Cards

PagBank Card or Bradesco Neo Card: which one to choose?

Among several card options on the market, finding a personalized card as you wish is not always an easy task. Therefore, PagBank card or Bradesco Neo card can be what you want with international coverage, exemption from annuity and Mastercard or Visa flag. So, see our comparative text and check it out!

Advertisement

PagBank x Bradesco Neo: find out which one to choose

So, when looking for a credit card that offers quality and service support that helps when problems arise, we don't always know which is the best option. For this reason, today we have two cards for you to discover: Pagbank card or Bradesco Neo card.

This is because the two cards offer proposals that value quality in the provision of services to customers and customer service support.

So, if you're looking for a card with multiple functions that will help you make your financial life more accessible, read on to find out about these two cards. Look!

How to apply for Pagbank card

If you liked the functionalities and advantages of the Pagbank prepaid card, find out right now how to apply without bureaucracy.

How to apply for the Bradesco Neo card step by step

Discover the step-by-step process on how to apply for Banco Bradesco's newest card, the Neo credit card.

| Pagbank | Bradesco Neo | |

| Minimum Income | not required | Minimum wage |

| Annuity | Exempt | Exempt (For this to happen, spend at least R$50.00 reais per month) |

| Flag | MasterCard | Visa |

| Roof | International | International |

| Benefits | Spending only from the balance available on the card Card recharge through account balance, bank slip, deposit or online debit Digital and streaming services Exclusive discounts and perks | Go from Visa |

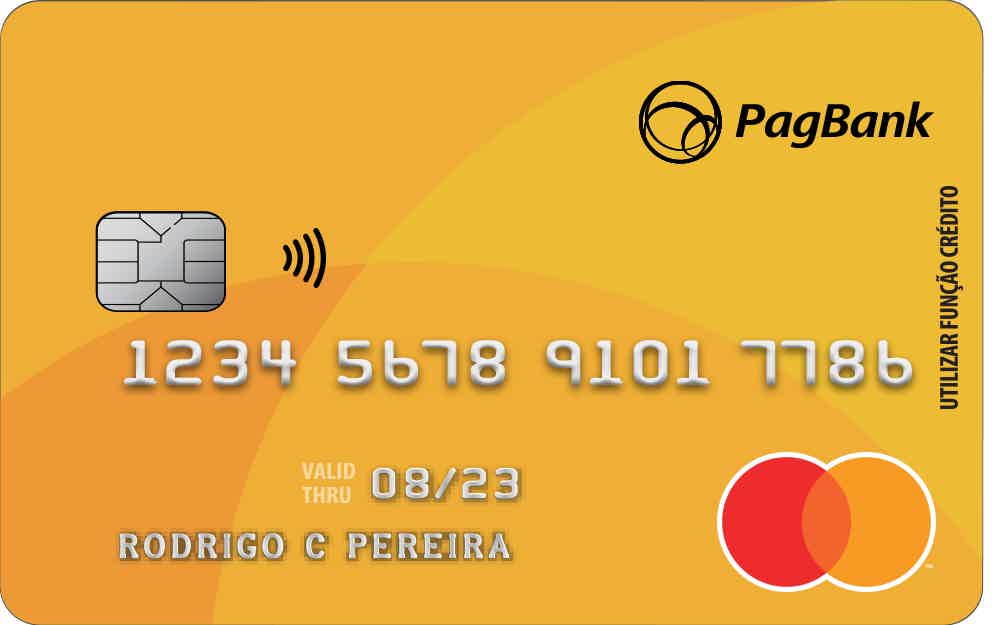

PagBank card

Well, the PagBank card is a credit card that works like a prepaid card, because in order for you to be able to make purchases using this card, you need to have an available balance in your PagBank account.

Thus, when making purchases with the PagBank card, the amounts will also be discounted immediately, as if it were a debit card.

Despite this, the PagBank card is a great option for a financial product for those who do not want to go into debt or commit to future expenses.

Another advantage of this card is that it is free, that is, you do not pay an annual fee to keep the PagBank card services active.

And, in addition, it is also international, so you can shop in national and international stores, as well as make withdrawals throughout Brazil using the Banco24Horas and Saque e Pague network, as well as the Plus network in other countries.

In addition, the PagBank card has the Mastercard brand, that is, you can make purchases at all Mastercard partner establishments, as well as have access to all the benefits of the brand, such as the Mastercard Surprise program.

Finally, the card still gives you access to digital services that applications that require a credit card for payment, providing much more interactivity with your card.

Bradesco Neo Card

So, the Bradesco Neo card is the new launch of Banco Bradesco with several advantages for customers, the first of which is the exemption of annuity on monthly expenses above R$50.00.

