Cards

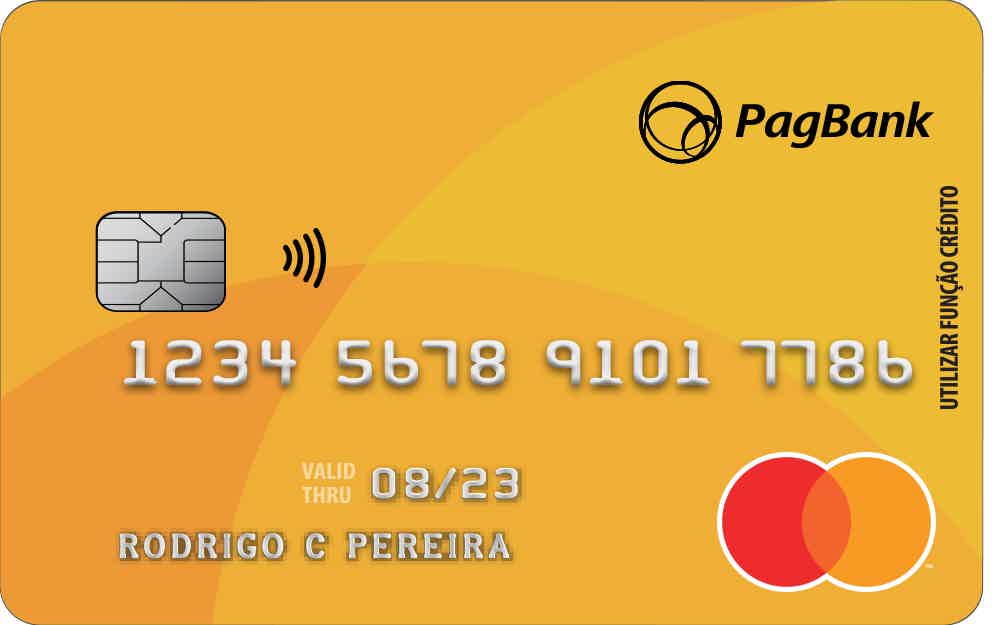

PagBank Card or C6 Bank Card: which one to choose?

Discover the PagBank card or C6 Bank card, cards with no annual fee, no proof of income, international coverage and you are also guaranteed the right to the Mastercard Surpreenda program. Check it out!

Advertisement

PagBank x C6 Bank: find out which one to choose

The Pagbank card or C6 Bank card offers digital services to customers through a digital account with services such as financial transfers, withdrawals, Mastercard Surpreenda program and international coverage.

So, continue reading to learn a little more about these cards.

How to apply for Pagbank card

See how to request PagBank that gives you exclusive discounts and digital and streaming services, as well as exemption from minimum income and annuity.

How to apply for the C6 Bank credit card

Find out now in this article how to apply step by step for your c6 bank card without complications.

| PagBank | C6 Bank | |

| Minimum Income | not required | not required |

| Annuity | Exempt | Exempt |

| Flag | MasterCard | MasterCard |

| Roof | International | International |

| Benefits | Spending only from the balance available on the card Card top-up using your account balance, bank slip, deposit or online debit Digital and streaming services | Discounts and offers C6 Triggy |

PagBank card

The PagBank card is a financial product with no annual fee, as well as a minimum income and has international coverage.

And, in addition, to have access to the PagBank card you need to open the PagBank account through the application itself and make the request, which happens in a very safe and fast way.

Furthermore, through the account you can make bank transfers, withdrawals, top up your cell phone, and have access to several interesting services and resources.

On the other hand, there are some disadvantages such as charging for withdrawals made using the card, as we will discuss later, but it is still a good card.

So, continue reading to learn a little more about this card that should be used in credit mode, but works as if it were a debit card.

C6 Bank Card

Well, the C6 Bank card is a financial product created in 2018. With it, you have the Mastercard brand, international coverage and several interesting features.

