Cards

PagBank Card or Bahamas Card: which one to choose?

The PagBank card or Bahamas card have several points in common, the main one being having an application to manage the card, that is, through it you can control your expenses, have access to various digital services, make purchases and pay bills. In the face of this, see our comparison and learn more!

Advertisement

PagBank x Bahamas: find out which one to choose

When choosing a credit card, several questions may arise regarding its scope, benefits program, annual fee, as well as proof of minimum income. With that in mind, in this text we are going to share two options for credit cards: the Pagbank card or the Bahamas card.

Thus, you can know their advantages and disadvantages, as well as see which of the two options is the best option. Let's go!

How to apply for Pagbank card

See how to request PagBank that gives you exclusive discounts and digital and streaming services, as well as exemption from minimum income and annuity.

How to Apply for the Bahamas Card

Discover the exact step by step to apply for the Bahamas card. It's a simple, easy process and can be 100% online, hassle free.

| Pagbank | Bahamas | |

| Minimum Income | not required | not required |

| Annuity | Exempt | 12x of R$ 9.80 for individuals 12x of R$ 16.00 for legal entities |

| Flag | MasterCard | Link |

| Roof | International | National |

| Benefits | Spending only from the balance available on the card Card recharge through account balance, bank slip, deposit or online debit Digital and streaming services | Credibility Security |

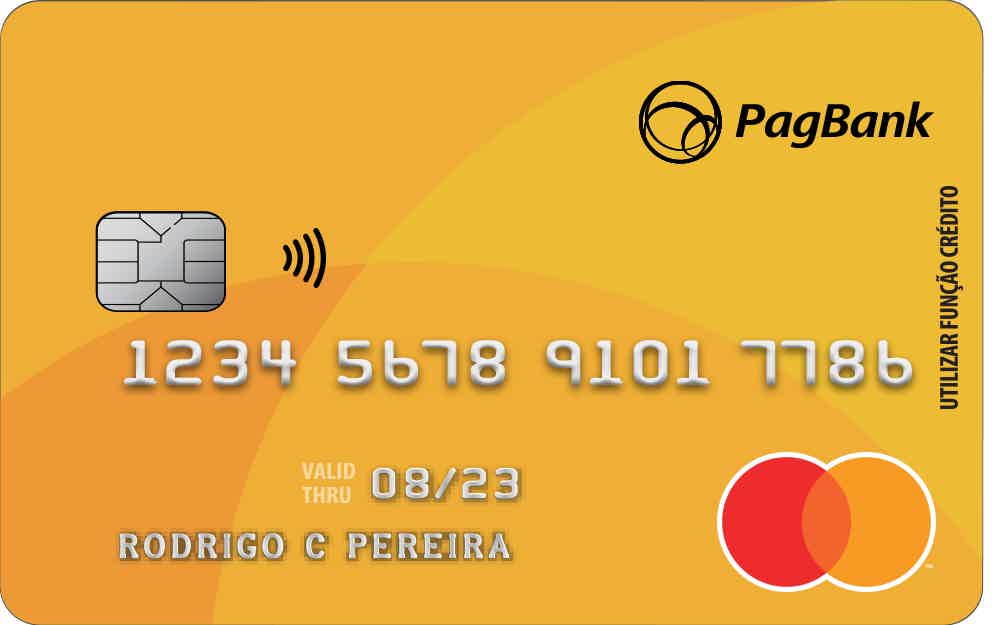

PagBank card

The PagBank credit card has a Mastercard brand and international coverage, as it can be requested after a credit analysis carried out by the PagBank institution.

So, to apply for the PagBank card you need to be among the pre-approved institutions. And, to find out if you are part of that list, just enter your application, go to the “Cards” tab and see your pre-approval.

If it is pre-approved, just select the “Credit Card” option. Then select “ask for card” and confirm the address. Then click to finish and wait until the card arrives at your residence.

And, in addition, with the PagBank credit card you can make purchases and pay bills without limits, because it works like a prepaid card, that is, you can only use it if you have amounts in your PagBank account, otherwise will need to make a deposit.