And, in addition, the card also has a Visa flag, that is, you can shop at all Visa partner establishments, as well as have access to the brand's benefits such as the Vai de Visa program, loans, consortia and other advantages.

In addition, the card has international coverage, that is, you can make purchases in national and international physical or digital stores.

And yet, Bradesco gives you access to a super functional application where you can access all transactions made with your credit card, as well as make purchases over the internet and have access to subscription services.

Therefore, if you are looking for a card unlike anything you've seen on the market, Bradesco Neo can be a good alternative.

What are the advantages of the PagBank card?

Well, the PagBank card has several advantages for customers, the first of which is the fact that you can count on an international card.

This is because, through the PagBank card, you can make purchases in national and international stores, as well as make unlimited withdrawals at accredited ATMs worldwide, in addition to being able to make payments in foreign currencies.

And, in addition, the PagBank card also helps you to avoid debts, because all purchases made with the card are immediately debited, as if it were a debit card, so you don't have to worry about the bill.

Another advantage is that if you have a dirty name or low credit score, you can also apply for the card, as the bank does not carry out analysis at credit agencies, nor does it require proof of minimum income, making the process less bureaucratic.

Therefore, the PagBank card represents everything you need in a financial product and without having to pay any fee for it, neither application nor annuity.

What are the advantages of the Bradesco Neo card?

So, the Bradesco Neo card also has several advantages, the first of which is the annuity waiver every time you spend monthly amounts above R$50.00.

And, in addition, through the Bradesco Neo card you have access to free 24-hour assistance for your vehicle, as well as protection insurance offered by the institution and, even, emergency services in cases where the car leaves you in the lurch.

In addition, it also has advantages such as a 50% discount for cinemas on the Cinemark network, as well as a 50% discount at Teatro Bradesco and a 15% discount at partner restaurants.

Finally, if you are looking for an interactive credit card that provides you with a unique experience, it is worth requesting Bradesco Neo and having access to all of this through the Bradesco application.

What are the disadvantages of the PagBank card?

Well, the Pagbank card, despite having several advantages, also has some disadvantages, for example, with this card you cannot pay in installments for your purchases.

This is because as it is a prepaid card, you pay for your purchases the moment you use the card with the amounts being debited immediately, without compromising the future budget, so you cannot make installments.

And, in addition, withdrawals are charged when reaching a certain number of free withdrawals per month in the amount of R$7.50.

In addition, the card also does not offer a virtual card, making your purchases in digital stores more complicated.

Therefore, if you are looking for a card with more options for purchases, installments and free withdrawals, PagBank is not for you.

What are the disadvantages of the Bradesco Neo card?

So, despite being a great credit card, the Bradesco Neo card also has some disadvantages.

For example, the annuity charge is the first one, because there will only be exemption if you spend at least R$50.00 per month.

So, every time the value is less than this, there will be an annuity charge of R$240, in the amounts of R$20 per month.

In addition, Bradesco performs a very careful credit analysis, not being an accessible card for negatives, for example. It is also worth noting that during the approval process it requires proof of income in the amount of a minimum wage.

Therefore, before opting for this card, look at the other options available on the market to find out if it is the best one for you.

PagBank Card or Bradesco Neo Card: which one to choose?

Well, the PagBank card or Bradesco Neo card, as you can see, are among the best card options on the market.

This is because they have customized proposals for each type of customer. On the one hand, a prepaid card so you don't have to worry about bills. On the other hand, a credit card with several functions to diversify your financial life.

But if you still have doubts, check out another card comparison in the recommended content below.

Saraiva card or Pan card?

Whether the Saraiva card or the Pan card, both have annuity exemption and international flag. Check out more information about them here!

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

7 companies with free technology courses

Discover in this post the most reliable free and online technology courses and get training recognized by the market!

Keep Reading

Digital bank or traditional bank: which is better?

There are differences between opening an account at a digital bank or a traditional bank, such as less bureaucracy and more agility with digital ones. Check it out!

Keep Reading

How to apply for the Brasil Você Prepaid Card

If you already know the benefits and facilities of the Brazil card, then see how to apply for it without leaving home. It's easy and fast

Keep ReadingYou may also like

How to order the NuTap card machine

The NuBank card machine finally hit the market bringing the novelty of being 100% online through the bank's app. Want to know how to get access to it? Then check out how to make the NuTap below.

Keep Reading

What can I do to increase my Nubank credit card limit this month?

A good credit card limit can be an excellent financial ally when used correctly. However, achieving this benefit is not always the easiest task! So, check out some suggestions on what to do to increase your Nubank card limit later this month.

Keep Reading

How to save money with the new function of the Nubank app

Every time roxinho releases a new feature to make life easier for its customers. This time, it's the save money function. Nubank helping you with financial education. Learn more below!

Keep Reading