Cards

PagBank card or BTG card: which one is better?

The Pagbank card or BTG card offer customers a credit card option so they can make purchases, pay bills and access discounts at a large number of partner stores. So, read this post to get to know these cards better.

Advertisement

PagBank x BTG: find out which one to choose

So, if you are looking for versatile credit cards that allow you to make purchases, pay bills, have access to a benefits program, as well as no annuity and proof of income, among other advantages, the Pagbank card or BTG card are great options. .

That's why, today, we're going to show you everything about these two cards so that you can choose the option that best suits your needs. Let's go!

How to apply for Pagbank card

If you liked the functionalities and advantages of the Pagbank prepaid card, find out right now how to apply without bureaucracy.

How to apply for BTG+ credit cards?

Do you want to know how to apply for BTG+ credit cards and have one of the best cashback programs on the market? So, know that you are in the right place! Find out now!

| Pagbank | BTG | |

| Minimum Income | not required | Basic Option: not required Advanced option: R$ 7 thousand or investments from R$ 30 thousand in the bank. Black Option: R$ 15 thousand or investments from R$ 150 thousand in the bank. |

| Annuity | Exempt | Exempt (Basic Option) |

| Flag | MasterCard | MasterCard |

| Roof | International | International |

| Benefits | Spending only from the balance available on the card Card recharge through account balance, bank slip, deposit or online debit Digital and streaming services Exclusive discounts and perks | Mastercard Surprise cashback program |

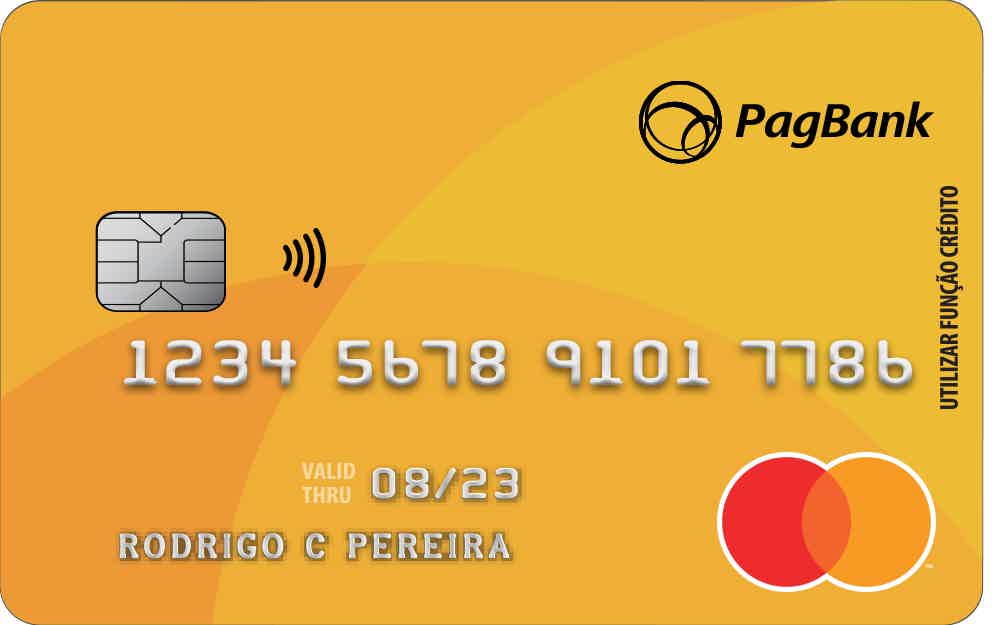

PagBank card

So, the PagBank card is a financial product that does not consult the credit protection agencies, so it is a great option for people with a dirty name or low credit score.

And, in addition, to use the card, you need to load it with the money you intend to use, so you can keep track of expenses and finances all up to date.

Furthermore, it is a cost-free and international card with dozens of advantages for customers, such as the benefits of the Mastercard brand, as well as unlimited withdrawals.

So, to apply for the card, you just need to access the website of the financial institution. Then register or login to the PagBank account and then request the card, which can be delivered within 15 business days.

