debit Digital and streaming services | Elo Scores free annuity Elo Flex Program |

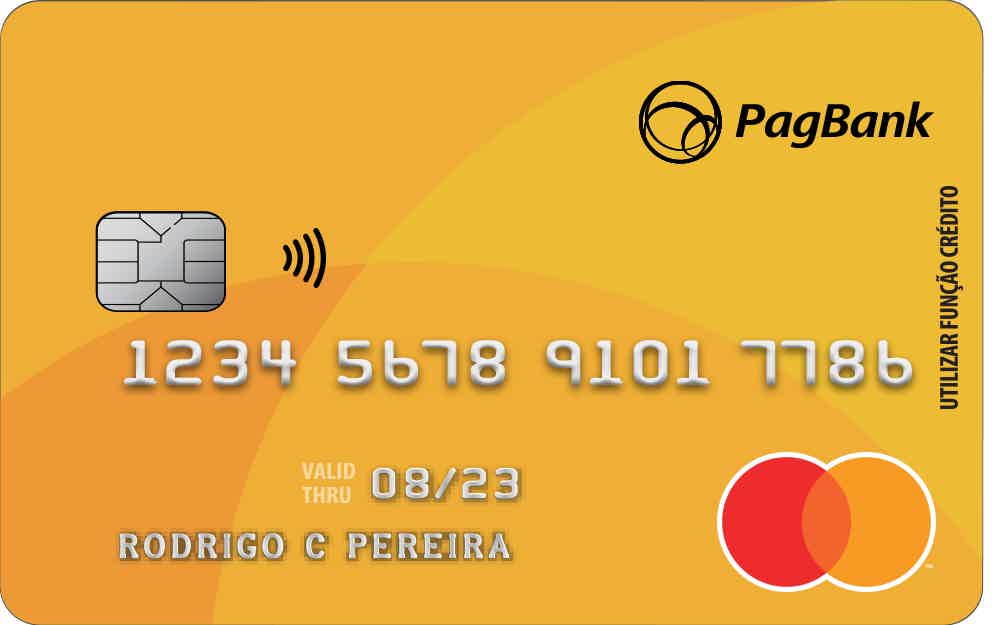

PagBank card

So, nowadays, most people prefer not to carry physical money in their pockets, opting instead for cards and digital accounts on their cell phones, such as Banco Inter, Banco Neon and also Pagbank.

To bring even more convenience to these users, Pagbank created the Pagbank card. With it, you can make purchases, pay bills and enjoy several benefits.

This is because, despite being used as a credit card, you will use it as a prepaid card, that is, the card amounts are discounted immediately, so you need to have a balance in the account.

And, in addition, it is a great card option, as you will not get into debt in the long term, nor will you be able to pay for purchases in installments and have to pay in the future, everything is done quickly, safely and practically.

So, the PagBank card, which has a Mastercard brand and international coverage, also allows you to participate in the Mastercard Surpreenda Program and have access to discounts at partner establishments. Therefore, if you are looking for a convenient card that helps you spend without getting into debt, it can be a good alternative.

Woman Cash Card

Well, the Caixa Mulher card is a financial product issued and created by Caixa Econômica Federal and can be used as a credit or debit card. In addition, it has the Elo brand and is an international card, meaning you can make purchases in national and international physical or digital stores.

Furthermore, to find out the limit on your card, you will need to undergo a credit analysis and, based on this, the institution will designate the limit on your card.

Furthermore, the card is exclusive to Caixa customers, that is, you need to open an account with the institution to have access to the card.

It is important to mention that, in order to apply for the card, you cannot have a negative credit history, as the institution carries out a credit analysis with credit agencies, such as SPC or SERASA, meaning that a regular CPF status is one of the requirements for approval.

Finally, the Caixa Mulher card, as the name suggests, is an exclusive card for women, with men having to opt for other card alternatives.

What are the advantages of the PagBank card?

So, the Pagbank card has several advantages, such as the fact that you can make purchases in national and international stores, due to international coverage.

And, in addition, you can subscribe to digital services quoted in reais and also services that are traded in foreign currencies.

Furthermore, you have up to 5 free withdrawals per month, as after this amount a fee is charged to users, as well as reduced rates and exemption from other service fees.

And, you also have access to the PagBank app, which allows you to pay bills, make purchases, pay bills with a QR Code and several other digital services. However, to access the card, you need to open an account with the institution.

What are the advantages of the Caixa Mulher card?

Well, the Caixa Mulher card has several advantages, the first of which is the fact that it is a card completely exempt from annual fees.

And, in addition, being a card entirely dedicated to women, it is concerned with creating benefits dedicated to them, such as body and mind care, home services, car insurance, funeral assistance and many others.

But you can only choose up to 5 benefits, customizing the card however you want, making it your own. Awesome, right?

What are the disadvantages of the PagBank card?

So, the Pagbank card charges for withdrawals made, this is because each customer can make up to 5 free withdrawals, but after this, an amount of R$7.50 is charged per withdrawal made.

Furthermore, you don’t have a virtual card like most other digital banks. Likewise, you can’t pay for purchases in installments, as it’s a prepaid card. Also, check out other options on the market before choosing PagBank.

What are the disadvantages of the Caixa Mulher card?

Well, the Caixa Mulher card has some disadvantages, such as the fact that it is an exclusive card for women, that is, men cannot have access.

And, in addition, it does not approve cards for women with negative credit ratings, that is, you need to have a regular CPF status before requesting the card.

PagBank card or Caixa Mulher card: which one to choose?

So, the PagBank card or Caixa Mulher card are cards from institutions committed to providing new experiences to customers with differentiated advantages, such as the Mastercard Surpreenda Program and the Elo Flex Program, respectively.

But if you still have doubts, see a new card comparison below.

Saraiva card or BBB card: which is better?

Either the Saraiva card or the BBB card, both are international credit cards, with no fees and benefits program. So check it out.

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Biz Capital loan: how it works

Biz Capital offers a loan without bureaucracy and low interest rates to help Brazilian entrepreneurs. Check out more about him here!

Keep Reading

Apps to identify plants: see the best!

Uncover the green world around you with amazing apps to identify plants. Connect with nature!

Keep Reading

5 best practices about credit card installments

How about knowing how credit card installments work and what to do to not compromise your income? So, click here and check it out!

Keep ReadingYou may also like

Discover the International Superdigital card

Do you know the Superdigital Internacional card? It offers many benefits. Want to know which ones? So, read on and check it out!

Keep Reading

Discover the Safra Visa Platinum credit card

The Safra Visa Platinum credit card is international and offers the Safra Rewards points program. Do you want to know more about him? Then read our article.

Keep Reading

Where can I take a free technical nursing course?

Have you ever thought about taking a free technical nursing course? This is completely possible! Keep reading the post and find out how.

Keep Reading