This is because you can make purchases in national and international physical or digital stores, as well as have access to the Mastercard Surpreenda program.

Furthermore, the card limit varies depending on your financial history and may be high or low. Therefore, we recommend that your credit score and CPF are in good standing.

Furthermore, to apply for C6 Bank you must be over 18 years old and the card limit is a maximum of R$$5000.00 per month.

So, continue reading to learn a little more about the C6 Bank card.

What are the advantages of the PagBank card?

The PagBank card has several advantages, the first of which is that you can count on an app to manage your card. This way, you can pay bills and bank slips, make payments via QR Code and access your bank statement.

And, in addition, you can top up your cell phone, as well as make purchases in national and international physical or online stores without paying an annual fee.

Another advantage is that you do not need to prove your income to apply for the card, and even if your credit score is bad, your application may be approved, as the institution does not perform analysis at credit agencies.

Therefore, for those looking for an easy-to-access, secure and credible card, PagBank is a good alternative.

What are the advantages of the C6 Bank card?

Well, the C6 Bank card is a credit card that has several advantages, the first of which is the fact that you can make transfers and withdrawals completely free of charge, as well as withdrawals and deposits through Banco24Horas.

And, in addition, you can also use the C6 Kick feature to make transfers without knowing the recipient's account number, as well as the C6 Taggy feature to avoid toll lines, as the amounts are debited directly from your account.

Finally, C6 Bank has a practical and intuitive application for you to manage your bank account and all transactions made with your credit card.

What are the disadvantages of the PagBank card?

The PagBank card has some disadvantages, for example, you cannot pay for your purchases in installments, as you can only spend the balance available in your account.

This is because, as we mentioned, despite the card being used in credit mode, it works as if it were a debit card.

Furthermore, withdrawals made from the PagBank account are also charged, as are other charges related to the card.

So, check out the disadvantages of PagBank before opting to apply for this card, to find out if it is what you need at the moment.

What are the disadvantages of the C6 Bank card?

Well, despite being a card full of advantages, C6 Bank also has some disadvantages, the first of which is the fact that it has a credit approval that is considered difficult by people who have already tried to apply for the card.

And, in addition, if you do not pay the minimum amount on your card bill, you will be charged a late payment fine of 2% on the amount, which does not happen with many other cards on the market. Therefore, before opting for this card, check out other options, such as PagBank.

PagBank Card or C6 Bank Card: which one to choose?

So, the PagBank Card or C6 Bank Card have several advantages, for example, you can enjoy the benefits of the Mastercard Surpreenda program, as well as cards exempt from proof of income and annual fees.

But, if you still have doubts, see a new card comparison that we bring in recommended content.

Saraiva card or BBB card: which is better?

Either the Saraiva card or the BBB card, both are international credit cards, with no fees and benefits program. So check it out.

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

I can't access Caixa Tem: how can I receive the Brazil Aid?

To receive the Auxílio Brasil, it is necessary to access the Caixa Tem account. But what to do if I can't access Caixa Tem? Find out the answer here.

Keep Reading

How do I sign up for Find Someone? See the process

Learn how to sign up for Find Someone so you can find someone important to you from this board!

Keep Reading

Discover the Nubank account

Get to know the Nubank account and make bank transfers without paying anything for it, in addition to having automatic income on the account!

Keep ReadingYou may also like

See how to pay Netflix monthly fee using PicPay

Users of the Netflix streaming platform and the PicPay digital wallet can now pay the video service monthly fee directly through the fintech app. And the best: earn cashback with every payment you make! Understand.

Keep Reading

What are the advantages of opening an international digital account?

An online international account can be a great alternative if you're going to be spending time abroad and want to save on fees and taxes. But how do you decide which option is best for your pocket? Check out!

Keep Reading

Which credit card does not consult SPC and Serasa?

Are you negative but want to apply for a credit card? Some financial institutions such as: BMG, Caixa, Inter and Pan have credit card options that do not consult SPC and Serasa. Discover the options now!

Keep Reading