After that, with the card in hand, all you have to do is unlock it, which can be done through the institution's website or application.

And so, to start using it, you must enter the application and click on “Reload Card” to top up with the desired amount.

Therefore, the Pagbank card is a card that brings several advantages to customers, always seeking to offer the best services.

BTG card

Well, the BTG+ card is a financial product that can be requested by anyone with a digital bank account.

And, in addition, the card offers a rewards program and access to VIP movie theaters, as well as no annual fee in the most basic model, Mastercard brand and approximation payment in contactless technology.

In addition, it works in the credit and debit function and also has the Virtual First function, which allows you to use the virtual card even before receiving the physical card. Therefore, the BTG+ card is a financial product full of alternatives that aim to make your life easier.

What are the advantages of the PagBank card?

So, the PagBank card has several benefits for customers, such as being an international card.

Thus, through it you can make purchases in stores inside and outside Brazil, as well as subscribe to digital services and have several options of partner establishments of the Mastercard brand.

And, in addition, the card is free of annual fees and also guarantees unlimited withdrawals. Therefore, the PagBank card has a program of unique advantages with a completely online application, bringing the security, practicality and ease that you need.

What are the advantages of the BTG card?

Well, the BTG card has several advantages, the first of which is the fact that you can apply for the card through the institution's website or application.

And, in addition, not all BTG+ credit cards are exempt from annuity, but the most basic option Mastercard Gold has the exemption.

Thus, if you spend a certain amount per month on other card options, you may also be exempt from the annuity portion related to that month.

In addition, you also have access to the Invest + loyalty program in which part of the amount you spend on your card is deposited in a BTG Pactual fund and, thus, your money will earn a lot.

Therefore, the BTG+ card is a great option, especially if you like to make investments.

What are the disadvantages of the PagBank card?

So, one of the biggest disadvantages of the PagBank card is the charge for withdrawals made by the bank in the amount of R$7.50.

And, in addition, you cannot make purchases in installments, as well as several other options that usually exist in other credit cards. So, compare this card with others on the market before placing your order right away.

What are the disadvantages of the BTG card?

Well, the BTG+ card has several advantages such as the absence of annuity in the basic card option, however, in the other options an annuity fee is charged.

So, in the Advanced option the annuity is R$ 15 per month and in the BTG card+ Black she is from R$ 90 per month.

And, in addition, another disadvantage is that the BTG+ card has a very rigorous credit analysis, because, even if you provide proof of income or accumulate investments, the BTG bank may deny your request according to internal criteria.

Therefore, before opting for the BTG card, get to know other options on the market that are more affordable.

PagBank card or BTG card: which one to choose?

So, the PagBank card or BTG card, as you can see, bring a unique proposal so that customers can access rewards programs. But it is worth noting that each of them has different characteristics and advantages, so think carefully before choosing the best option for your financial reality.

But if you still have doubts, check out another card comparison in the recommended content below.

Saraiva card or Pan card?

Whether the Saraiva card or the Pan card, both have annuity exemption and international flag. Check out more information about them here!

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Discover the Rendeira Pagbank account

The PagBank income account is a great option for those who want to invest without doing much. See in this article how it works and open yours!

Keep Reading

Best apps for editing Christmas and New Year photos!

We'll explore the best apps for editing Christmas and New Year photos. With the arrival of these festivities, we all want to immortalize the moments!

Keep Reading

Loan for negative employee debit account

Get a loan even if you are negative. Discover in this article the loan for salaried negatives and get out of debt!

Keep ReadingYou may also like

How to order the Stone machine

For those looking for a complete solution to sell on debit, credit and even accept food and meal vouchers, Stone's vending machine may be the ideal choice. Then check out how to get yours via WhatsApp.

Keep Reading

Pan Payroll Loan or C6 Consig: which is better?

In today's article we compare two loan options, Pan bank and C6 Consig. Interested? Continue reading and check out the features of each one.

Keep Reading

Discover the C&A Credit Card

The CEA card only requires an income of one minimum wage, is exempt from annual fees and has international coverage. Do you want to know more about him? Check out the content below!

Keep Reading