So, the card also does not require proof of minimum income, as well as accepting the request for negatives, since there will be no need for such a careful credit analysis. Therefore, the Pagbank card can be a good option if you are negative.

Bahamas Card

Well, the Bahamas Cred Elo card is a financial product created by the Bahamas Card, a company founded in 1999 and which, since 2014, has partnered with the Elo and Up Brasil flag.

And, in addition, the card has had a high approval rate in recent years, being accepted throughout Brazil, and can be requested through WhatsApp itself, as well as accepting negatives and people with low credit scores, as it has a more accurate credit analysis. simple.

So, the card is also exempt from minimum income, but charges an annuity of 12x R$ 9.80 for individuals and 12x R$ 16.00 for legal entities, as well as being nationwide.

What are the advantages of the PagBank card?

So, through the PagBank card you can use the institution's various services through the digital account, such as making transfers via TED or PIX, as well as making payments via QR Code and also paying bills, making purchases and being able to check your balance.

And, in addition, the card helps you save money, since you can only use it if you have a balance in your PagBank account, since without balance in the account, you will need to top up the card to be able to make purchases or make payment of accounts.

In addition, the card can be used internationally and has a Mastercard brand, allowing you to access the Mastercard Surpreenda program.

So, the PagBank card has several advantages in addition to the security and credibility offered by the PagBank institution.

What are the advantages of the Bahamas card?

Well, the Bahamas card has several advantages, the first of which is the fact that you can choose the due date of your invoice from 6 different days: 01, 05, 10, 15, 20 and 25.

And, in addition, you are entitled to two additional cards, the first copy of the card being free, as well as the card's coverage is national and you still have an intuitive and practical application to manage all your card movements.

In addition, you can apply for the card through WhatsApp itself and the credit analysis is fast and secure, even if you are negative.

Therefore, if you are looking for a card that, despite being simple, is very versatile, the Bahamas can be a good alternative.

What are the disadvantages of the PagBank card?

So, the PagBank card has some disadvantages such as charging withdrawals, as well as the absence of a virtual card. And, in addition, because it is a prepaid card, you cannot pay for your purchases in installments, which can be a negative point.

What are the disadvantages of the Bahamas card?

Well, one of the biggest disadvantages of the Bahamas card is the coverage that is only national, that is, you cannot make international purchases.

And, in addition, the card charges an annual fee of R$ 9.80 for individuals and R$ 16.00 for legal entities, that is, it is also something that can make access impossible for those who are unwilling or unable to pay this fee .

PagBank Card or Bahamas Card: which one to choose?

The PagBank card or Bahamas card have several points in common, the main one being having an application to manage the card, that is, through it you can control your expenses, have access to various digital services and pay bills.

But if you still have doubts, see a new card comparison below in the recommended content.

Saraiva card or BBB card: which is better?

Either the Saraiva card or the BBB card, both are international credit cards, with no fees and benefits program. So check it out.

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to become a Rappi courier?

Find out here what are the main requirements to become a Rappi delivery man and how you can apply through the app!

Keep Reading

Discover the Santander 1|2|3 Gold credit card

The Santander 1|2|3 Gold credit card offers points on international purchases and discounts. Learn more about how it works and request yours!

Keep Reading

Know the American credit card

The Americanas credit card offers cashback, in addition to other exclusive discount programs. See more benefits here!

Keep ReadingYou may also like

What is commission-free consolidated credit and how does it work?

You know that moment when you urgently need to organize your finances? Or even, have control over what your debts are and not forget to pay any of them? Consolidated credit without commissions can be the solution to this search, as with the extended payment period and special conditions, it combines all debts into a single monthly payment. Furthermore, see everything about the subject here.

Keep Reading

Nubank enters the investment market

Nubank acquires the largest digital brokerage in Brazil, Easynvest.

Keep Reading

Discover the Samsung Platinum Credit Card

Samsung Platinum credit card is a novelty in the Brazilian financial market of cards with no annual fee. Click and learn more!

Keep Reading